American Gold Eagle Coins

American Eagle gold coins are the most popular gold coin in the world, making them an ideal investment for all investors. They are minted by the United States Mint, backed by the US government, and come with a face value. Gold Eagle Coins are the perfect cornerstone hard asset for portfolios of all sizes and purposes, whether you’re looking for a stable addition to your IRA or are just starting out with bullion investment and want to leave your children something that will persevere in the face of change.

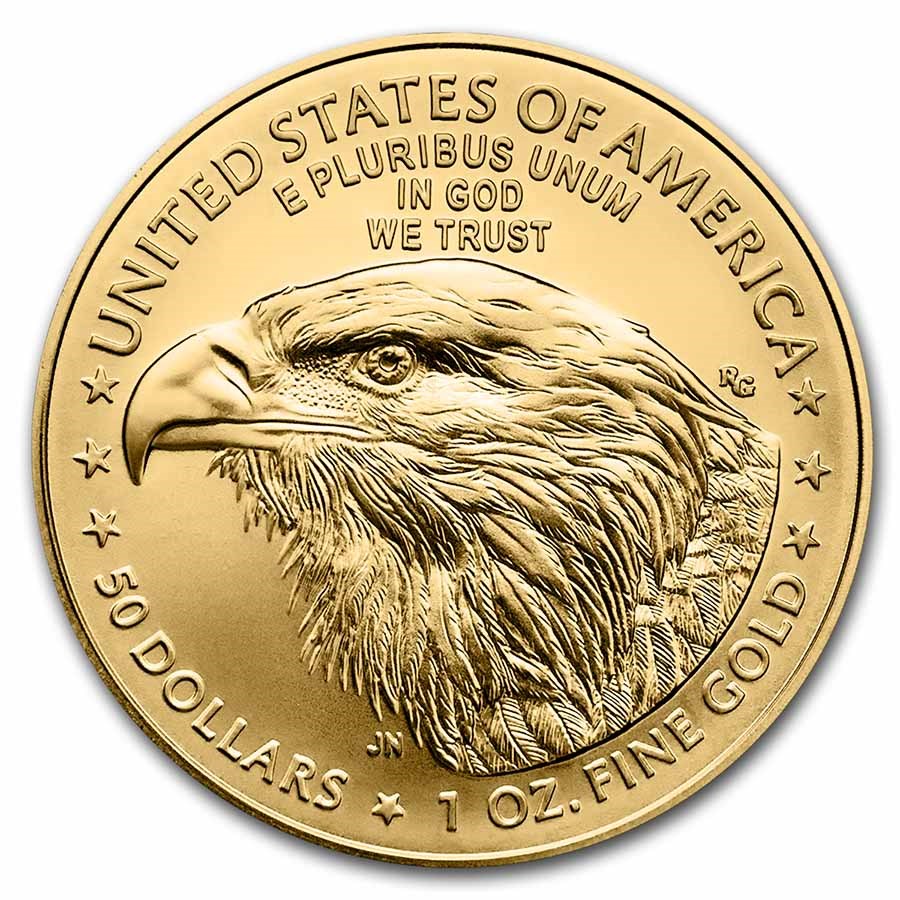

Since American Gold Eagles are the most popular bullion coin in the world, with over 12 million minted and sold. It’s beloved by investors, collectors, and historians due to its beautiful design — featuring one side with Lady Liberty and an olive branch torch and the obverse side stamped with an eagle carrying an olive branch to his mate and babies — as well as its long-term investment appeal.

The Modern Gold American Eagle Coin

The modern American Gold Eagle was first minted in 1986. It was the first U.S. gold coin produced since 1933, when Franklin Roosevelt signed an executive order outlawing the private ownership of gold. Carrying a face value of $50, The Eagle immediately became the world’s most coveted gold coin, a status it has enjoyed to the present day. Its popularity is reflected in the higher premium it commands in the marketplace over competing one-ounce coins from other countries around the world.

Although the Eagle contains one full ounce of gold, it is not pure gold. It consists of 91.67 percent gold, 3 percent silver and 5.33 percent copper. The Eagle is thus 22-carat, containing .9167 fine gold. Some other one-ounce coins have a higher purity, though they all contain one troy ounce. For example, the Gold Maple Leaf is .9999 fine (24 carat). Which you prefer is a matter of personal taste. Pure gold is softer and more susceptible to damage; coins that contain an alloy are harder and thus more durable.

As of 2016, about 18.75 million one-ounce Eagles have been minted since its inception in 1986. Demand remains high. In addition to the one-ounce Gold Eagle, the U.S. mint also produces a 1/2-ounce Eagle, a 1/4-ounce Eagle and a 1/10-ounce Eagle. All Eagles are available for purchase online through GoldSilver, and should be viewed as a cornerstone of every investor’s precious metals portfolio.

The History of Gold Dollars

American gold coins date back to the beginning of the Republic, and were routinely used in commerce for nearly a century and a half. The Half-Eagle ($5 face value) and $10 Eagle both first appeared in 1795. The $2.5 Quarter Eagle followed in 1796. The $20 Double Eagle--first coin containing a full ounce of gold--was initially minted in 1850.

For 70 years, from 1863 to 1933, the government issued gold certificates. These paper currencies were legal tender but not redeemable for actual gold until 1879, after which they were fully convertible to the physical metal at a fixed rate of $20.67 per troy ounce. They disappeared when Roosevelt prohibited gold ownership.

Eagles of varying face values have always constituted the bulk of official U.S. gold coinage, but there have been other designs. Most prominent were the Indian ($2.5, $5 and $10), available from 1908-1932, and the $3 Liberty, minted from 1854-1889.

Although Double Eagles had existed for 57 years, they didn’t achieve iconic status until 1907, with the introduction of the $20 St. Gaudens coin. It was first proposed in 1904 when President Teddy Roosevelt sought to create a coin more beautiful than the prevailing Liberty design.

To accomplish the task, he commissioned renowned sculptor Augustus St. Gaudens. It was an arduous task that took three years, and St. Gaudens didn’t live to see his creation advance to production. But the beloved coin still bears his name, and it is a classic—Miss Liberty bears a torch and an olive branch on the obverse, and a winged eagle flies over the sun’s rays on the reverse.

Today’s $50 Eagle is the direct descendant of St. Gaudens’ coin. The obverse is a replica of the original design, while the reverse has been modified to depict a bald eagle returning to its nest with an olive branch in its talons. Many American values such as strength, liberty and family are symbolized.

All modern Eagles regardless of denomination feature this same design.

(Note: The St. Gaudens coin and its $20 precursors are called Double Eagles, while the modern $50 coin is called simply an Eagle. All, however, are 1 oz. gold coins.)

Yearly Mintage Numbers for Gold Eagle Coins

Each year, a limited number of Gold Eagles are minted by the US Mint. Over time, the yearly production totals have fluctuated significantly, depending on market demand and the supply of gold.

Gold has always been a safe-haven from crisis, including the uncertainties of the stock market. This is reflective in the mintage numbers of Gold Eagles. In 2007, for instance, when the stock market was near an all-time high, mintage for Gold Eagles was at an all-time low. In just two years, the mintage jumped to its second highest level of all time, reflective of the economic uncertainty and pessimism that followed the stock market meltdown. This is an excellent example of the function of Gold in the investment world. People flock to precious metals in times of economic uncertainty, and with the future looking more uncertain than ever before, now is the time to invest.

Gold Eagle Tubes

The US Mint offers investors the ability to purchase what they refer to as “tubes” of American eagle coins at lower premiums than those you’ll find on smaller orders. Buying tubes of gold American Eagles can ensure your profit margin is as high as possible come selling time. It also offers a convenient way to store your coins.

BU American Gold Eagles

All current year coins sold at GoldSilver are uncirculated and delivered in pristine condition directly from the Mint. Common dated Eagles and other gold and silver coins may show signs of circulation. Generally, BU (Brilliant Uncirculated) Gold Eagles will carry a slightly higher premium than common year Eagles, which is why some investors opt for random year coins.

Investing in Gold Eagles

Are you thinking about making the leap and buying a few gold American Eagle coins for your investment portfolio? Both silver and gold American Eagles are a popular investment option, with the gold option providing more value and also historically providing more stability, as silver tends to be more volatile in terms of price. These are just a few of the reasons why American Gold Eagles are an excellent investment. Here are some more reasons why we recommend these gold bullion coins to investors at any level:

- Guaranteed by the U.S. Government – With American Eagle coins, you’re getting a legal tender coin of reliable quality and purity that will be guaranteed by the U.S. government.

- Usable as Money in times of Crisis – Gold and silver coins have been used as a medium of exchange for at least 2,500 years. They will always be accepted as money even if paper declines drastically in a hyperinflationary environment

- Universally Recognizable and Redeemable for Currency – An ounce of gold or silver can be redeemed for local currencies at a fixed market price, anywhere in the world.

-

Inflation hedge:

- The purchasing power of gold tends to remain steady in times of continually-rising inflation such as we have today. It is often said that an ounce of gold still buys a good suit of clothes, just as it did two hundred years ago, whereas paper currency wouldn’t come close.

- has been used as currency more often in history than gold. It has served a role of not just currency but money, especially when paper currencies lose value

- Potential Appreciation in Value – Gold and silver have the potential to increase in value not only due to inflation, but also because gold can be used for other purposes, such as in the electronics and aerospace industries, and silver is a major element used in even more industries. Thus, you can certainly use silver or gold coins as a means of investment.

- Uncorrelated with Other Asset Classes – The prices of gold and silver are unrelated to stocks, bonds, land or other assets, which provides investment diversification

- IRA-Eligible – You may place American Eagle coins in a properly-structured IRA or 401(K), which can provide some income tax advantages.

- Easy Storage – You may wish to keep your Eagle coins at home or in a safe deposit box, but for heightened security we offer vault storage for bulk purchases at reasonable rates. Both domestically and abroad, our partnership with Brinks means our storage is strictly allocated so that coins are held in your name and can be retrieved at any time

- Inheritable – Looking for something special and valuable to pass along to your kids or grandkids? Your Gold Eagles and Silver Eagles are easily passed on to heirs for a valuable inheritance option.

Buying Gold Eagles Online from GoldSilver

For your convenience, we offer Eagles in all denominations, with secure purchase just a few clicks away. You may elect to pay via credit/debit cards or PayPal, or receive a 4 percent discount for purchases paid by bank wire or check. You can also take advantage of a 3 percent discount if you pay with Bitcoin. Discounts are also applied to purchases of 10 coins or more.

We think of American Gold Eagles as a best buy, but if you are interested in gold coins of foreign origins, you will find them here as well. An additional domestic alternative to the American gold eagle is the American Buffalo, which is struck in .9999 fine (24 carat) gold, the purest gold coin offered by the US Mint.

Guaranteed Lowest Prices on Gold Eagles

The price of gold fluctuates constantly in the markets. This can make pricing somewhat challenging for many dealers. But GoldSilver has created a strategy that updates the prices of our products in real time in accordance with the relevant spot price at the time of purchase. We also have a price match guarantee to match the advertised price of any of our products on the sites of our top competitors.

To learn more about how you can always get the best price from GoldSilver, read about our price match guarantee.

Simple Online Selling

GoldSilver will buy back most bullion products, whether you bought them from us or elsewhere, with competitive prices and an easy-to-use online sales portal—by mail or from storage. If you decide to sell some of your gold coins, you have a ready buyer on standby, something not all other dealers offer

Read more about our sell-back policy, request a quote for your gold coins, or find out why our sell-back policy and storage program are a match made in heaven.

The GoldSilver Difference

At GoldSilver, we pride ourselves on offering investors world-class education, an investor-friendly product catalog, and a uniquely secure and flexible storage program.

Our educational video series has generated tens of millions of views on YouTube. Our founder, Mike Maloney, is the best-selling author of Guide to Investing in Gold & Silver, the most popular book ever on precious metals investing.

Our catalog is focused on physical precious metals products with the most competitive premiums. We believe these products allow investors to get maximum exposure to gold and silver while increasing potential profits by saving on costs.

And our unique storage program offers allocated and segregated storage options at your choice of global vaults, with easy and rapid liquidity.

On top of all this, we are committed to providing our clientele with a broad assortment of purchase options, with discounts when you pay through check or wire so you can make even more money. We also offer discounts on bullion for those who pay with Bitcoin.

Together, we believe these features offer an unmatched experience for precious metals investors.

But don’t take our word for it. See what our investors are saying about us: read our testimonials.

Front.png)