Daily News Nuggets | Today’s top stories for gold and silver investors

February 17th, 2026 | Brandon Sauerwein, Editor

The Jobs Report Mirage: Strong Headline, Weaker Reality

January’s headline jobs gain of 130,000 masked a much bigger development: sweeping benchmark revisions that dramatically downgraded 2025 payroll growth. Previously reported job gains of +584,000 were cut to +181,000 — roughly 15,000 jobs per month — while March payroll levels were revised down by nearly 900,000.

That shift reframes the narrative. The labor market isn’t deteriorating rapidly, but it may be stuck in what economists call a “jobless expansion” — output grows, yet hiring momentum lags. Unemployment ticked down to 4.3%, but young and Black workers have seen disproportionate increases in joblessness.

At the same time, inflation expectations remain anchored around 3%, and new tariffs are adding cost pressure. With nearly 90% of tariff costs falling on U.S. firms and consumers, the Fed faces a familiar bind: cooling employment versus still-elevated inflation.

What we’re watching now is whether the U.S. economy stabilizes — or quietly slips into something more fragile.

Stay Ahead with Gold & Silver News The most important market insights, Fed updates, and global trends — everything investors need to make smarter, safer decisions.

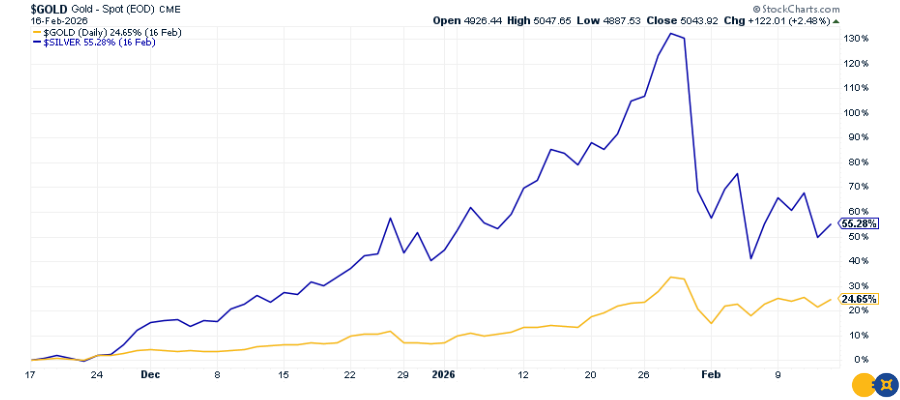

Gold Dips Below $5,000 as Markets Reassess Risk

Gold briefly pulled back below $5,000 after a powerful rally that saw prices approach $5,600 earlier this year.

The drivers remain intact: geopolitical tension, persistent inflation concerns, and rising sovereign debt. Bond yields are volatile. Equity valuations remain stretched. Fiscal deficits continue to widen.

Gold and Silver Prices Three Month Chart

This isn’t just about price action — it’s about positioning. Investors appear to be using gold as a portfolio stabilizer in a world where policy risk hasn’t faded. For many, the debate isn’t short-term momentum. It’s whether traditional assets alone are enough in a structurally uncertain environment.

But while gold remains elevated, not everyone sees this as the start of a broad commodities boom.

Goldman Sachs: This Is a Gold Rally — Not a Commodity Supercycle

Gold’s surge has sparked comparisons to past commodity supercycles. But Goldman Sachs disagrees.

According to the bank, this rally is being driven by structural factors — central bank buying, geopolitical fragmentation, and reserve diversification — not synchronized global growth. Unlike previous commodity booms, energy and industrial metals haven’t posted the same broad-based strength.

That distinction reshapes the outlook. A supercycle implies years of rising prices across raw materials driven by surging demand. Gold’s move, by contrast, appears tied to monetary policy, sovereign debt concerns, and reserve realignment.

Gold may remain supported even if global growth cools — but investors shouldn’t assume a blanket commodities surge is underway. Still, even without a supercycle, some analysts see considerably more upside ahead.

Gold to $6,000? Analysts Debate the Next Big Move

Gold’s powerful run has prompted some aggressive forecasts — including one from Thomas Winmill, portfolio manager at Midas Funds, who believes the metal could finish 2026 above $6,000 per ounce. Winmill points to sustained central bank buying and what he views as U.S. policies that are weakening confidence in dollar-denominated assets.

Others are more measured. Several analysts see gold advancing into the $4,000–$5,500 range over the next 12–18 months, depending on how quickly interest rates fall and whether economic growth slows more sharply. Central bank accumulation — which has remained strong in recent years — is widely viewed as a key pillar of support.

Forecasts differ, but the broader gold price outlook 2026 remains constructive as analysts weigh debt expansion, geopolitical risk, and continued central bank demand.

What’s striking is the consensus beneath the disagreement. Few are calling for a major reversal. Instead, the conversation has shifted toward how far and how fast gold climbs in a world marked by fiscal expansion, geopolitical strain, and persistent inflation risks.

Sweden Reopens Debate on Joining the Euro

Sweden is once again debating whether to adopt the euro, as shifting geopolitical dynamics and concerns about global stability prompt a reassessment of its long-standing currency independence.

While Swedes rejected euro membership in a 2003 referendum, the landscape has changed. Russia’s war in Ukraine, Sweden’s NATO accession, and deeper integration with EU institutions are reshaping how policymakers think about economic alignment. Proponents argue that joining the euro could strengthen Sweden’s position within Europe and reduce currency volatility tied to a smaller, more exposed krona.

No referendum is imminent. But the renewed debate signals something larger: in a shifting global order, even long-standing monetary arrangements are being quietly reconsidered.