Precious metals investors are watching market conditions closely as gold and silver hover at pivotal price points. While both metals have already posted impressive gains, multiple converging factors suggest we may be witnessing the early stages of a gold and silver price surge rather than a market peak.

Understanding these catalysts can help you position your portfolio to benefit from the potential upside while managing risk appropriately. Here are seven compelling reasons why gold and silver could erupt from current levels.

1. Central Bank Demand Remains at Record Highs

Central banks worldwide have shifted from net sellers to aggressive buyers of gold — a fundamental change in how nations view monetary reserves.

The numbers tell the story: Central banks purchased over 1,000 tonnes of gold annually in 2022, 2023, and 2024 — the highest levels since 1967.

Countries like China, India, Poland, and Turkey continue expanding their gold holdings as they diversify away from dollar-denominated assets. The People’s Bank of China, for example, increased its gold reserves for 18 consecutive months through May 2024.

This isn’t just about portfolio diversification. It signals growing concerns about fiat currency stability and the long-term structure of the global monetary system. When the institutions managing national wealth consistently buy an asset, individual investors should pay attention.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

2. Real Yields Are Working in Gold’s Favor

Gold’s relationship with real yields — interest rates adjusted for inflation — remains one of the most reliable predictors of price movements.

When real yields fall or stay negative, gold becomes more attractive because it doesn’t carry the opportunity cost of foregone interest payments. You’re not sacrificing much by holding a non-yielding asset when bonds barely beat inflation.

Current monetary policy suggests real yields will stay compressed for the foreseeable future. Central banks face a difficult balancing act between controlling inflation and supporting economic growth. This often results in interest rates that fail to keep pace with actual inflation — exactly the environment where gold historically thrives.

Even as inflation has moderated, real yields (10-year Treasury yields minus inflation) have hovered near zero or below. This compression creates a favorable backdrop for the gold and silver price surge many analysts anticipate.

3. Silver’s Historic Rally Demonstrates Its Explosive Leverage

The gold-to-silver ratio measures how many ounces of silver equal one ounce of gold. At approximately 57:1 today, the ratio tells a remarkable story about what’s already happened—and what could still unfold.

In April 2025, this ratio sat above 100:1, suggesting silver was undervalued relative to gold. Since then, silver has delivered exactly the kind of explosive catch-up rally that historically occurs when the ratio reaches extremes.

With prices surging from around $30 to over $78, silver has dramatically outperformed gold, validating the thesis that it offers higher upside potential during rallies.

The current 57:1 ratio now sits below the decade-long average of approximately 70:1. Historical patterns suggest the ratio could compress further—in the 2011 peak, it reached 31:1—but investors should recognize that silver’s volatility cuts both ways. The same leverage that drives 150%+ gains can produce equally sharp corrections.

What this means for positioning: If you missed silver’s initial move, recognize that bull markets often have multiple legs. The 2010-2011 rally saw silver climb from $17 to $49 over 11 months with several 15-20% pullbacks along the way. For those already positioned, the compressed ratio suggests the rally has matured, making risk management crucial. For those considering entry, wait for pullbacks rather than chasing extended moves.

4. Industrial Demand for Silver Creates a Supply Squeeze

Unlike gold, which serves primarily as a store of value, silver plays a dual role as both an industrial metal and investment asset. This creates unique supply dynamics that are tightening.

The green energy transition is a game-changer for silver demand. Each solar panel requires about 20 grams of silver. Electric vehicles use 25-50 grams per car for electronics and charging infrastructure. 5G networks, medical devices, and consumer electronics all require silver for its unmatched electrical conductivity.

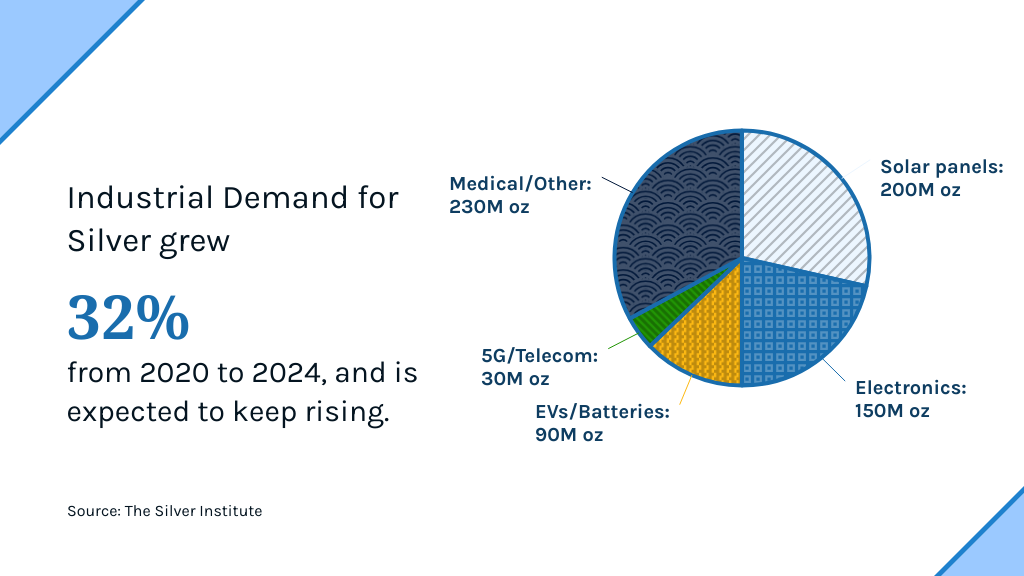

The numbers are climbing fast. The Silver Institute projects industrial demand will reach approximately 700 million ounces this year, up from around 530 million ounces in 2020. That’s a 32% increase in just four years — and the trajectory shows no signs of slowing.

It’s also important to note that industrial consumption removes silver from the market permanently. Unlike investment demand, which can return during price spikes when investors sell, silver used in solar panels and electronics is gone forever.

Annual mine production sits around 850 million ounces, while total demand (industrial plus investment) approaches 1.1 billion ounces. The deficit is currently filled by recycling and above-ground stocks, but that’s not sustainable long-term. This supply-demand imbalance could drive significant price appreciation.

5. Geopolitical Tensions Are Intensifying

Global uncertainty has reached levels not seen since the Cold War. Ongoing conflicts, trade disputes, and shifting alliances create an environment where safe-haven assets thrive.

Gold and silver have performed well during geopolitical instability for a simple reason: they maintain value regardless of political outcomes. They can’t be sanctioned, frozen, or devalued by government decree.

Recent examples validate this safe-haven role. When Russia invaded Ukraine in February 2022, gold jumped from $1,900 to over $2,050 in a matter of weeks. Similar spikes occurred during the Israeli-Hamas conflict in October 2023 and during U.S.-China trade tensions throughout 2018-2019.

The current landscape includes strained international relations, concerns about the stability of global institutions, and the fracturing of the post-World War II order. As geopolitical risks show no signs of abating, this safe-haven demand should continue supporting prices.

6. Currency Devaluation Concerns Are Growing

Massive government debt levels and continued monetary expansion have raised serious questions about long-term currency stability.

The numbers are staggering: U.S. federal debt now exceeds $38 trillion — more than 120% of GDP. And it’s not just the U.S. — Japan’s debt-to-GDP ratio sits above 260%. These are levels historically associated with currency crises or dramatic devaluations.

When confidence in fiat currencies erodes, investors naturally turn to precious metals. Gold and silver have maintained purchasing power across centuries and civilizations. An ounce of gold bought a fine suit in Roman times, and it buys a fine suit today.

The unprecedented fiscal and monetary responses to recent economic challenges — from the 2008 financial crisis through COVID-19 — have expanded money supplies globally. While these policies prevented immediate crises, they’ve also sown seeds of concern about future currency valuations.

Precious metals serve as insurance against this monetary uncertainty. As currency concerns intensify, their value increases proportionally.

7. Technical Indicators Suggest a Breakout Is Imminent

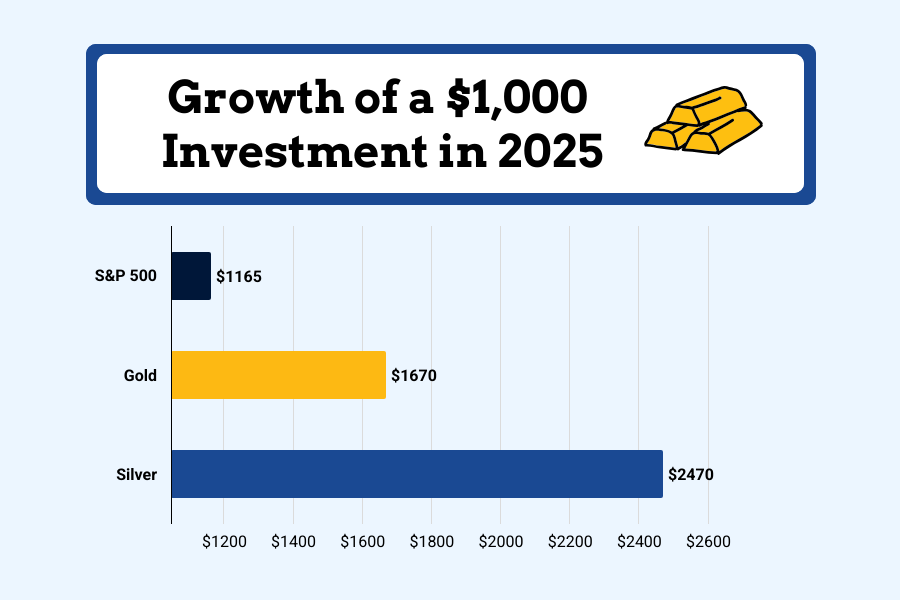

From a technical analysis perspective, 2025 delivered exactly the kind of explosive move that chart patterns suggested was building. Gold surged 67%, while silver climbed an even more impressive 147%.

These aren’t modest gains — they’re the kind of moves that define bull markets. And while the initial breakout has clearly occurred, historical patterns suggest major precious metals rallies often unfold in multiple waves rather than single parabolic moves.

Gold’s climb from around $2,650 to over $4,400 represents a decisive break above previous consolidation ranges. The metal is now establishing new support zones around $4,200-$4,400, suggesting the market is digesting gains rather than reversing them.

Silver’s 147% surge in 2025 validates everything we know about its leverage during bull markets. When fundamentals align — industrial demand, monetary conditions, geopolitical risk — silver delivers outsized returns compared to gold.

The charts now show price discovery zones with limited historical resistance overhead. Volume patterns during this rally indicate institutional participation, not just retail speculation. Pullbacks have been met with buying rather than selling — a bullish sign.

The 2010-2011 rally offers instructive precedent. Gold gained 80% over 18 months with several corrections along the way, while silver more than tripled. If current fundamentals remain supportive, 2025’s gains could be the first chapter rather than the final page.

That said, managing risk after such significant moves is crucial. Consider taking partial profits, dollar-cost averaging on pullbacks, or raising stop-losses rather than chasing extended rallies.

Positioning Your Portfolio for 2026

Understanding these catalysts is only valuable if translated into appropriate action.

For investors looking to capitalize on potential precious metals appreciation, consider a dollar-cost averaging approach that builds positions gradually while managing risk. This strategy smooths out volatility and prevents the regret of poorly timed lump-sum purchases.

Conservative investors might allocate 8-10% to gold and 2-3% to silver, focusing on stability and wealth preservation. This provides meaningful exposure without excessive volatility.

Those with higher risk tolerance could emphasize silver more heavily — potentially 7-10% to silver and 3-5% to gold — to capture its higher upside potential during rallies. Just remember that silver’s volatility cuts both ways.

The convergence of central bank demand, favorable monetary conditions, supply constraints, geopolitical uncertainty, and technical setups creates a compelling case for precious metals appreciation from current levels.

While timing market peaks and troughs perfectly remains impossible, positioning yourself before these catalysts fully manifest could prove rewarding for patient investors focused on long-term wealth preservation and growth.

People Also Ask

What are the key factors driving gold and silver prices higher?

Central banks are buying record amounts — over 1,000 tonnes annually — as they diversify away from dollar reserves. Real yields remain compressed, making non-yielding gold more attractive. Silver faces a unique supply squeeze: industrial demand from solar panels, EVs, and 5G infrastructure is surging while mine production struggles to keep pace. Add geopolitical tensions, currency devaluation concerns, and bullish technical patterns, and you have multiple catalysts converging to push prices higher.

Is now a good time to invest in gold and silver?

After gold’s 67% gain and silver’s 147% surge in 2025, timing becomes tricky. Rather than trying to catch perfect entry points, consider dollar-cost averaging to build positions gradually. This smooths out volatility and prevents poorly timed lump-sum purchases. Conservative investors might favor gold’s relative stability (8-10% allocation), while those comfortable with volatility could emphasize silver’s leverage potential (7-10% allocation). The key is aligning your allocation with your risk tolerance and recognizing that bull markets often have multiple legs higher separated by corrections.

How does the gold-to-silver ratio impact investment decisions?

The gold-to-silver ratio shows how many ounces of silver equal one ounce of gold. At approximately 57:1 today, the ratio has compressed significantly from the 80:1+ levels seen earlier this year — validating silver’s explosive leverage during bull markets. Historically, the ratio averages around 70:1, with bull market bottoms often reaching 30-40:1. A compressed ratio like today’s suggests silver has already delivered strong outperformance, though historical precedent shows it can compress further if the bull market continues. Use the ratio as a tactical timing tool, but don’t let it override your core allocation strategy.

What role do central banks and industrial demand play in the price surge?

Central banks purchased over 1,000 tonnes of gold annually in 2022-2023 — the highest levels since 1967. China alone added to reserves for 18 consecutive months through mid-2024. This institutional buying creates persistent upward pressure and signals concerns about fiat currency stability. For silver, industrial demand tells an equally compelling story. The Silver Institute projects 700 million ounces of industrial consumption in 2024, driven by solar panels (~20 grams each), electric vehicles (25-50 grams per car), and electronics. Unlike investment demand that can return to the market, industrial consumption permanently removes silver from circulation — creating supply deficits that drive prices higher.

What are the risks of investing in gold and silver at current levels?

After 2025’s explosive gains (gold +67%, silver +147%), volatility risk is elevated. Sharp 15-25% corrections are normal even within bull markets — silver’s leverage cuts both ways. Rising real yields could make bonds more attractive than non-yielding gold. Geopolitical tensions could ease, reducing safe-haven demand. Silver faces additional risks if economic slowdown weakens industrial demand or if new technologies substitute away from silver use. Most experts recommend limiting precious metals to 5-15% of a diversified portfolio rather than making them a concentrated bet. After such strong moves, risk management—through stop-losses, partial profit-taking, or smaller position sizes — becomes crucial.

Past performance does not guarantee future results. This article is for informational purposes only and should not be considered investment advice. Always conduct thorough research or consult with a financial advisor before making investment decisions.

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)