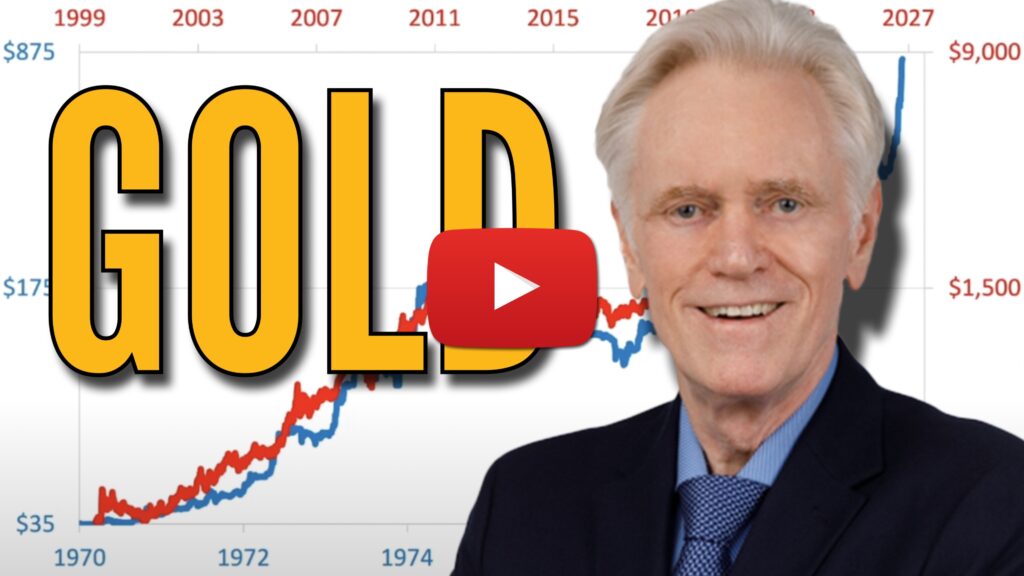

Is 2025 the New 1979? Why Gold Could Be Set to Double Again

Gold doubled in 42 days in 1979. The setup today looks eerily similar. Here’s why Mike Maloney says the biggest moves may still lie ahead.

The Final Blowoff: Why Gold’s Surge Could Be Just Beginning

During the 1970s, when gold doubled in price in just 42 days, investors who saw it coming transformed their wealth. Today, Mike Maloney and Alan Hibbard believe we are witnessing a similar setup, with the potential for an equally dramatic move. They provide a critical update on the gold market, breaking down why we may be entering the final—and most explosive — stage of the gold bull market. This insight cuts straight to the core of today’s financial landscape. Stocks, bonds, and the dollar are faltering. Central banks are steadily increasing their gold reserves. Meanwhile, geopolitical and economic tensions are […]

America’s Credit Downgrade: What It Means for Gold

Moody’s just downgraded U.S. debt. Here’s why investors are turning to gold — and why it might be too early to take profits.

“Is it Too Late to Buy Gold?” The #1 Question Right Now

Gold prices are soaring. Headlines are buzzing. And many investors are asking the same thing: “Did I miss my chance to get in?” In his latest video, Mike Maloney unpacks that question — and reveals what’s really behind gold’s recent run. If you’re wondering what happens next, you’re not alone. In this video, Mike covers: If you’re sitting on the sidelines, watch Mike’s new video to get clarity before your next move. So… who’s driving the price up? Institutional Whales Are Quietly Loading Up The Public Hasn’t Even Entered the Game The majority of financial advisors still recommend […]

Why Mike Believes Gold Could Triple by 2027

Mike Maloney and Alan Hibbard just released an eye-opening video — and if you’re serious about gold, you won’t want to miss it. In it, they unveil new data from Mike’s updated Gold Bull Market Chart, showing striking similarities to the explosive run of the 1970s. Based on current trends, the trajectory suggests gold could potentially triple within the next two years. This chart is pulled straight from Mike’s Amazon best-seller, The Great Gold & Silver Rush of the 21st Century — now updated with the latest data and market context.

Gold Pulls Back After Record Run — What Comes Next?

Gold is still up 44% YoY — but after hitting $3,500, it’s cooling. Is this a reset… or a rare buying window?

Capital Rotation: A Rare Opportunity for Precious Metal Investors

Learn how capital rotation precious metals indicators help investors identify market shifts and optimize portfolio allocation for better returns.

Gold Price Record $3400 for First Time in HISTORY

Gold passes $3,400 per ounce, shattering another historic milestone — a move that has left even seasoned market watchers astonished at the speed and intensity of the current bull market. In just the past few days, gold has leapt from breaking the $3,300 barrier to topping $3,400, a feat that underscores how rapidly momentum is building in the precious metals space. The Velocity of Gold’s Rally: Unprecedented Acceleration The pace of gold’s ascent in 2025 is nothing short of extraordinary. Year-to-date, gold has gained over 30%, and we’re not even halfway through the year. Gold is vastly outpacing its historical […]

Gold Passes $3,300/oz as Metals Bull Market Rages

As markets grapple with tariff chaos, gold soars to a record $3,300/oz. See why metals are outperforming while traditional investments falter.

Gold’s Quickest $500 Climb in History

“On average, gold takes 1,708 days to climb $500 increments, but this latest jump took just 210 days,” notes Taylor Burnette, Research Lead at the World Gold Council.