5 Market Moves for August 25 — Gold Pullback, Jackson Hole, Intel’s Warning and more

Gold Retreats from Two-Week High as Dollar Gains Gold pulled back after Friday’s pop, as a stronger dollar made bullion pricier for overseas buyers. Spot gold dipped 0.2% to $3,364/oz while December futures eased to $3,410. The retreat came after gold touched its highest level since August 11 on Friday, following Fed Chair Powell’s Jackson Hole speech. Traders still see an 85–90% chance of a 25bp Fed cut on September 17, supportive for gold in the long run. In the near term, however, gold is tracking the dollar. UBS analyst Giovanni Staunovo noted Powell’s comments point to only a modest […]

Silver at $50 AUD: What Australian Prices Could Be Telling the World

While many investors track gold and silver prices in U.S. dollars, those watching in Australian dollars have seen something remarkable: What’s driving these eye-catching numbers? A key factor is currency devaluation. Back in 2015, the Australian and U.S. dollars were nearly at parity. That same year, Mike identified what he called the bottom of a cyclical correction in the gold market — not a bear market, but a pause in a much larger bull run. Since then, the Australian dollar has lost around 50% of its value relative to the USD. As a result, gains in gold and silver prices […]

Why Silver’s 32% YTD Rise Might Just Be the Beginning

Silver just hit $38 — its highest price in 14 years. What’s driving the rally, and why some analysts say much higher prices could be next.

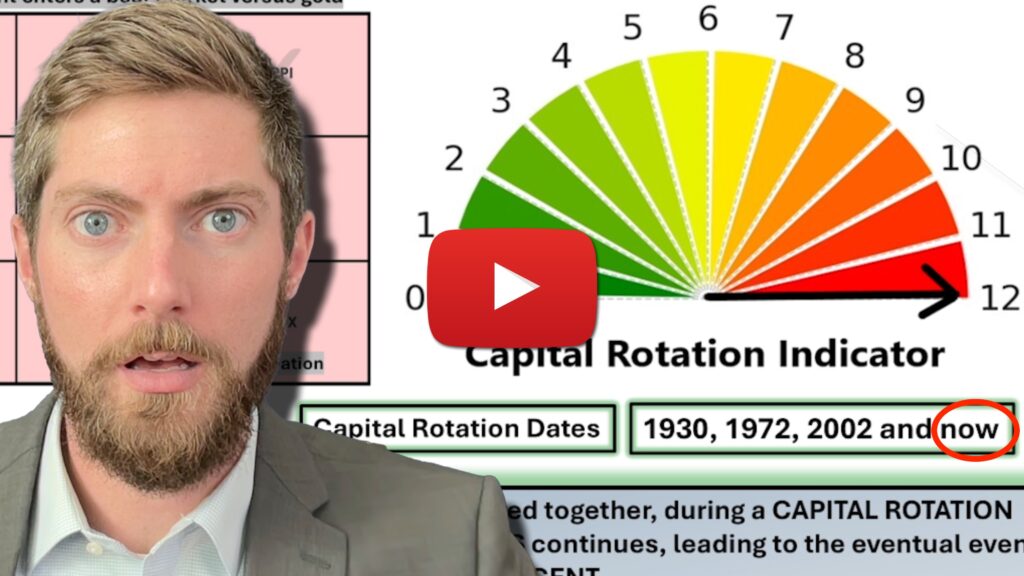

The Global Capital Rotation Event Is Underway — Are You Ready for the Shift?

Alan Hibbard sits down with Kevin Wadsworth and Patrick Karim of Northstar Bad Charts to expose what they call the Capital Rotation Event — a rare and powerful shift of global capital out of stocks and into precious metals. In today’s must-watch interview, you’ll discover: This isn’t just another chart review. It’s a warning — and a roadmap.