How Argentina May Become the Freest Country on Earth – Mike Maloney & Alan Hibbard (Part 1)

In this eye-opening deep dive, we explore Argentina’s astounding economic turnaround after one year under President Javier Milei. Discover how a country once stuck near the bottom of the global economic freedom index is now climbing rapidly, thanks to bold reforms and fiscal discipline that few thought possible. Hear about the direct correlation between economic liberty and human flourishing—longer lifespans, higher incomes, and happier lives. We break down the surprising data, the policies that sparked this revolution, and what the rest of the world can learn from Argentina’s unprecedented shift. Highlights include: Argentina’s fiscal balance achieved for the first time […]

Breaking: NJ Eliminates Gold & Silver Tax + Banks Target $3,000 Gold

Gold and silver investors in New Jersey just got a major win: zero sales tax on precious metals. The bipartisan legislation, which took effect January 1st, eliminates all sales tax on gold, silver, and precious metals purchases, positioning New Jersey among the most competitive states for metals trading. As more states recognize the importance of precious metals investment, this could mark the beginning of a broader shift in state tax policies… 📈 Alan Hibbard: Gold and Bitcoin Set for ‘Explosive’ 2025 In a compelling NYSE TV interview this week, Alan Hibbard addressed Powell’s recent Bitcoin comments and highlighted a critical […]

Explosive 2025: Why Bitcoin, Gold & Silver Are Set to Surge w/ Alan Hibbard

Discover why Bitcoin, gold, and silver could be the power trio of 2025 in this exclusive interview with precious metals and alternative money specialist, Alan Hibbard of GoldSilver.com. Alan breaks down Fed Chair Powell’s comparison of Bitcoin to gold, explaining why true “money” focuses on long-term value, whereas “currency” is all about seamless transactions. Hear Alan’s predictions for an explosive Bitcoin bull run in 2025, insights into gold and silver’s steady climb, and why changing political winds in Washington likely won’t stop the global shift to digital assets. If you’ve been wondering how to secure your financial future—or simply hold […]

I Find This Scary Because It’s What Happens In A Blow-Off Top

Prepare to be startled by the dramatic extremes in today’s stock market. Mike Maloney and Alan Hibbard discuss the urgent red flags signaling a potential “blow-off top,” where market gains soar to dizzying heights before a sudden collapse. Learn how the top 10 S&P 500 stocks alone are worth more than some of the world’s largest stock markets combined, why one of America’s biggest tech giants trades at all-time-high valuations, and how economic indicators are flashing warnings that many have chosen to ignore. Whether you’re an experienced investor or just starting your financial journey, this episode arms you with vital […]

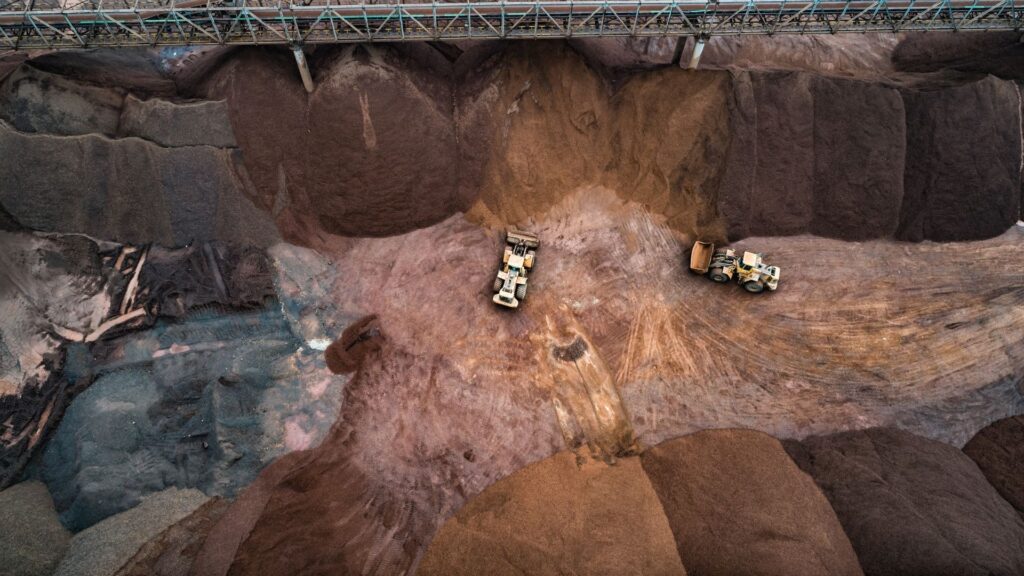

Gold Mining’s Hidden Crisis: Production Costs Climb Despite Record Prices

Gold’s price may be grabbing headlines, but there’s a bigger story unfolding in the mining industry. Despite gold reaching near-record highs earlier this year, miners are facing a serious challenge: production costs are soaring at an unprecedented rate. According to the World Gold Council, these rising costs are pushing some mining operations to the brink, even as gold prices remain strong… The True Cost of Gold Mining To get a better understanding of the rising cost of mining let’s look at the All-in Sustaining Cost (AISC). This crucial metric shows the true cost of running a gold mine – […]

Should I Buy Bitcoin, Gold…or Both? Alan Hibbard on Market Movers

Bitcoin and gold often get compared, but are they really competitors—or complementary parts of a balanced portfolio? In this insightful interview, alternative money strategist Alan Hibbard from GoldSilver.com shares why both assets serve as valuable stores of wealth. Learn how to approach physical vs. ETF ownership, why government plans could make “digital gold” mainstream, and what you need to know about securing your investments. Whether you’re a Bitcoin believer, a gold enthusiast, or both, this deep dive covers how to position yourself for the years ahead. Key Topics Covered: Why Fed Chair Powell sees Bitcoin more like gold than a […]

“Right Now, Things Are So Out Of Whack It’s INSANE” – Mike Maloney

Are we on the brink of a severe recession—or could the markets somehow keep soaring? In this eye-opening discussion, Mike Maloney and Alan Hibbard unveil the key data points that have signaled every modern recession without fail. From year-over-year employment metrics to the notorious yield curve inversion, you’ll see why they believe “things are so out of whack it’s insane.” Plus, learn about the “Blood Indicator,” a little-known composite gauge that’s flashing red, and find out why the Federal Reserve’s early rate cuts could be a sign that they see something lurking just around the corner. What You’ll Learn: Which […]

Breaking: Fed Plans Fewer Rate Cuts in 2025

Gold prices rose Friday but remained on track for a weekly decline of 1-2%, pressured by the Federal Reserve’s more hawkish stance on interest rates. The Fed’s latest projections showed fewer rate cuts planned through 2025 than previously expected, with officials now forecasting just two quarter-point cuts instead of the four cuts suggested in September. While markets digest the Fed’s hawkish shift, another source of uncertainty emerges from Washington… US Government Faces Shutdown Over Funding Bill Another government shutdown looms as House lawmakers rejected a stopgap funding measure Thursday evening, voting 174-235 against the bill despite former President Trump’s endorsement. […]

“2025 Could Be The Last Year For GOLD Under $3000” – Alan Hibbard

Gold and silver have taken center stage in 2024, with prices skyrocketing and demand hitting unprecedented levels. In this insightful discussion, Alan Hibbard of GoldSilver.com and Kurt Nelson of SummerHaven Investment Management share why 2025 might be a pivotal year for precious metals. Highlights: Gold’s safe-haven appeal amidst inflation and global volatility Silver demand outstripping supply for five consecutive years Central banks stocking up on gold reserves ($40 billion in 2024 alone!) Bold price predictions: Gold above $3,000, Silver at $40 by 2025 Why this could be your last chance to buy gold under $3,000 Whether you’re an investor or […]

Silver Set to Skyrocket: The Gold-Silver Ratio’s STORED ENERGY – Mike Maloney & Alan Hibbard

Join Mike Maloney and Allan as they uncover the insane undervaluation of silver and what it means for your portfolio. In this deep dive, we explore: Historical Gold-Silver Ratios: Why today’s 84:1 ratio is a screaming buy signal for silver. Market Manipulation Exposed: How 411 paper silver ounces exist for every real ounce – a crisis waiting to happen. Explosive Potential: Both gold and silver are forming rare, parabolic bases, pointing to a seismic revaluation. The $10,000 Gold Prediction: What history tells us about the future of precious metals. Don’t miss this compelling analysis and the unique opportunity to position […]