Analyst Predicts Gold at $4,000, Silver Over $40 — Here’s the Timeline

Up 28% and 33% YTD, but the biggest moves may be ahead. Analyst sees perfect storm of Fed cuts, weak dollar, and tariff chaos.

The Stock Market Recovery Is a Mirage — Here’s What’s Really Happening

Behind the headlines: record debt, surging defaults, and a housing slowdown. Mike Maloney says the crash has already begun.

Gold Shines as Market Storm Clouds Gather

While stocks erase $4 trillion in value, gold has quietly gained 57% in 24 months. Discover why this precious metal rally has more room to run.

What Is Gold Liquidity and Why Is It Important?

Not all gold investments are equally easy to sell. Gold liquidity determines whether you’ll get fair value or be forced to accept less. Learn which coins offer the best liquidity, how the spot price protects your investment, and why “minding the spread” matters more than the purchase price.

What ‘Inflation’ Actually Means: Is the Real Rate Already 10%?

Amidst the pitched arguments about inflation (though almost nobody argues at this point that it’s not, at the very least, on the way), it would be nice if we could agree on what that words specifically means. When we refer to ‘inflation’, we refer to the government’s definition.

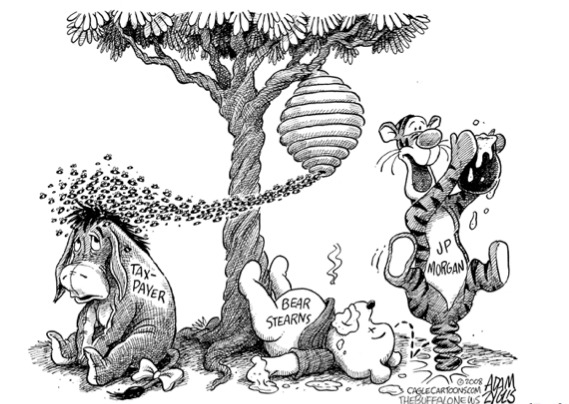

Why the Collapse of Bear Stearns Changed the Silver Market Forever

Very few people know exactly what was said, promised, discovered, obfuscated, threatened, etc. in the dark and high-tension days surrounding the collapse of Bear Stearns and its taxpayer-subsidized subsequent digestion by JPMorgan. What is irrefutable is that JPMorgan inherited Bear’s enormous and disastrous short silver position. How they would deal with it in response has fundamentally altered the silver market, while simultaneously setting it up for a historic rally. Bear Stearns’ failure coincided, to the day, with gold hitting all-time highs (over $1000) and silver hitting 30 year highs ($21). It’s easy to calculate that Bear lost more than $2 […]