Brandon Sauerwein, Editor

Housing has become nearly impossible for many Americans to afford. Since 2010, the income required to purchase a home has almost tripled, while today’s high interest rates have pushed the dream of homeownership further out of reach.

But what if the housing crisis looks completely different when viewed through gold?

Gold vs. Real Estate: Why Investors Are Shifting to Precious Metals

The statistics are troubling:

- The median homebuyer age has jumped from 31 to 49 since 1981.

- Monthly payments have doubled in just two years.

- Home sizes have shrunk by 12% since 2016.

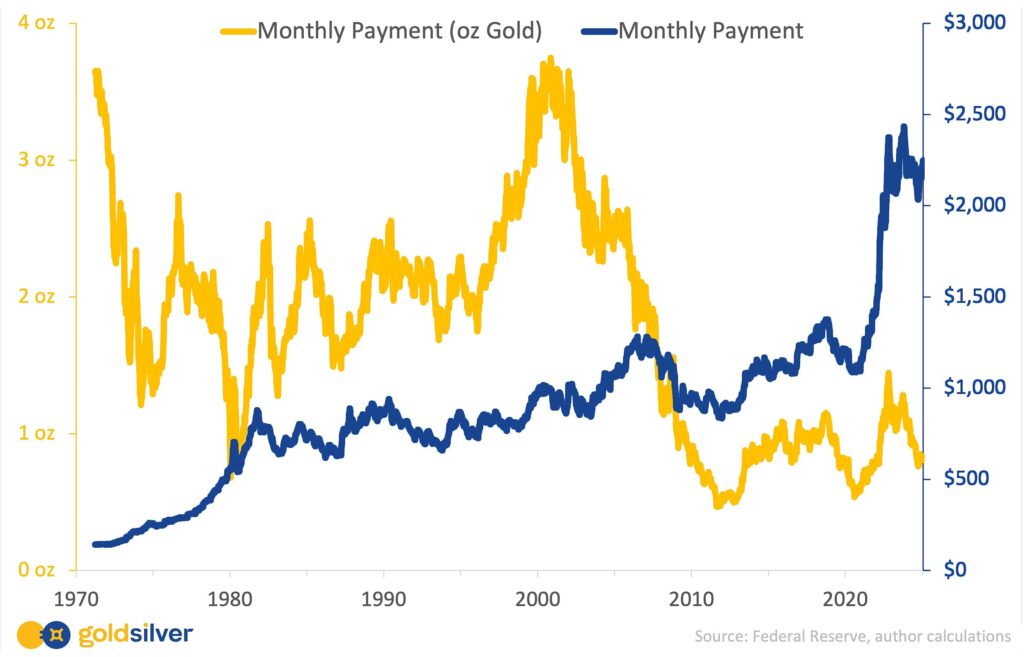

Yet Alan has uncovered something remarkable. In his latest video, Alan shares a chart that challenges what we might think about housing affordability. When measuring mortgage costs in gold instead of dollars, the picture transforms entirely:

Suddenly, home ownership doesn’t look so out of reach. This perspective shift reveals why forward-thinking investors are increasingly moving portions of their portfolio into precious metals.

As Alan demonstrates, gold has maintained its purchasing power for housing despite dollar inflation — making it one of the most powerful hedges against today’s economic uncertainty.

What Else is in the News?

📉 JOB MARKET SHOWS TROUBLING WEAKNESS

February job cuts have reached their highest level since mid-2020, while private sector job creation fell dramatically short of expectations at just 77,000 versus the 148,000 forecast. Trump’s economic policies, including tariff threats and potential federal job cuts through Musk’s DOGE initiative, are adding further uncertainty to an increasingly fragile labor market.

📊 MARKET VOLATILITY RISES AMID TARIFF CHAOS

President Trump’s administration has implemented tariffs in an unpredictable pattern of announcements and reversals, creating confusion among trading partners and businesses alike. The resulting economic uncertainty, with key trade positions still unfilled, has triggered market instability that could strengthen the case for precious metals.

🚀 US GOLD BUYING FROM AUSTRALIA EXPLODES

January’s Australian gold exports to the US reached an extraordinary $4.62 billion — more than double Australia’s entire 2024 US gold exports combined. This unprecedented demand spike, representing a 15-150x increase over typical monthly volumes, suggests a fundamental shift in US investment strategy as the economic landscape shifts.

🔒 GOLD SHORTAGE GRIPS SOUTH KOREA

South Korea is experiencing a critical gold shortage as KOMSCO has halted sales due to procurement issues, leaving even Seoul’s gold vending machines completely sold out. Retail investors have flocked to gold as a safe haven amid domestic political uncertainty and currency weakness, driving a 29% surge in gold bar and coin investment to 5.9 tons in Q4 2024.

📈 VANECK FORECASTS GOLD SURGE TO $3,250

VanEck portfolio manager Imaru Casanova forecasts gold could reach $3,250 per ounce by late 2025, extending its 43% rise over the past year. This bull run is driven by central banks dramatically increasing gold purchases—roughly 1,000 tonnes annually since 2022, double their pre-Ukraine invasion levels—as they seek protection against geopolitical risks and economic uncertainty. Despite gold’s surge, gold mining stocks have underperformed in comparison.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Since I am a repeat customer

“Since I am a repeat customer, I can vouch that your company is very trustworthy and honest. Thank you for all the emails with videos from Mike and Alan. They keep me updated on what’s happening now and the future. Love Mike’s Insider portfolio updates too!”

— Inez from Hawaii

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?