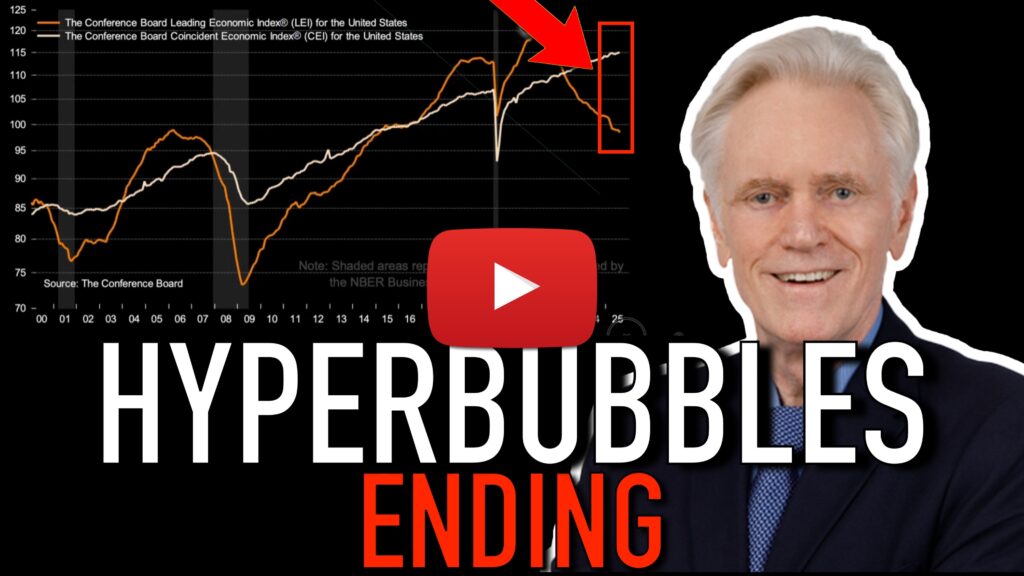

The Hyperbubble: Is the Next Crash Already Unfolding?

Silver’s sharp rise this week may be more than a market move — it could be a signal. In his latest video, Mike Maloney, best known for predicting the 2008 financial crash, says today’s economy is flashing red across every major sector. And this time, the warning signs go far beyond real estate. “Not a Bubble — a Hyperbubble” According to Mike, the U.S. housing and credit markets have gone far past typical “bubble” territory. “Do we have a housing bubble? No,” he says. “We’ve got a hyperbubble.” Insider data shows homebuilders are selling off their own stock — a […]

Silver Breaks $50 for the First Time Since 1980

Discover the major silver price drivers behind silver’s surge past $50 and gold’s climb toward $4,000 — and what it means for investors today.

The $20 Trillion Tipping Point for Gold & Silver

In the latest episode of The GoldSilver Show, Mike Maloney and Alan Hibbard unveil one of the most eye-opening charts they’ve ever presented. While most headlines focus on the $7 trillion parked in U.S. money market funds, Mike makes a case that more than $20 trillion in ultra-liquid capital could soon come flooding into safe-haven assets — gold and silver chief among them. What makes this episode essential viewing is not just the number itself — it’s how it’s built, what it signals, and why this time truly is different. More Than Money Markets: The Real Liquid Capital Pool The […]

The Silver Awakening: Why Silver Prices Are Soaring and What’s Next

Silver is making headlines once again, breaking through barriers that have held it down for years. Recently, silver hit a remarkable 14-year high, closing at an impressive $39.33 per ounce. Many investors are now asking the critical question: What’s driving this surge, and can it continue? There’s a few major factors: Physical Demand Skyrocketing: On the COMEX, deliveries of physical silver are surging to nearly 2 million ounces per day — matching global daily production. This unprecedented demand underscores a looming supply squeeze as industries, investors, and short-sellers compete fiercely for limited resources. Critically Low Inventories: London Bullion Market Association […]

Silver at $50 AUD: What Australian Prices Could Be Telling the World

While many investors track gold and silver prices in U.S. dollars, those watching in Australian dollars have seen something remarkable: What’s driving these eye-catching numbers? A key factor is currency devaluation. Back in 2015, the Australian and U.S. dollars were nearly at parity. That same year, Mike identified what he called the bottom of a cyclical correction in the gold market — not a bear market, but a pause in a much larger bull run. Since then, the Australian dollar has lost around 50% of its value relative to the USD. As a result, gains in gold and silver prices […]

JUST RELEASED: Mike Maloney’s Critical Silver Price Prediction

Mike Maloney just made a rare public appearance at the Secrets of Syndication Conference, and his forecast for gold and silver might be the most important one he’s made in years.