Gold Trading Volume: Why $227 Billion Daily Trades Matter for Investors

Every second, millions of dollars worth of gold changes hands across global markets. In 2024, daily gold trading volume grew to an astounding $227 billion — a 39% jump from 2023’s $163 billion average. This explosive growth isn’t just a number; it’s a powerful signal of gold’s evolving role in modern portfolios and a roadmap for savvy investors. What Is Gold Trading Volume and Why Should You Care? Gold trading volume represents the total dollar value of gold traded across all markets within a specific timeframe. This encompasses: Unlike many commodities, gold enjoys exceptional market liquidity — rivaling major currencies and […]

Bessent: New Fed Chief Must Go Beyond Monetary Policy

Treasury Secretary Scott Bessent outlined his vision for the next Federal Reserve chair in a recent interview, emphasizing the need for someone who can examine the entire organization beyond just monetary policy. “It’s someone who has to have the confidence of the markets, the ability to analyze complex economic data” Bessent says new Fed chair should be someone who can examine organization, Nikkei reports | 104.1 KSGF, Bessent told Japan’s Nikkei newspaper. He stressed the importance of forward-thinking leadership rather than relying solely on historical data. Bessent is currently leading the search for Jerome Powell’s successor, with an expanded list […]

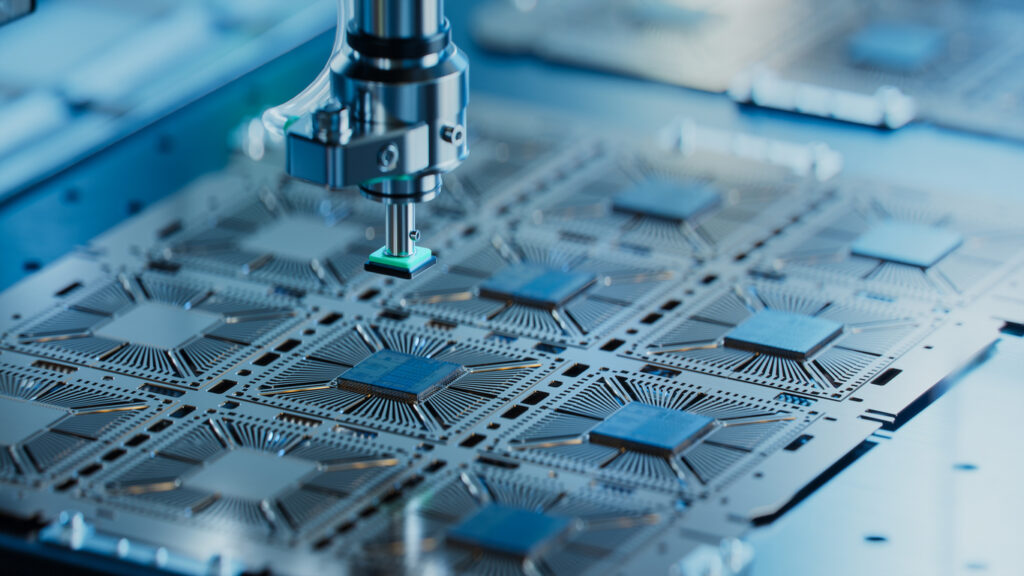

U.S. Takes 15% Cut of Nvidia and AMD’s China Chip Sales in Exchange for Export Licenses

Nvidia and AMD have struck an unprecedented deal with the Trump administration: they’ll pay the U.S. government 15% of their China chip sales revenue in exchange for export licenses. The agreement, finalized after Nvidia CEO Jensen Huang met with President Trump last week, allows both companies to resume selling AI chips to China after months of restrictions. This marks a major shift in U.S. export policy—traditionally based on national security, not revenue generation. For Nvidia, the stakes are huge: being blocked from China cost them $4.5 billion in just one quarter. While the deal offers immediate market access, experts worry […]

Tariff Pain Shifting from Businesses to Consumers, Could Push Inflation to 3.2% by Year-End

New research from Goldman Sachs reveals a significant shift in who pays for tariffs imposed by the Trump administration. According to economists led by Jan Hatzius, American consumers have so far shouldered only 22% of tariff costs through June, with businesses absorbing the majority. However, this dynamic is changing rapidly as companies increasingly pass these costs to consumers through higher prices. Goldman predicts consumers will bear 67% of tariff costs if current patterns continue. The impact on inflation could be substantial, with core PCE inflation potentially reaching 3.2% year-over-year by December, compared to 2.4% without tariffs. This creates a complex […]

Tariff-Driven Inflation Surge Complicates Fed’s September Decision

Markets are closely watching this week’s inflation data as the Federal Reserve faces mounting pressure to cut interest rates. The July Consumer Price Index (CPI) report, due Tuesday, is expected to show inflation rising to 2.8% annually, up from 2.7% in June, with tariffs driving the acceleration. The nomination of Stephen Miran to the Fed Board adds another voice potentially favoring rate cuts, as economists predict the Fed may need to act by September to avoid multiple dissenting votes. Meanwhile, retail sales data on Friday will provide crucial insight into consumer spending strength amid these economic crosscurrents.

Trump’s Trade Wars Threaten Century of Dollar Dominance

President Trump’s aggressive trade policies and tariff regime are challenging the US dollar’s long-standing role as the world’s primary reserve currency. While the dollar currently dominates global transactions—used in 90% of foreign exchange trades and making up nearly 60% of government reserves worldwide—Trump’s approach to reshaping international trade is causing governments and investors to reconsider their reliance on US assets. This shift could reduce America’s economic leverage and its ability to fund budget deficits through foreign investment, potentially ending a key advantage the US has enjoyed since World War II.

World Gold Council: Gold Tests Key $3,351 Level as Triangle Pattern Nears Completion

Gold faces a critical test at $3,351/oz – a break above this level would confirm the uptrend continues. Last week saw mixed signals: new tariffs were implemented, UK and India central banks made cautious policy moves, and US economic data weakened even as strong corporate earnings lifted stocks. The biggest story was a record price gap between COMEX gold futures and London spot prices, caused by new 39% US tariffs on Swiss exports. Switzerland refines most of the world’s gold, but the tariffs didn’t clearly exempt gold bars (1kg and 100oz sizes), creating market chaos. The White House plans to […]

Gold Market in Chaos: White House Promises Quick Fix After Tariff Confusion Halts Bullion Flights

The White House plans to issue an executive order to clarify confusion about gold bar tariffs after the U.S. Customs and Border Protection indicated that popular 1-kilogram and 100-ounce gold bars would be subject to country-specific import tariffs. This ruling stunned the gold industry, with Switzerland facing a potential 39% tariff, prompting some companies to pause gold deliveries to the U.S. The White House called the tariff concerns “misinformation” and promised clarification, causing gold futures to pare gains after initially hitting record highs. The uncertainty has disrupted global gold supply chains between major hubs in Switzerland, London, and New York.

Tariff Chaos Sends Gold Markets Into Turmoil, Then Retreat

Gold futures retreated Monday after the Trump administration promised to clarify “misinformation” about new tariffs on gold bars that had sent prices soaring to record highs last week. The confusion stemmed from a US Customs ruling suggesting certain gold bars would face import duties, causing futures to spike over $100 above London spot prices on Friday. While gold has gained about 30% this year amid trade tensions, the market remains on edge awaiting long-term clarity on the precious metal’s tariff exemption status. Traders are also watching Tuesday’s inflation data for clues about Federal Reserve rate policy, which could significantly impact […]

Tariffs at Depression-Era Highs to Keep 10-Year Treasury Yields Elevated

U.S. Treasury yields are set to diverge, with longer-term rates rising while shorter-term rates fall, according to a Reuters survey of nearly 50 bond strategists. The 10-year Treasury yield, currently at 4.27%, is expected to climb to 4.30% and remain there through next year, driven by concerns over persistent inflation from tariffs—now at their highest levels since the Great Depression—and a surge in government debt issuance. Meanwhile, the 2-year yield is projected to drop from current levels to 3.50% within a year as markets price in Federal Reserve rate cuts following weak employment data. This divergence will steepen the yield […]