How to Buy Gold: A Beginner’s Guide for Investors

Wondering how to buy gold in today’s volatile market? Gold and silver are climbing again as inflation, war-driven supply shocks, and economic uncertainty push investors toward precious metals for protection.

The History of Currency Debasement: What Rome Teaches Us About Money Today

From ancient Rome to Nixon’s 1971 gold shock, the history of currency debasement follows a predictable pattern. Understanding it is one of the most valuable things a long-term investor can do.

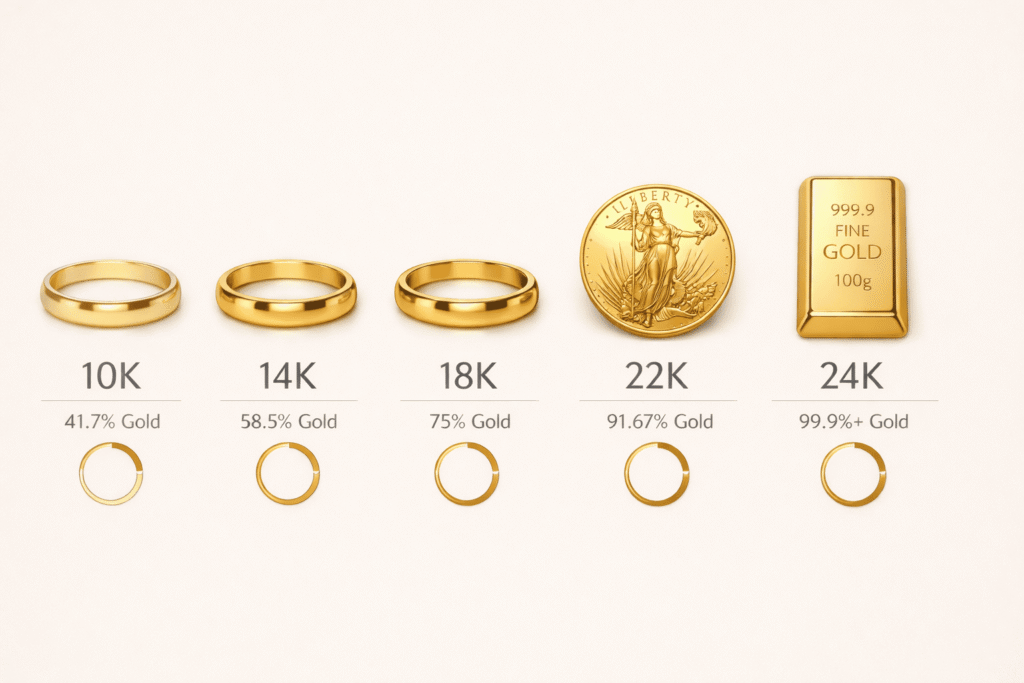

Gold Purity Explained: What Investors Need to Know

Not all gold is created equal. The karat on a jewelry piece and the fineness on a bullion coin are measuring the same thing — but they mean something very different for investors. Here’s how to read gold purity the right way before you buy.

How Government Debt Affects Gold and Silver

As government debt reaches record levels, gold and silver are emerging as critical hedges against inflation, currency devaluation, and declining confidence in sovereign financial systems. This article breaks down the key mechanisms linking national debt to precious metals prices, explores a decade of historical performance data, and provides actionable portfolio allocation strategies for investors looking to protect their wealth in an era of fiscal excess.

7 Reasons Gold and Silver Will Surge From Current Levels

Precious metals investors are watching market conditions closely as gold and silver hover at pivotal price points. While both metals have already posted impressive gains, multiple converging factors suggest we may be witnessing the early stages of a significant price surge rather than a market peak. From record central bank demand and compressed real yields to industrial supply squeezes and geopolitical tensions, seven powerful catalysts are aligning to drive gold and silver prices higher. Understanding these factors can help you position your portfolio to benefit from the potential upside while managing risk appropriately.

Is Silver About to Break the COMEX?

The disconnect between paper silver and real-world demand is widening fast. In this episode, Mike and Alan reveal why a silver COMEX breakdown is becoming more likely — and what happens when industrial buyers need physical metal the futures market can no longer deliver.

“This Bull Market Is By No Means Over”

Mike just stepped off stage at the world’s oldest investment conference — and if you weren’t there, you missed something. The New Orleans Investment Conference just wrapped with a record crowd. “We were bursting at the seams,” producer Brien Lundin told Mike. But these weren’t casual observers. These were investors who’ve been watching, waiting, and positioning themselves for this moment in the precious metals markets. And if you’re wondering whether you’ve already missed the move… Brien had a clear message. The Bull Market That’s Just Getting Started “This bull market in precious metals is by no means over,” Mike said. […]

Silver Breaks $50 for the First Time Since 1980

Discover the major silver price drivers behind silver’s surge past $50 and gold’s climb toward $4,000 — and what it means for investors today.

Why Silver’s Surge Could Ignite Mining Stocks Next

Silver vs. Miners: A Strange Divergence Silver today looks extremely undervalued — both against inflation and compared to gold. Yet mining stocks, which typically amplify moves in metals, have lagged badly since the mid-2000s. The HUI index (a benchmark for mining companies) has been in a long decline relative to gold, though Lundin believes it may now be breaking that downtrend. If miners start to “catch up” to silver’s rally, the leverage could be enormous. History shows that when this gap closes, the moves can be fast and violent — rewarding those positioned early. Two Core Reasons to Own Gold […]

The $20 Trillion Tipping Point for Gold & Silver

In the latest episode of The GoldSilver Show, Mike Maloney and Alan Hibbard unveil one of the most eye-opening charts they’ve ever presented. While most headlines focus on the $7 trillion parked in U.S. money market funds, Mike makes a case that more than $20 trillion in ultra-liquid capital could soon come flooding into safe-haven assets — gold and silver chief among them. What makes this episode essential viewing is not just the number itself — it’s how it’s built, what it signals, and why this time truly is different. More Than Money Markets: The Real Liquid Capital Pool The […]