Fed’s Cautious Approach: June Likely Earliest for Rate Cuts as 2025 Outlook Takes Shape

The Federal Reserve has seven remaining meetings in 2025, with markets anticipating two to three interest rate cuts likely weighted toward the second half of the year. While March and May meetings are expected to maintain current rates (4.25-4.5%), cuts become increasingly probable starting with the June 18 or July 30 meetings. The Fed’s decision-making will balance inflation’s progress toward the 2% target against potential economic slowdown concerns, with Jerome Powell emphasizing they “don’t need to be in a hurry” to reduce rates.

Atlanta Fed Forecasts Recession | Projects a 2.8% GDP Contraction in Q1 25

The Atlanta Fed’s latest GDP projection signals recession ahead, forecasting a 2.8% contraction for Q1 2025. Are you prepared for what’s next?

Crescat Capital: Full Faith and Credit of Gold

Crescat Capital’s research highlights gold’s resurgence as a monetary anchor amid unprecedented US debt levels. Currently, US Treasury gold reserves account for just 2% of outstanding government debt—one of the lowest ratios in history and dramatically below the 40% backing seen during WWII. This imbalance creates a compelling case for gold revaluation, with models suggesting prices of $24,000 per ounce if gold-to-debt ratios returned to 17%, or $55,000 per ounce at 40% coverage. Meanwhile, a significant global monetary realignment is underway as international central banks rapidly accumulate gold reserves, which have reached a 49-year high, while US reserves have fallen […]

Oil Slumps Below $71 as OPEC+ Boosts Output and Trade Tensions Flare

Oil prices extended their downward trend on Tuesday with Brent crude dropping 1.5% to $70.53 and WTI falling 1.3% to $67.51. This decline comes as OPEC+ surprised markets by proceeding with its first output increase since 2022, adding 138,000 barrels per day in April. Simultaneously, new U.S. tariffs took effect on imports from Canada, Mexico, and China, with China quickly retaliating through increased levies on American agricultural products. Market analysts also point to President Trump’s pause on Ukraine military aid as a significant factor, with speculation that this signals potential sanctions relief for Russia that could bring more oil to […]

US Economy Projected to Contract 2.8% as Warning Signs Emerge

Despite a US economy that has been “chugging along” with 2.3% GDP growth through Q4 2024, the Federal Reserve Bank of Atlanta’s real-time GDP forecast now projects a 2.8% economic contraction. This negative swing primarily reflects a sharper-than-expected decline in post-holiday consumer spending and increased imports ahead of tariff implementation. While not necessarily signaling a recession, this projection comes amid growing consumer pessimism about economic prospects and renewed inflation concerns, particularly regarding the potential impact of Trump’s steep import tariffs on consumer prices.

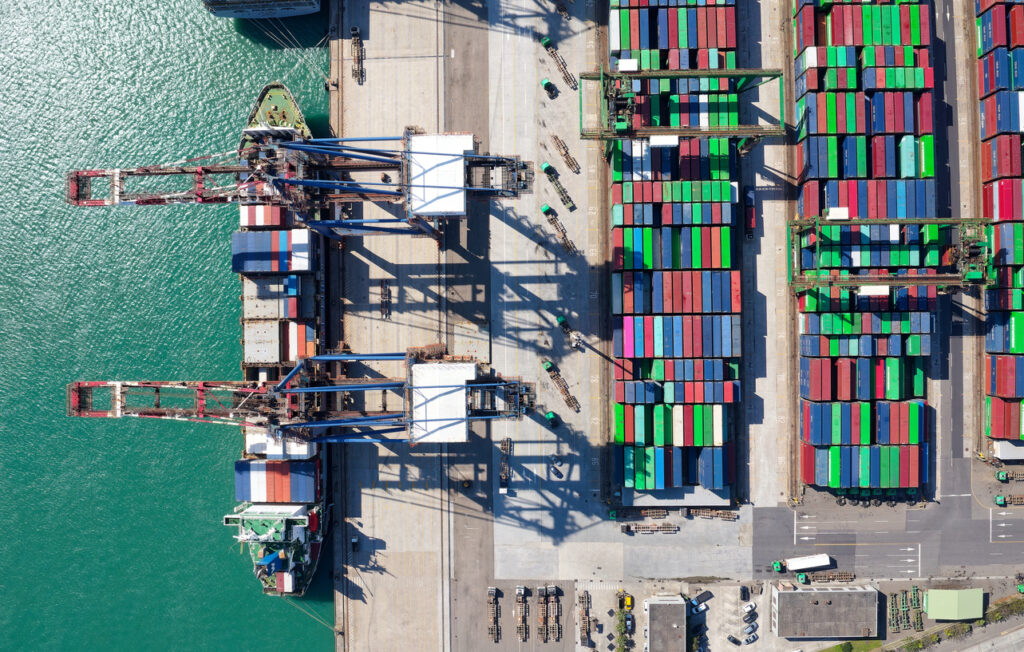

North American Trade Thrown into Chaos as Trump’s 25% Tariffs Begin

President Trump’s 25% tariffs on Canadian and Mexican goods took effect Tuesday after he declared “no room left” for negotiations. These tariffs apply to all imports except energy products (oil and natural gas), which face a lower 10% rate. Trump stated clearly that companies must move manufacturing to the United States to avoid these tariffs, telling them to “build their car plants, frankly, and other things, in the United States.” U.S. markets reacted negatively, with stocks falling Monday after Trump confirmed the tariffs would proceed. At the same time, he increased pressure on China with an additional 10% in tariffs, […]

Euro Surges to 2025 High as Defense Spending Boom Derails Dollar Parity Forecasts

The euro has reached its strongest position of 2025 against the dollar, climbing 0.7% to $1.0556 on Tuesday despite new U.S. tariffs on China, Mexico, and Canada. This represents a significant 4% recovery from a two-year low just one month ago. Major banks including Goldman Sachs, MUFG, and TD have now abandoned their predictions that the euro would reach parity with the dollar this year. Deutsche Bank also sees less likelihood of the euro falling below parity. This currency strength comes from Europe’s massive increase in military spending, with European Commission President Ursula von der Leyen announcing potential funding of […]

Central Banks Continue Strategic Gold Buying Streak in January 2025

Central banks started 2025 with continued gold buying, adding 18 tonnes in January. Emerging markets led this trend, with Uzbekistan, China, and Kazakhstan making the largest purchases. Poland and India each added 3 tonnes to their reserves. The World Gold Council’s 2024 report shows central banks remain key drivers of gold demand, responding to both economic and geopolitical factors. Since 2022, as tensions shifted from military conflicts to economic uncertainties, central banks have increased their gold holdings. Many take advantage of price dips to buy while making tactical sales during price increases. This ongoing interest highlights gold’s strategic value in […]

Canada, China Strike Back After Trump Imposes Sweeping Trade Barriers

President Donald Trump has imposed 25% tariffs on most Canadian and Mexican imports and raised the charge on China to 20%, affecting roughly $1.5 trillion in annual imports. Canada and China have retaliated with their own tariffs, with Canada imposing phased levies on $107 billion worth of US goods and China imposing tariffs of up to 15% on American agricultural shipments. The tariffs are expected to have significant economic impacts, including increased costs for US households and slower economic growth, and may lead to further retaliatory measures from other countries.

Gold Climbs as Trump’s Tariffs Trigger Global Safe-Haven Rush

Gold extended its gains for a second consecutive session on Tuesday, rising 0.9% to $2,919.44 an ounce as investors flocked to safe-haven assets amid escalating global trade tensions. President Trump’s implementation of 25% tariffs on Mexican and Canadian imports, along with doubling duties on Chinese goods to 20%, triggered immediate retaliation from China through additional tariffs and new export restrictions. This trade conflict, described by BullionVault’s head of research as “Trump 2.0 delivering exactly the chaos he promised,” has bolstered gold’s appeal as an “all-weather hedge” for both Western investors and emerging-market central banks. Gold has gained 10% this year, […]