How Much Gold and Silver Should I Buy for My Portfolio?

How much of your portfolio should be in gold or silver? What percent of your portfolio should they comprise? And should you buy more of one metal than the other?

These are important questions. Buy too little and they may not make a material difference to your portfolio. Imagine the sick feeling in your gut if, during a crisis, you realize you didn’t buy enough bullion to withstand it (or better, if you had enough gold and silver, to earn a handsome profit from it). Buy too much and your portfolio is negatively impacted if prices go nowhere or fall.

What Silver Should I Invest In? – Here’s The Best Types of Silver to Buy & Sell

Investing in silver is an affordable and easy way to diversify some of your paper portfolio, assets denominated in fiat currency like stocks or bonds, with a tangible, valuable commodity.

Silver tends to hold its value over time and has been used as money for thousands of years.

GoldSilver Infographic: History of Money and Currency in the USA

What you’ll see is that with each monetary change in the US, the value of our currency has gradually been destroyed. We started with 100% gold-backed currency.

The Effect of a Stock Market Collapse on Silver & Gold

Many investors hold gold and silver to hedge against various economic crises. But does this hedge hold up during stock market crashes? Knowing what effect a market plunge and subsequent dollar collapse will have on silver and gold is vital to making investment decisions now and then deciding what course to take should a major recession or depression occur.

The Day the Hunt Brothers Capped the Price of Gold (Part 2)

Many people think the Hunt Brothers were responsible for manipulating gold. But the truth is, they were framed…

A Guide to Trading Gold and Silver Futures Contracts

There are two primary ways to invest in precious metals: physical metals and “futures”. The former comes in many forms itself, from allocated storage or ETFs to simply stocking away some metals in a safe at home.

What Is Gold Liquidity and Why Is It Important?

In a free-market economy, virtually any tangible good can be sold to someone, somewhere. When you’re a seller, your primary concern will likely be receiving what you consider to be “fair value.” Is that something you can be reasonably sure of getting, or might you wind up disappointed? Liquidity refers to how easily you will be able to sell an asset at a widely recognized fair price on the open market. Let’s take a closer look. [ View the Current Gold Price ] Liquid and Illiquid Investments Gold and silver bullion are highly liquid assets. There is a universally recognized pricing […]

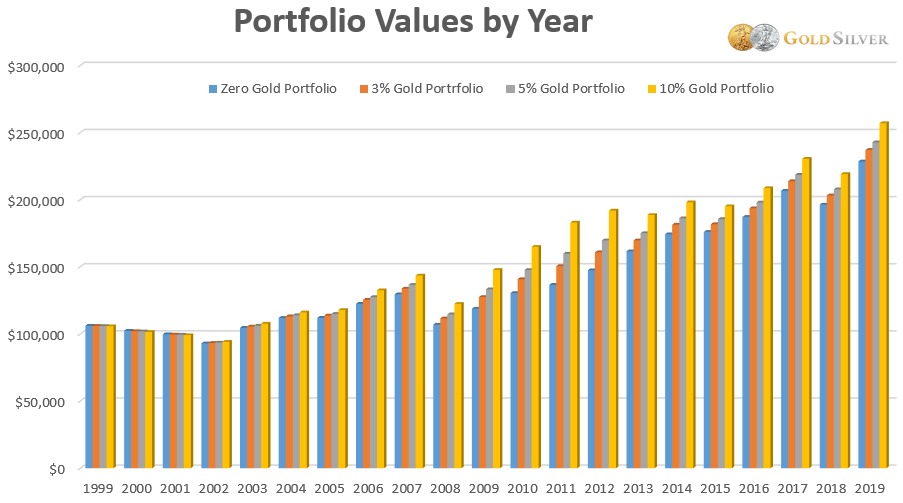

How Effective Is Gold As a Hedge? History Has an Empirical Answer

Gold has been a safe haven for literally thousands of years. But how effective is it as a “hedge”? A hedge is an asset that tends to rise when others fall. For example, an investor holding common stocks might find it advantageous to hold some gold too, since it has historically been strong during the worst stock market crashes. But in the big picture, does it really pay to always have some gold in one’s portfolio? History provides some clear answers. We analyzed several historical scenarios to see how a theoretical portfolio performed with various amounts of gold (including zero). The […]

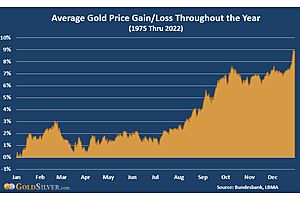

The Best Time to Buy Gold & Silver in 2024

When is the right time to invest in Gold & Silver precious metals? GoldSilver.com looks at historical data that will help find the dates on your calendar to get the best price.

What Is the Gold Spot Price and How Is It Set?

The spot price of gold is based on the price of one troy ounce of gold on international exchanges. Gold spot prices refer to the “bid” price you see listed—which is the price most recently quoted in the market that buyers are willing to purchase at. This is usually lower than the “ask” price sellers are currently seeking. The spot price is based on trading activity in the futures markets. It is an international standard for the spot price of gold to be quoted in US dollars. In the US, the COMEX is the primary exchange where gold is traded […]