Daily News Nuggets | Today’s top stories for gold and silver investors

October 2nd, 2025

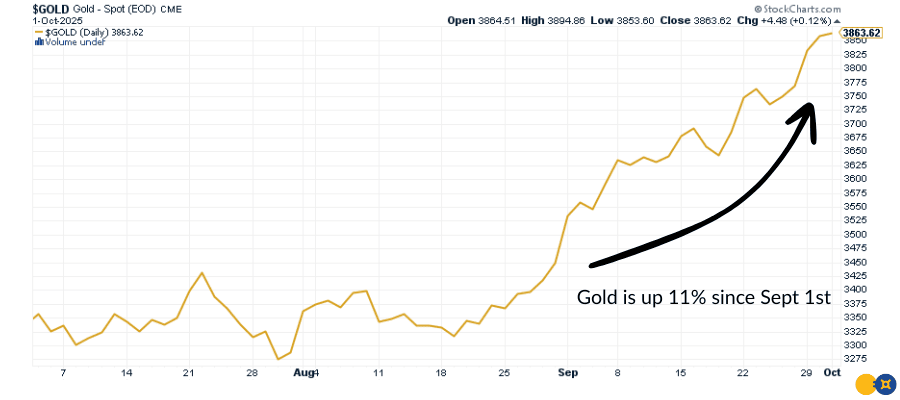

Gold Extends Rally to Five Days

Gold prices are riding a five-day winning streak, holding near $3,880/oz as traders weigh political turmoil at the Federal Reserve and a looming U.S. government shutdown. Silver is also firm, hovering around $47.50/oz.

The real headline, though, is September’s performance: up 11% in a single month — one of gold’s strongest runs in recent memory. The chart tells the story: investors have poured into safe havens as political turmoil shakes confidence in the Fed and a government shutdown adds to uncertainty.

This kind of move is more than a knee-jerk reaction. It signals investors are repositioning for a weaker dollar, volatile bond markets, and the likelihood the Fed will keep cutting rates well into 2025.

Government Shutdown Begins Amid Healthcare Clash

The U.S. government officially shut down Wednesday after Congress failed to pass a budget agreement. A vote to reopen the government quickly collapsed, with Senate Democrats holding firm on demands to extend healthcare subsidies under the Affordable Care Act. Without a deal, hundreds of thousands of federal workers face furloughs, and critical data releases — from jobs to inflation — are now delayed.

The standoff hinges on tax credits that help millions afford insurance, set to expire at year’s end if no extension is passed. With both parties digging in, investors face renewed policy uncertainty. For markets, the immediate risk is the absence of reliable data, which could complicate Fed decision-making. Historically, gold has drawn safe-haven flows during shutdowns as investors hedge against volatility and political dysfunction.

With the shutdown underway, all eyes turn to Friday’s jobs report — assuming it’s released on schedule.

Supreme Court Keeps Lisa Cook at the Fed

The U.S. Supreme Court ruled Wednesday that Lisa Cook will remain a Federal Reserve governor at least until January, when it hears arguments on her contested dismissal. President Trump has sought to remove her, accusing the Fed of dragging its feet on rate cuts. At stake is a precedent-setting question: can a president fire a Fed governor without cause?

The implications go well beyond one seat. If the Court sides with Trump, it could alter how independent the Fed truly is — a cornerstone of investor confidence for decades. For markets, that uncertainty fuels demand for assets immune from political tampering, with gold again standing out as the safe-haven of choice.

Goldman Sachs: ‘Large Upside Risk’ for Gold

Goldman Sachs analysts say the metal’s record-setting run may only be the beginning. The bank sees “significant upside risk” for gold if the Fed keeps easing and Washington remains gridlocked. Goldman says if private capital flows aggressively into gold, the bank believes prices could climb toward $4,500/oz — and notes a more moderate path to $4,000+ by mid-2026.

The bottom line: Goldman’s call echoes the broader thesis that gold is no longer just a crisis hedge — it is becoming a structural portfolio allocation for both large institutions and individual investors.

Investor Outlook: Gold in a Stagflation World

The World Gold Council is warning that stagflation — the toxic mix of slowing growth and stubborn inflation — is back on the radar. For investors, that means the worst of both worlds: weaker stock market returns alongside rising costs at the grocery store and gas pump.

Historically, this backdrop has punished equities but supported gold, which tends to benefit when confidence in growth assets falters. With tariffs, political shocks, and Fed policy uncertainty adding fuel to the fire, gold’s role as a stabilizer looks increasingly vital.

As Q4 begins, the steady climb in gold suggests investors are already bracing for a stagflationary squeeze.