You’re ready to buy precious metals — but should you favor gold or silver? At first glance, the two seem similar: both are monetary metals, both are scarce, and both offer protection against economic uncertainty. Yet when it comes to building a resilient portfolio, the differences between them are profound.

Understanding those differences is what separates the casual buyer from the strategic investor.

Below are the five distinctions that matter most for gold and silver in 2026.

Difference #1: The Silver Price is More Volatile

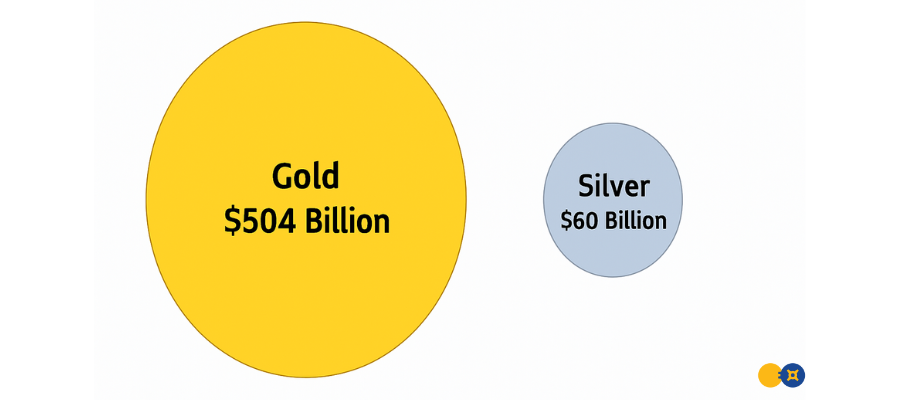

Annual mine supply hasn’t changed dramatically, but dollar values have — because prices have risen so sharply.

- Gold annual supply: ~120 million ounces

- Silver annual supply: ~1 billion ounces

At today’s prices:

- Gold supply (~120M oz × $4,200) ≈ $504 billion

- Silver supply (~1B oz × $60) ≈ $60 billion

That means the gold market is now over eight times larger than the silver market, despite silver’s higher volume. In dollar terms, silver remains a tiny market — and tiny markets move.

Market Value of 2025 Supply: Gold vs Silver

To put this in perspective:

- Apple’s market cap is over $3 trillion — more than 50× the size of the entire annual silver supply.

- Even a single mid-cap tech company is often larger than silver’s whole yearly market value.

This structural smallness is why silver is far more volatile than gold.

A relatively small amount of capital — from investors, hedge funds, or industrial users — can push silver sharply higher… or lower.

Historically:

- In bull markets, silver outperforms gold by a wide margin.

- In bear markets, silver falls faster and farther.

Investor Implication: You must be emotionally prepared for bigger swings. But if you buy early in a bull cycle, volatility becomes an asset, not a burden. Silver has consistently delivered higher percentage gains than gold in major precious-metal advances.

If you believe we’re still in the early stages of a secular bull market — fueled by monetary stress, geopolitical conflict, and accelerating global debt — then silver’s volatility isn’t a problem.

It’s leverage.

Difference #2: Silver is More Affordable

Silver’s affordability has always been one of its superpowers — and that remains true even at $60+ per ounce.

Like gold, physical silver:

- Is a tangible, hack-proof asset

- Is monetary metal with thousands of years of history

- Carries no counterparty risk

- Cannot be defaulted on

- Offers a degree of privacy uncommon in digital finance

But silver lets investors capture those benefits at a much lower entry point.

Buying small amounts of gold is possible, but premiums on fractional coins are typically much higher. By contrast, silver offers fractional optionality naturally — 1-oz rounds, 10-oz bars, 100-oz bars, etc., all at low premiums relative to gold.

This matters for one key reason:

Silver is easier to use for everyday transactions or small liquidity needs.

Imagine needing:

- $600 for a repair

- $2,000 for a short-term expense

- $500 for emergency cash

Liquidating silver is simple — and avoids having to sell a full ounce of gold, which as of December 2025, is a $4,200 asset.

Investor Implication: Silver’s affordability makes it the ideal metal for smaller purchases, incremental accumulation, and practical liquidity. Every diversified stack benefits from both metals — gold for larger wealth preservation, silver for flexibility.

Difference #3: Silver Requires Much More Storage Space

Silver’s low price per ounce comes with a logistical trade-off: bulk.

Silver is dramatically less dense than gold. At today’s prices, equal dollar amounts look very different:

- $50,000 in gold weighs ~2.6 pounds and fits in your hand.

- $50,000 in silver weighs ~800 ounces — roughly 55 pounds and fills several shoeboxes.

A safe deposit box that holds $200,000 in gold might hold only $3,000 worth of silver.

This matters for:

- Home storage — silver takes real physical space

- Transport — silver is heavy and cumbersome

- Professional vaulting — many depositories charge more for bulk metals (though GoldSilver’s rates are the same for gold and silver)

Silver also tarnishes over time, making proper storage more important. Gold does not.

Investor Implication: Storage strategy matters more with silver. Keep silver for liquidity, diversification, upside — but understand you’ll need more space and better logistics than with gold.

Difference #4: Silver Has Higher Industrial Use

Gold is used in jewelry, investment, and some tech applications. But silver is indispensable.

Over half of annual silver demand comes from industry:

- Electronics

- Medical equipment

- Solar panels

- Batteries

- EV manufacturing

- Chemical catalysts

- 5G infrastructure

Silver is the most conductive metal on Earth — electrical, thermal, optical. Modern life cannot function without it.

But here’s the critical distinction: Most industrial silver is consumed, not recycled.

Tiny amounts are spread across billions of products, many of which are discarded long before it’s economical to recover the silver. As a result, millions of ounces are lost permanently each year.

This limits secondary supply.

Even more striking: despite recessions, inflation cycles, and geopolitical turmoil, silver demand for green-energy technologies continues to expand. Solar manufacturers in 2024–2025 operated at record throughput, consuming unprecedented volumes of silver per gigawatt of capacity.

Investor Implication: Industrial demand makes silver more sensitive to economic cycles — but in monetary crises, silver behaves more like gold.

Case in point: During the stagflationary 1970s — two recessions, soaring inflation, oil shocks — silver demand fell… but the price exploded upward anyway. Monetary fear overpowered industrial weakness.

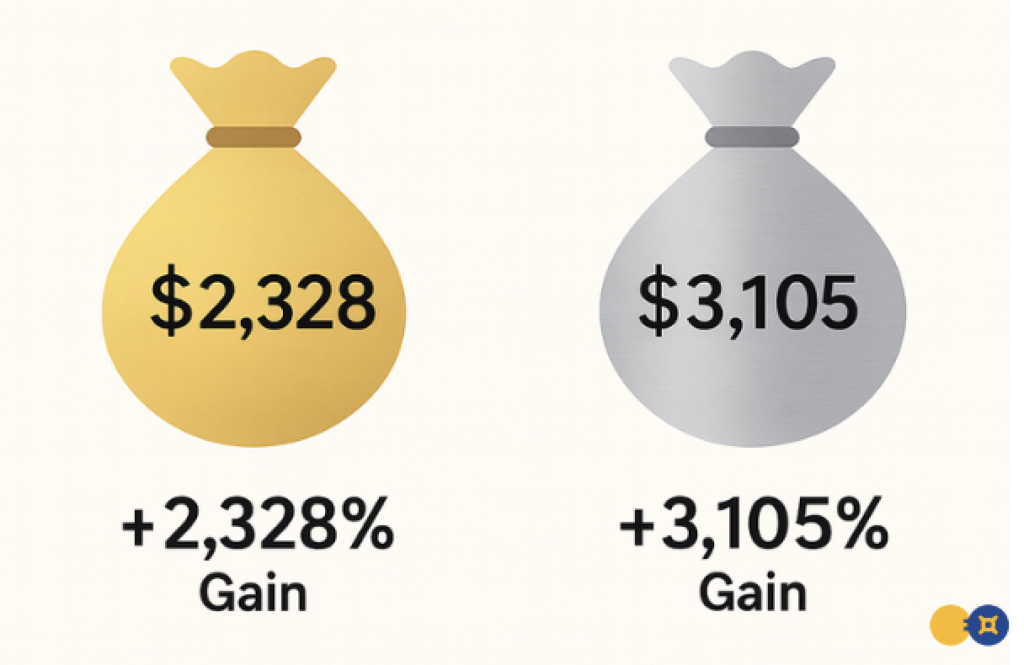

$100 In Gold or Silver From 1970-1980 Became

In today’s environment — marked by currency dilution, geopolitical fragmentation, and accelerating “electrification” — silver stands at the crossroads of monetary demand + industrial necessity.

Difference #5: Silver Stockpiles are Falling, Gold’s are Rising

This difference may not seem to have immediate importance to an investor, but it’s a behind-the-scenes development that could potentially have big consequences in certain circumstances.

Governments and other institutions used to hold large inventories of silver. Today, however, most of them no longer have stockpiles of the metal. In fact, the only countries that warehouse silver are the US, India, and Mexico.

Look what’s happened to those inventories since 1970.

The primary reason governments don’t hold a lot of silver is because it’s no longer used in coinage. But as we outlined above, silver is used in industry to a much greater degree now… so if future industrial needs rise, or the supply chain were interrupted, governments will be ill-equipped to support those needs.

In contrast, central banks hold over 34,000 tonnes (1.09 billion ounces) of gold in official Reserves. And on a net basis, they continue buying every year. These ongoing purchases contribute to the overall demand for the metal.

This source of demand isn’t present for silver. However, it does put the silver market in a precarious position. If the need for physical silver were to suddenly increase—a monetary crisis, a shortage in industrial supply, a spike in investment demand—governments won’t be able to meet these needs with such tiny stockpiles.

- If governments started to buy silver for any reason, it would have a huge impact on the market—demand would spike, and the price would skyrocket.

This scenario may or may not play out, but it’s a delicate position that could have a deep and immediate impact on the silver market.

5 Major Distinctions Between Gold and Silver

Gold | Silver | |

Volatility | Less volatile than silver. Will fall less than silver in bear markets and rise less than silver in bull markets. | More volatile than gold. Will fall more than gold in bear markets and rise more in bull markets. Selling after big run-ups will be critical to investment success. |

Affordability | One ounce costs 80 times more than one ounce of silver (at current prices). Can buy smaller denominations than one ounce but premiums are higher. | More affordable than gold, with similar benefits. Enables seller to meet small financial needs in the future. Cheaper for gift-giving. |

Storage | Takes up less space than silver, is cheaper to store, and doesn’t tarnish. | Requires up to 128 times more storage space than gold, is more expensive to store, and will tarnish over time. |

Industry | Only 12% of demand, and has little impact on price. A poor economy typically pushes investors into gold. | Comprises 56% of total supply. Health of economy can impact demand. Most industrial silver cannot be recovered. |

Stockpiles | Central banks buy and hold a lot of gold. | Governments have only a very small stockpile of silver. |