Best Tool to Track Gold and Silver Prices Effectively

If you’re serious about protecting your wealth, learning how to track gold and silver prices isn’t optional—it’s essential. In today’s volatile markets, having real-time access to accurate price data can mean the difference between catching an opportunity and missing it entirely. Whether you’ve been stacking metals for decades or you’re just starting to diversify beyond paper assets, monitoring precious metals prices helps you stay ahead of inflation, currency debasement, and the next Fed policy surprise. Why Real-Time Data Matters More Than Ever Here’s the reality: Gold and silver markets move 24/7. They react to every Fed announcement, every geopolitical tension, […]

5 Key Drivers of Gold Spot Price Movements

The spot price of gold changes minute by minute, reflecting a constant tug-of-war between markets, policies, and global risks. For investors, the key is recognizing the major gold price drivers that sit beneath those price swings. Understanding these dynamics doesn’t just explain where gold has been — it helps reveal where it could go next, and how it can strengthen a diversified investment strategy. The gold spot price moves minute by minute during trading hours, shaped by economic data, central bank decisions, and global events. Below, we’ll break down the five most important gold price drivers that consistently move markets. […]

The Signs Are Clear: Why This Stock Market Bubble “Cannot Last”

In the latest episode of The GoldSilver Show, Mike Maloney and Alan Hibbard deliver one of their most urgent warnings yet: the stock market is in “insane bubble territory” — and the fundamentals don’t support the hype. 📉 The Buffett Indicator Is Flashing Red One of the most striking charts shared in the episode is the Buffett Indicator — total U.S. stock market capitalization divided by GDP. The number? Over 200%. For context, that’s higher than the peaks seen during the dot-com bubble and the 2008 financial crisis. Mike calls it “insane bubble territory,” and for good reason. In a […]

The Hidden Chart Pattern That’s Predicted Every Silver Boom

Silver just flashed a rare breakout signal — Mike explains why this could lead to triple-digit prices.

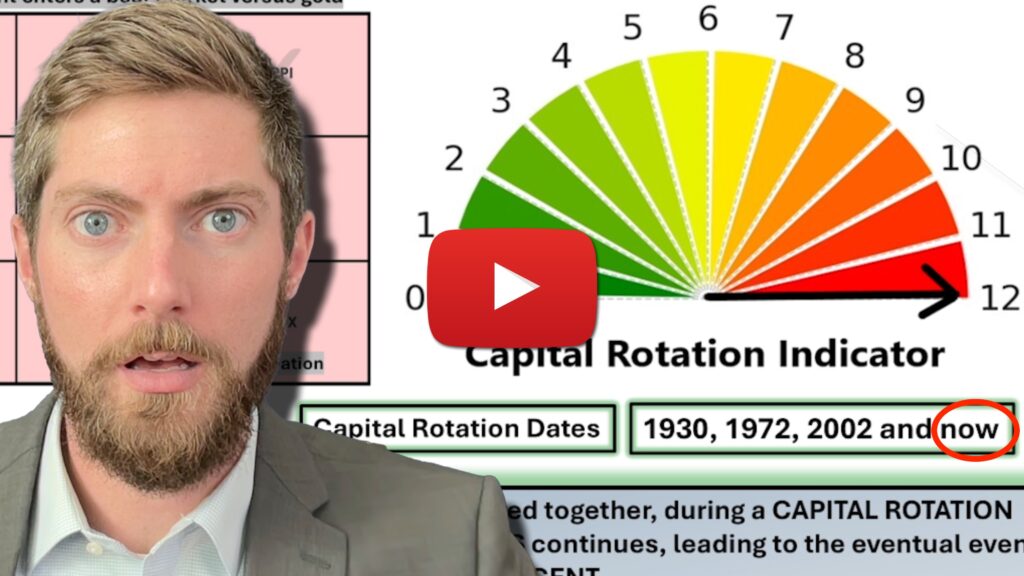

Capital Rotation: A Rare Opportunity for Precious Metal Investors

Learn how capital rotation precious metals indicators help investors identify market shifts and optimize portfolio allocation for better returns.

The Global Capital Rotation Event Is Underway — Are You Ready for the Shift?

Alan Hibbard sits down with Kevin Wadsworth and Patrick Karim of Northstar Bad Charts to expose what they call the Capital Rotation Event — a rare and powerful shift of global capital out of stocks and into precious metals. In today’s must-watch interview, you’ll discover: This isn’t just another chart review. It’s a warning — and a roadmap.