America’s $18 Trillion Debt Crisis: When Even Lunch Requires a Payment Plan

Consumer debt has reached an all-time high of over $18 trillion nationally, with the average family owing more than $100,000. The situation has become so dire that services like DoorDash now offer “buy now, pay later” options for meals. Default rates are climbing, particularly among vulnerable populations. While federal relief seems unlikely, some states are addressing medical debt through legislation, and some localities are using COVID funds to buy up medical debt. More ambitious solutions like the Poor People’s Campaign’s “Jubilee Platform” to cancel various debts for low-income Americans face significant political hurdles but could become important in upcoming elections.

History Repeats? How Today’s Economy Mirrors the 1970s Stagflation Crisis

The Federal Reserve faces a difficult challenge balancing two opposing economic threats: rising prices due to new tariffs and increasing unemployment. This combination risks “stagflation” – a dangerous economic condition where inflation increases while job growth weakens. Fed Chairman Jerome Powell has chosen a wait-and-see approach for now, but history shows stagflation is extremely difficult to resolve. Similar to the 1970s crisis, today’s economy faces external price shocks (tariffs instead of oil prices) while consumers are already struggling. For investors, stagflation creates a challenging environment where both stocks and bonds typically perform poorly.

Capital Rotation: A Rare Opportunity for Precious Metal Investors

Learn how capital rotation precious metals indicators help investors identify market shifts and optimize portfolio allocation for better returns.

Presidential Authority vs. Fed Independence: Can Trump Remove Powell?

President Trump recently hinted he might fire Federal Reserve Chair Jerome Powell before his term ends next year, citing disagreements over interest rate policies. Powell maintains such a dismissal is illegal, and markets reacted negatively to the suggestion. Harvard Law Professor Daniel Tarullo, a former Fed Board member, explains there are two key legal questions: whether the Fed Chair position has “for cause” removal protection, and whether the Supreme Court would uphold presidential removal power over independent agency officials. Tarullo notes that while the Supreme Court has been expanding executive authority, several conservative justices have hinted they might view the […]

Economic Uncertainty Grows as White House and Federal Reserve Clash

Wall Street is experiencing significant volatility as President Trump escalates his criticism of Federal Reserve Chairman Jerome Powell. Trump wants immediate interest rate cuts to stimulate the economy, even threatening to fire Powell on social media before walking back those comments in an Oval Office meeting. Economic experts, including Moody’s Analytics chief economist Mark Zandi, predict no rate changes at the upcoming May Fed meeting, noting that monetary policy will likely remain unchanged until there’s more clarity on trade wars and economic policy. Investors are concerned about potential threats to Fed independence, which has historically led to inflation problems.

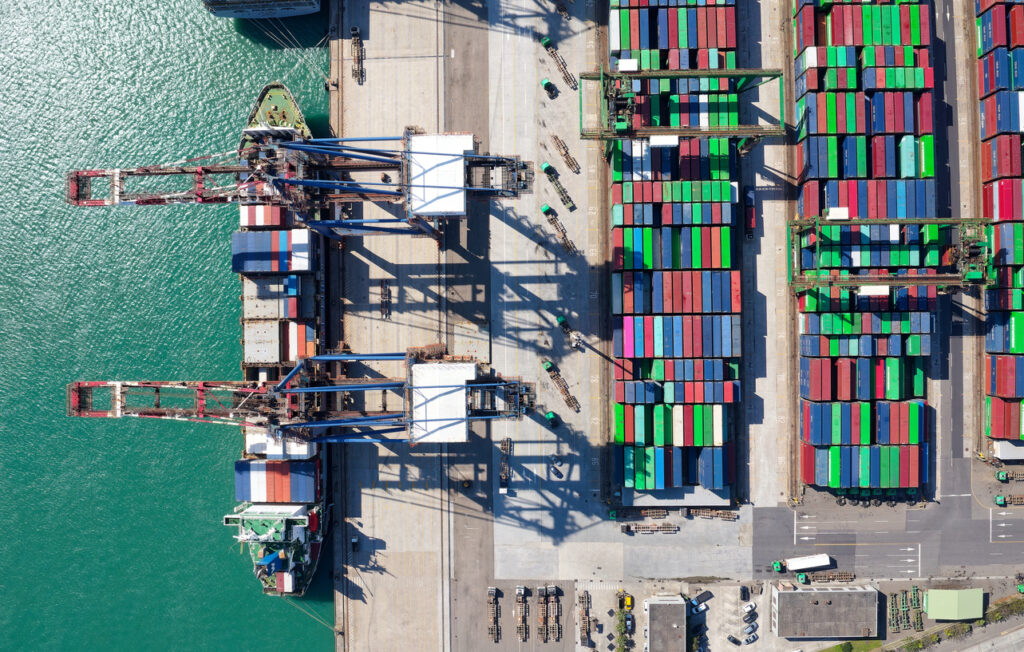

Pre-Tariff Import Surge Drives US Trade Deficit to Historic High

The US goods-trade deficit unexpectedly reached a record $162 billion in March 2025, widening by 9.6% from February. This surge was driven by companies rushing to import goods before President Trump’s new tariffs took effect. Imports rose 5% to $342.7 billion, with consumer goods reaching record levels. The widening deficit is expected to negatively impact first-quarter GDP, with some economists now forecasting a contraction instead of growth.

Trade War Consequences: Apollo Economist Predicts Rapid Descent into Summer Recession

Apollo Global Management warns that Trump’s tariffs could trigger a summer recession, with Americans experiencing store shortages as early as May. According to their chief economist Torsten Slok, the timeline begins with April’s tariff announcements disrupting shipping from China, leading to supply chain issues by May, retail and trucking industry layoffs by June, and ultimately a recession by summer 2025. While Treasury Secretary Bessent acknowledges trade tensions with China are “unsustainable,” he doesn’t predict a full recession, and some analysts note existing inventory may delay visible impacts.

Chinese Banks Capitalize on Gold’s Record Run as Investor Demand Soars

Record-high gold prices have triggered increased interest in gold investment products at Chinese banks. As demand surges, banks have raised minimum purchase amounts to manage risks while extending trading hours. This gold boom has significantly increased banks’ precious metal holdings (up 70% in 2024) and boosted their revenue from gold sales and transaction fees, making it an important growth area as interest margins narrow.

Trump Tariffs and European Growth Push Dollar to Worst Decline Since 2002

The US dollar is on track for its biggest two-month decline since 2002, falling 7.7% during March and April 2025. Two key factors drove this decline: Germany’s decision to end decades of austerity with increased public spending (boosting euro area growth expectations), and President Trump’s tariff announcements triggering a flight to safe-haven currencies like the yen, Swiss franc, and euro. Despite edging up 0.25% on Tuesday following reports that the Trump administration might soften planned tariffs, the dollar remains under pressure. Deutsche Bank notes that foreign investors are staging a “buyers’ strike” on US assets despite recovering prices. The euro, […]

What If the Future of Money Isn’t Digital — but Gold?

Mike Maloney’s new video uncovers fresh evidence that a gold-backed monetary system may be closer than anyone expected. Behind the scenes, Trump’s comments on gold, quiet shifts at the U.S. Treasury, and actions by global elites are setting the stage for a massive financial reset. Mike also uncovers why global gold flows are surging, how COMEX is bracing for a crisis, and what history teaches about what comes next. The rules of the game are changing — fast. Will you be ahead of the shift, or left behind?