Gold is better than any currency because of its consistent, undeniable store of value. While currencies have come and gone, gold keeps its purchasing power. Gold is a private, tangible asset that can serve as a hedge against your stock market investments.

It’s easy to see the value and strength of owning gold, but how do you buy gold for investment? Here’s how to go from knowing the merits of gold to becoming a proud owner of your very own gold coin or bar.

How to Buy Gold Coins

Buying gold coins is usually the first stop for most investors. It can feel like coins are a cheaper option and more manageable than a bar of gold. Before you rush out and buy your first gold coin, find out more about what to look for and common pitfalls you should avoid.

Finding gold coin sellers isn’t difficult. There are hundreds of vendors, but there are quite a few of them who sell numismatic gold coins with large mark-ups for a higher perceived collectible value, rarity, or historical importance (like shipwreck gold).

Unless you want to become a coin collector, it isn’t a good idea to invest in numismatic coins. Because at the end of the day, the only value a gold coin holds is its pure gold content.

So if you’re looking to invest in gold as a hedge against paper assets, you want to get maximum ounces for your currency rather than over-paying for a piece of art or a piece of memorabilia.

Yes, there are always manufacturer and dealer markups but – you should look to pay a reasonable price for your gold coin. Shop around and compare the prices and qualities of the gold coins in stock. If you see any dealer who is selling a gold coin significantly over (or even lower) than its market value, avoid them.

There is a global market price for gold that establishes the baseline for its value; all gold of a specific weight and quality should be about the same value. You can check the gold price as it moves throughout the trading day.

Buying Local vs. Online

Is it better to buy gold coins from a local dealer or buy from an online dealer? Both come with their pros and cons, and it’s important to know the strengths or weaknesses of each.

Local dealers give you the ability to take immediate possession of your coin with no shipping or insurance fees. Once you buy your coin, you can walk out of the shop with it in your hand. However, local dealers typically have higher premiums when you’re buying and have a limited stock to choose.

Online dealers help you avoid pushy salespeople and typically provide a greater selection of gold coins. Because there is less overhead for online dealers, the total cost is typically lower than local dealers, and rather than walking out with a gold coin in your pocket when you buy from a store, online dealers ship your gold discreetly to your door via insured express carriers.

Whether you’re buying locally or online, look at customer reviews and see how reputable the vendor is. If you can’t find any reviews or the majority of the reviews are negative, choose a better vendor.

Gold Rounds vs. Gold Coins

Gold coins are either gold rounds or sovereign-minted coins. When you’re investing for the first time in gold, you need to know the difference.

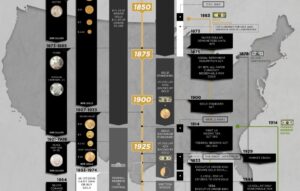

Gold coins are minted by national mints, including the US Mint, Royal Canadian Mint, Perth Mint, South African Mint, etc. They are guaranteed by governments and highly liquid – that means they can be easily bought or sold around the world because every investor and dealer immediately recognizes their quality and purity.

Gold coins are also known for their beauty and bear designs important to their home country, like an Eagle for the United States Mint or Maple Leaf for the Royal Canadian Mint. Gold coins carry higher premiums than gold rounds but investors typically get back part of that premium when they sell because the bid/ask spreads are tighter – meaning gold coins are in much higher demand than gold rounds and dealers bid over spot to buy them back.

Gold rounds are manufactured by private mints and are typically cheaper, i.e. have lower premiums. If you just want to own gold in round form or appreciate the custom design, gold rounds may be right for you. Just make sure the gold round bears a well-known and reputable mintmark so you’ll be able to sell the round back should you choose to in the future.

How to Buy Gold Bars

Buying a gold bar is more accessible than you think. Gold bars come in more accessible weights and sizes than the large 400-ounce “good delivery” bar Hollywood has made famous. Gold bars are available in much smaller weights, so you don’t have to be a millionaire before investing.

Gold Bars vs. Coins

Just like when you’re buying gold coins, you should do some comparison shopping and decide whether you want to buy locally or from an online dealer. Gold bars are typically very close to the spot price with very little markup.

Buying gold bullion bars for an investment is the best starting point for new investors because bars are less expensive than gold coins.

Where to Store Your Gold

Once you have your gold, you don’t want to leave it out in the open where it can be stolen or damaged. Decide if you’re going to store it at your home or a professional vault.

Buy Gold with GoldSilver

GoldSilver makes it possible for new and small investors to start with small gold amounts. With InstaVault, you can purchase 1/100th troy ounce increments of gold and convert to popular whole sizes later if you wish and even take delivery.

GoldSilver also offers popular 1 oz, 10 oz, and kilo gold bars and of course all the world’s gold sovereign coins including Gold Eagles, Gold Philharmonics, Gold Maple Leafs, Gold Krugerrands, Gold Britannias and more.

Invest in gold with GoldSilver today. We let you buy gold 24/7 through a safe and secure online connection with many different payment methods to help you invest the way you want. Our broad selection lets you compare prices and premiums so you can find what you’re looking for.