Daily News Nuggets | Today’s top stories for gold and silver investors

September 10th, 2025

Inflation Watch: All Eyes on This Week’s Reports

Key inflation data dropping this week could show prices picked up speed in August, with economists expecting 0.3% increases across the board. But here’s the twist: Even if inflation ticks higher, the Fed is likely to shrug it off and cut rates anyway.

Why? The job market is weakening fast, and that’s become the Fed’s bigger worry. The central bank appears ready to look past any inflation bump and focus on preventing a deeper economic slowdown when it meets September 16-17. Speaking of the Fed, not everyone’s happy with how it’s being run…

Trump vs. The Fed: Judge Blocks Presidential Power Play

President Trump’s attempt to fire Federal Reserve Governor Lisa Cook just hit a legal wall. A federal judge temporarily blocked the move, ensuring Cook keeps her seat — at least through the crucial September 16-17 Fed meeting where she’ll vote on interest rates.

Trump had tried to oust Cook over mortgage fraud allegations, but the ruling underscores the Fed’s independence from presidential interference. It’s a significant early victory for Cook and a reminder that even presidents can’t simply dismiss Fed officials at will.

All this uncertainty is showing up in the markets — and traditional safe havens continue to win big…

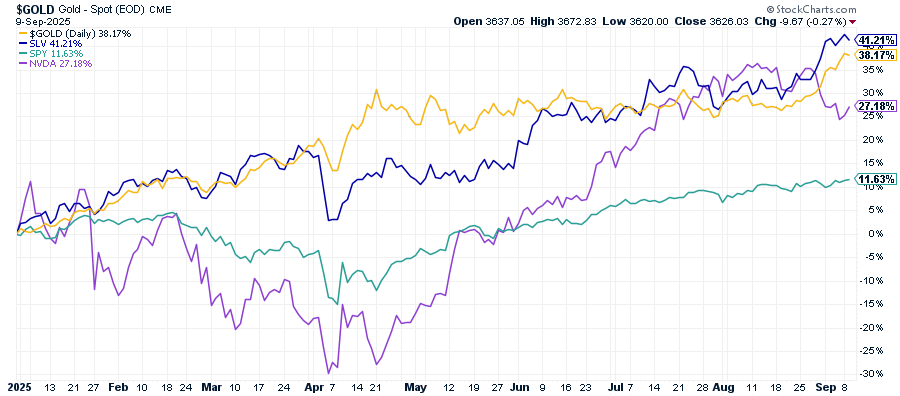

2025’s Surprise Winners: Metals Triple S&P 500 Performance

Here’s a stat that might surprise you: While everyone’s been obsessing over AI stocks, gold and silver have quietly become 2025’s runaway winners. Gold has surged 38%, silver an impressive 40% — both crushing the S&P 500’s modest 11.6% gain.

Even more remarkable? Nvidia, despite dominating headlines and AI hype, sits at 27%—a full 11 points behind gold.

It’s a tale as old as markets themselves: When confidence wavers, investors flee to what they can hold. But this time, the flight to safety is just beginning. Major banks are calling for much higher prices ahead, with some targeting levels that would make today’s gains look conservative.

ANZ Bank: $3,800 Gold by Year-End

ANZ Group raised their gold forecast to $3,800 by December, with a potential peak near $4,000 by mid-2026. The Australian bank cites “robust investment demand” as the driving force.

With gold already hitting a record $3,674 yesterday and up 38% this year, their forecast doesn’t seem far-fetched. If gold does reach $3,800, that would mean 45% gains for 2025 — crushing nearly every other asset class. The momentum shows no signs of slowing as investors seek safety from currency debasement and geopolitical tensions.

Goldman’s Call: $5,000 Gold “Highest Conviction” Trade

Goldman Sachs just made a bold call: gold is their top commodities pick, with potential to hit $5,000 by late 2026. The investment bank warns that threats to Fed independence could spark higher inflation, tank stocks and bonds, and erode the dollar’s dominance.

Their message to investors? Load up on gold as insurance. With political uncertainty mounting and central banks worldwide already hoarding the metal, Goldman sees a perfect storm brewing for precious metals.