Brandon Sauerwein, Editor

Someone in the U.S. just took possession of approximately 30 million ounces of physical gold — a sum equal to over 11% of the U.S. government’s reported reserves.

This isn’t just another market headline — it could be the critical canary in the gold mine.

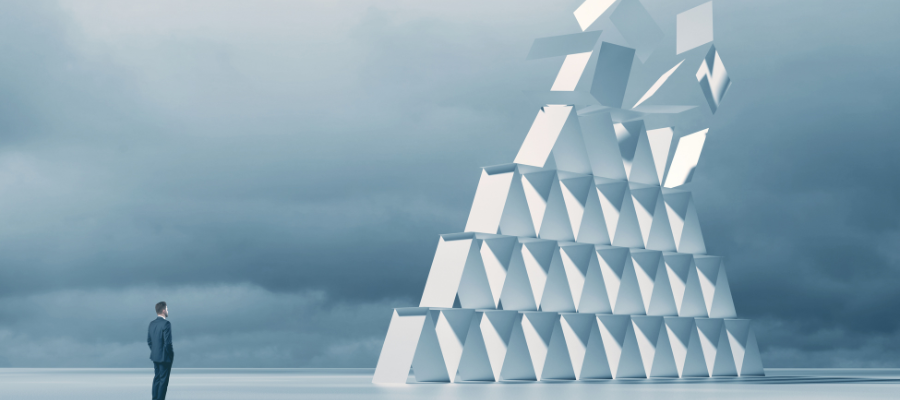

For years, Mike Maloney has warned about the dangerous disconnect between paper gold promises and physical reality, with derivatives contracts vastly outnumbering actual available bullion.

As the dangerous disconnect between paper promises and physical reality grows, are you prepared for what happens when the paper gold market finally confronts the truth?

Gold Cartel In Turmoil As Derivatives Unravel

Banks are frantically scrambling to cover their massive gold short positions — and in this explosive episode, Mike and Alan reveal why this could trigger a financial crisis even bigger than 2008.

With trillions in paper gold derivatives backed by insufficient physical metal, we’re witnessing the moment when multiple parties discover they’ve been promised the same ounce. In today’s video you’ll see:

- How derivative markets have artificially suppressed gold’s true price

- Why banks with massive short positions now face potentially unlimited losses

- The striking parallels between today’s gold derivatives and 2008’s mortgage-backed securities collapse

What Else is in the News?

🔥 GOLD’S HISTORIC STREAK APPROACHES $3,000 MILESTONE

Gold has logged eight straight weeks of gains — the longest winning streak since 2020 — as prices reached an all-time high of $2,956 before experiencing some profit-taking. Market analysts believe the psychological $3,000 barrier will soon be tested as economic uncertainty and a weaker dollar continue to boost safe-haven demand.

🔍 FED’S INFLATION GAUGE IN FOCUS THIS WEEK

All eyes are on Friday’s release of the Fed’s preferred inflation measure, with January’s core PCE expected to ease slightly to 2.6% annually. Despite the projected modest improvement, inflation remains stubbornly above the Fed’s 2% target, keeping potential rate cuts off the table for the first half of 2025.

⚠️ MUSK’S FEDERAL WORKER SURVEY SPARKS CHAOS

Federal workers received conflicting guidance about responding to a government-wide email asking them to document their weekly accomplishments by Monday night. While President Trump publicly backed the effort led by Musk’s Department of Government Efficiency (DOGE), at least seven major agencies told their employees to disregard the request entirely.

⚖️ COINBASE SCORES MAJOR WIN AS SEC BACKS DOWN

In a significant development for cryptocurrency markets, the SEC has agreed to drop its lawsuit against Coinbase, marking a potential shift in the regulatory landscape. While Coinbase celebrates being “right on the facts and the law,” challenges remain with 10 states still investigating the company’s staking services.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Sam is such a great customer success…

“Sam is such a great customer success agent. She is kind, intelligent, and has the customer’s interest at heart. I can’t say enough about my experience with her and Gold Silver. Thanks again for the help today, Sam.” — Mark T.

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?