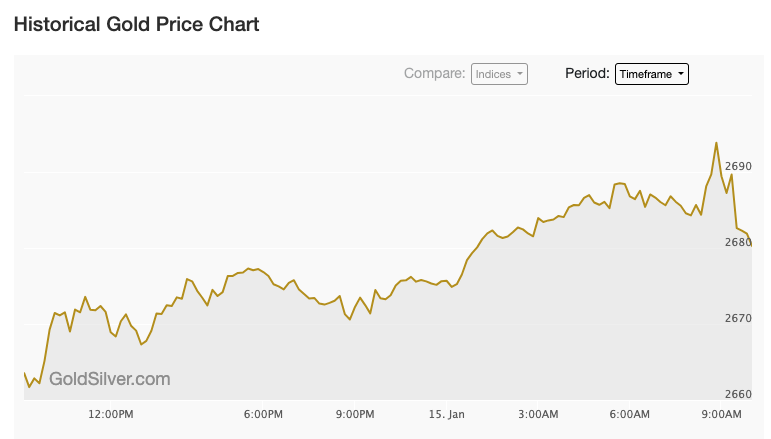

Gold prices gained momentum as both the U.S. dollar index and Treasury yields retreated, with spot prices rising 0.4% to $2,687.59 per ounce and futures climbing over 1% to $2,710.00. Markets are particularly focused on upcoming CPI data, expected to show annual inflation increasing to 2.9% from November’s 2.7%. According to Saxo Bank’s Ole Hansen, market uncertainty is heightened by both the pending inflation data and political considerations, including Trump’s proposed import tariffs that could impact inflation and complicate the Federal Reserve’s rate decisions. Despite Tuesday’s moderate PPI increase, analysts suggest rate cuts may not materialize until the second half of the year.

Articles

Gold Holds Above $5,000 as Hedge Funds Brace for Turbulence

Gold remains steady above $5,000 as the dollar weakens and investors position defensively ahead of crucial inflation and jobs data. Hedge funds are shorting U.S. stocks at record levels while China marks its 15th consecutive month of gold purchases—signaling a strategic shift in how markets view risk.