Key Takeaways

- Gold consolidates near $3,355-$3,390, with upside capped at $3,388 resistance amid Fed hawkishness

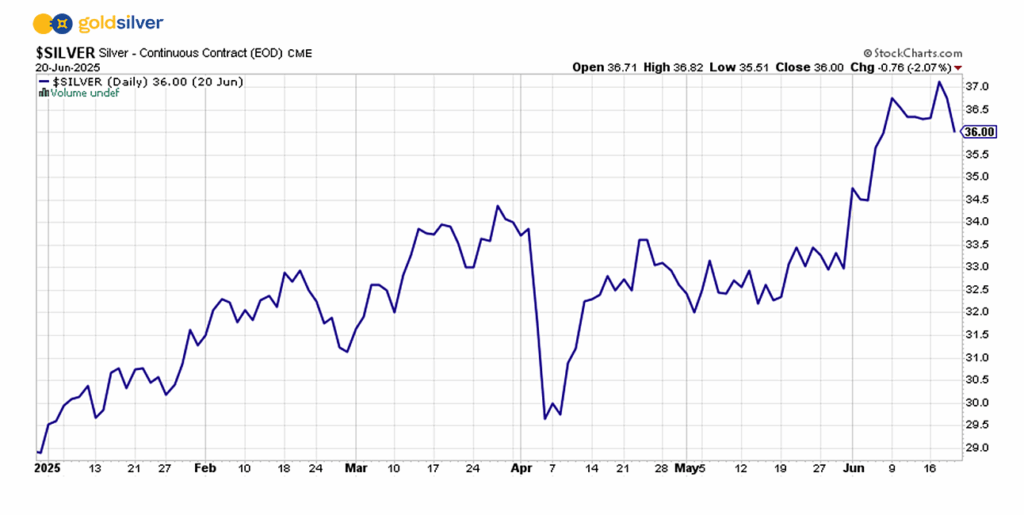

- Silver reaches 14-year high of $37 before pulling back to $36, facing resistance at $36.31

- Strong U.S. dollar and reduced Fed rate cut expectations limit bullish momentum for both metals

- Investors await flash PMI data and Middle East developments for directional clarity

Market Overview

Gold and silver remain caught between opposing forces. Persistent geopolitical risks have offered safe-haven support, while the Federal Reserve’s increasingly hawkish stance and dollar strength apply downward pressure.

Gold trades near $3,390, struggling to break resistance at $3,388 despite elevated geopolitical tensions. Silver has pulled back to $36 after briefly reaching its highest level since 2011.

The Federal Reserve’s projections now suggest just two rate cuts in 2025, with minimal adjustments expected beyond that. This unexpected hawkish shift has strengthened the dollar, undermining demand for dollar-priced metals.

Gold Year-to-Date Performance

- YTD: +29% (at the time of this writing $3,384)

- Weekly Range: $3,340-$3,391

- Key Resistance: $3,391

- Key Support: $3,340

Silver Year-to-Date Performance

- YTD: +25.5% (at the time of this writing $36.31)

- Weekly Range: $35.60-$37.28

- Key Resistance: $36.31

- Key Support: $35.60

If the metals replicate their first-half performance, annualized gains could reach 58% for gold and 51% for silver. For more insight on where gold and silver are headed, check out our price prediction articles:

Technical Analysis & Market Dynamics

Gold

Despite rising Middle East tensions and U.S. military activity, dollar strength has capped gold’s safe-haven rallies. The metal remains trapped below $3,388 resistance. Investors increasingly recognize a “new gold playbook,” where central bank demand from emerging markets and de-dollarization trends play a growing role in price support, even as Western financial investors hesitate.

Silver

Silver’s dual nature as both precious and industrial metal creates unique volatility. After its dramatic surge to $37, profit-taking and concerns about global manufacturing weakness have pushed the metal back to $36. The next move hinges on economic data that could either validate growth concerns or reignite industrial demand.

For more on gold and silver prices, check out our price pages.

Critical Catalysts: What Could Break the Stalemate

1. Flash PMI Data (Immediate Impact)

Global manufacturing and services indicators will reveal whether economic momentum is accelerating or stalling. Weak data could trigger risk-off flows benefiting gold, while strong readings might boost silver through industrial demand channels.

2. Middle East Escalation (High Impact Potential)

Current tensions remain a powder keg. Any significant escalation — expanded military action, oil supply disruptions, or broader regional involvement — could spark immediate safe-haven buying, potentially breaking gold above resistance.

3. Dollar Dynamics (Persistent Influence)

The greenback’s strength remains the primary headwind. Watch for:

- Any signs of peak dollar momentum

- Shifts in interest rate differentials

- Changes in global reserve allocation patterns

4. Fed Communication (Market Moving)

Markets hang on every Fed word. Key scenarios:

- Dovish surprise: Could unleash significant precious metals rally

- Maintained hawkishness: Likely keeps current ranges intact

- Data-dependent pivot: Would inject volatility across all markets

Trading Ranges

- Gold: $3,340-$3,388 (break above $3,388 needed for bullish continuation)

- Silver: $35.60-$36.45 (must clear $36.31 to resume upward trajectory)

What’s Next for Precious Metals?

Precious metals remain in a holding pattern, trapped between powerful opposing forces. Geopolitical uncertainty provides a floor, while Fed policy and dollar strength create a ceiling. This tension won’t last forever.

The impressive year-to-date gains — largely overlooked amid broader market drama — demonstrate underlying strength. Yet without a catalyst to tip the balance, expect continued consolidation.

The key question: Which force breaks first — dollar strength or geopolitical stability? The answer will determine whether precious metals’ stellar 2025 continues or stalls at current levels.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.