These Gold Charts Keep Me Up at Night

Two decades of market data point to an unprecedented opportunity in gold. See why Mike says ‘explosion’ is coming.

Russian Regulators Abruptly Ban BestChange Crypto Platform

Russian communications regulator Roskomnadzor has blocked cryptocurrency exchange platform BestChange for unspecified “financial sphere” violations. The platform is working with Russia’s central bank to understand and resolve the situation. While Russia bans crypto circulation and advertising, it allows cryptocurrency mining and international payments, having recently legalized these activities to potentially generate significant tax revenue and circumvent Western sanctions.

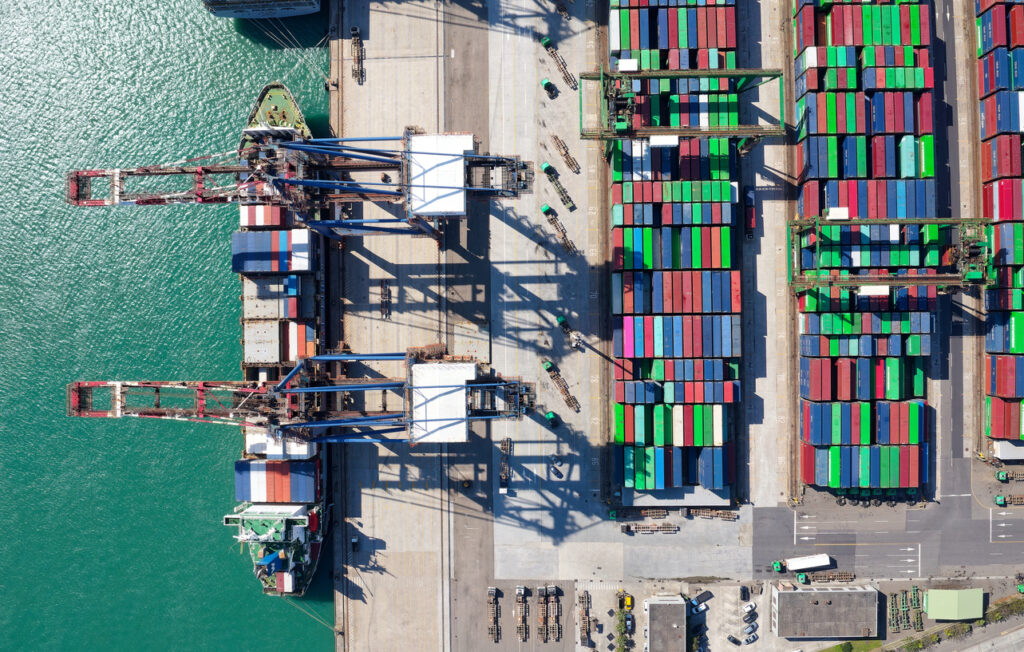

Metal Tariffs Jump to 25% as Trump Plans Global Trade Shake-up

In a significant shift in U.S. trade policy, President Trump has taken immediate action by signing proclamations that eliminate all existing exclusions on steel and aluminum tariffs while simultaneously raising these duties to 25%. This move reverses what a U.S. official described as an “out of control” exclusion process under the Biden administration, which had granted hundreds of thousands of specific product exemptions. The President is now preparing to unveil what he calls a “very sophisticated plan” for reciprocal tariffs, targeting a broader range of sectors including automobiles, semiconductor chips, and pharmaceuticals. Trump has remained steadfast in his position, dismissing […]

UBS: Gold to Hit $3,000 Amid Record Central Bank Demand

UBS has raised its gold price target to $3,000 as the precious metal surges past $2,900, gaining over 11% since mid-December despite Fed hawkishness. The rally is primarily driven by unprecedented central bank buying, which reached 1,045 metric tons in 2024 – double the 2011-2021 average. This sustained institutional demand, combined with growing geopolitical uncertainties – including unpredictable US trade policies and Middle East developments – has strengthened gold’s appeal as a safe-haven asset. These factors have led UBS to revise its price target to $3,000 per ounce over the next 12 months, with the bank suggesting investors consider structured […]

5 Amazing Gold & Silver Charts, “The Best Is Yet To Come” – Mike Maloney & Alan Hibbard

Join Mike Maloney and Alan Hibbard and discover five eye-opening charts that reveal how gold has outpaced the S&P 500

Gold Sets 12 Records in 2025, Up +11% YTD

Gold has set 12 record highs in just two months of 2025, reaching as high as $2,940 per ounce and marking an 11% year-to-date gain. This rally, reminiscent of the COVID-19 era surge, has been driven by a perfect storm of market conditions. Central banks, especially in Asia, are actively diversifying away from U.S. dollar reserves, with China leading the charge by reducing U.S. Treasury holdings in favor of gold purchases. Major investment firms, central banks, and retail investors are all participating in this historic rally, pushing domestic gold prices past ₹85,000 per 10 grams. The metal’s traditional role as […]

Gold’s Physical Demand Surge Prompts Citi to Target $3,300

Citibank has raised its gold price target to $3,300, citing unprecedented physical demand rather than speculation as the primary driver. “Using our quarterly price changes model, we see gold prices rising to well over $3,300/oz, though we view this is a bull case given the potential for jewelry and scrap over the next 12 months. We take a more conservative base case… which suggests gold increases to $2,900-3,000/oz over the next 6-12 months” – Kenny Hu, Max Layton and team for Citi. The bank’s analysis shows that 95% of mine supply will be absorbed by investors by late 2025, while […]

Record-Breaking Gold Rush Pushes Metal Toward $3,000

Gold has surged to a record $2,940 per ounce, marking its seventh peak in 2025 and an 11% gain this year following 2024’s 27% advance. President Trump’s announcement of 25% tariffs on steel and aluminum imports has amplified inflation concerns, while central banks’ persistent buying – surpassing 1,000 tons annually for three straight years – demonstrates sustained institutional demand. The gold market’s enthusiasm is evident in the unusual premium for U.S. gold futures, currently around $28 over spot prices, sparking a global scramble to move physical gold to American exchanges. This has led to a significant 90% increase in COMEX […]

Gold Rises Past $2,900 Amid Fresh Trade Tensions

Gold reached a historic high of $2,942 per ounce as markets react to President Trump’s announcement of 25% tariffs on steel and aluminum imports. While U.S. steelmaker stocks rose, global markets remained relatively stable, with investors anticipating potential deal-making and exemptions. China has responded with retaliatory duties, yet Hong Kong’s Hang Seng index has shown resilience, driven by strong AI and chip sector performance. The market’s attention now turns to Federal Reserve Chair Powell’s upcoming testimony, which is expected to address the implications of these trade measures on inflation and monetary policy. Meanwhile, the dollar remains firm, and oil prices […]