Daily News Nuggets | September 3rd, 2025 — Here’s what you need to know about today’s most important economic and precious metals news:

Gold Hits New All-Time High at $3,559

Gold surged to an all-time high of $3,559 per ounce, extending its record-setting run as rate-cut expectations, dollar weakness, and safe-haven demand fuel investor appetite. The metal is up more than 5% over the last seven trading days, making this one of its strongest weekly moves of the year. Analysts point to heightened volatility in global markets, concerns over central bank independence, and a rush into hard assets as key drivers behind bullion’s momentum.

Gold’s sustained strength underscores its appeal as a hedge in uncertain times. With monetary policy in flux, momentum traders and long-term allocators alike are adding exposure.

BRICS Summit Looms Amid Gold-Fueled De-Dollarization Push

The upcoming BRICS+ summit, set for late October in Russia, could significantly reshape the global monetary order — and gold is at the center of it. With new members like Egypt, Iran, and the UAE already in and heavyweight contenders like Saudi Arabia, Turkey, and Mexico waiting in the wings, the bloc now represents more than 43% of global oil production and a growing share of global GDP. As dollar-reliant trade faces mounting skepticism, BRICS nations are rapidly increasing their gold reserves and exploring settlement systems independent of Western banking rails.

The takeaway here is: As geopolitical alliances shift and trust in fiat weakens, gold is emerging as the reserve asset of choice. Central banks aren’t just talking — they’re backing their currencies with bullion, and that trend is likely to accelerate after the BRICS summit.

World Gold Council to Test Blockchain Gold Trading in London

The World Gold Council (WGC) is launching a pilot program to digitize gold trading in London’s massive $900 billion bullion market. The initiative would allow gold to be traded, settled, and used as collateral on a blockchain-based platform, potentially cutting costs. Backers say it could help bridge the gap between physical and digital assets, making gold more accessible to a wider range of investors.

While “digital gold” might sound threatening to traditional bullion investors, think bigger picture: millions of new investors gaining easy access to gold ownership could drive unprecedented demand for the physical metal that backs it all.

Digital gold trading could be a game-changer for the precious metals market, bridging the gap between physical assets and the digital economy while potentially boosting demand from tech-savvy investors.

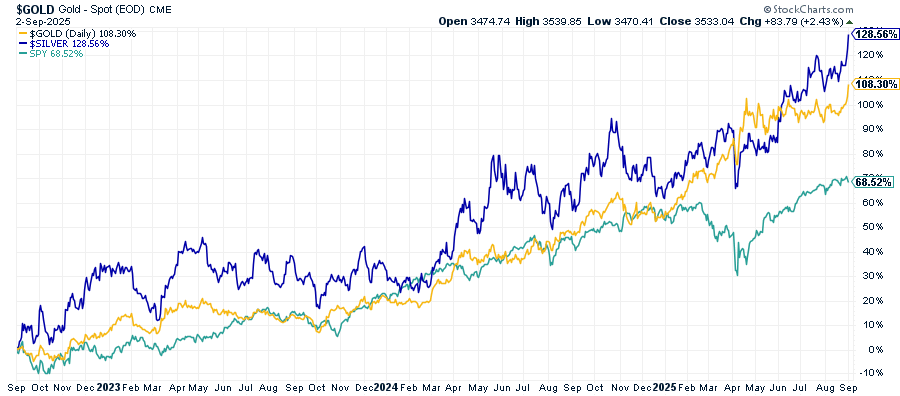

The Quiet Outperformers: Gold and Silver Leave Stocks in the Dust

While everyone’s been focused on the stock market’s recent highs, precious metals have been quietly crushing it. Over the past three years, gold has surged 108% and silver an eye-popping 128%, while the S&P 500 (SPY) has gained a respectable but comparatively modest 68%. Despite the constant headlines about stock market records, it’s actually been gold and silver delivering the real returns for patient investors.

Gold vs Silver vs SPY Over Past 3 Years

Long-Term Bond Yields Surge, Signaling Trouble Ahead

A sharp selloff in long-dated U.S. Treasuries has pushed yields to multi-year highs, rattling policymakers and investors alike. Higher long-term yields increase borrowing costs for governments already running record deficits — and they ripple outward, raising financing costs for corporations, mortgages, and consumers. That can slow growth and tighten financial conditions even without Fed action.

For markets, spiking yields also risk triggering volatility: equity valuations come under pressure as discount rates rise, and highly indebted sectors face refinancing risks. Historically, such episodes often feed safe-haven demand for gold, as investors hedge against both inflationary financing and the risk of policy missteps.

The takeaway here is: Rising long-term yields are a double-edged sword — they highlight market fears about debt sustainability and fiscal strain, while also reinforcing gold’s role as a hedge when the bond market itself becomes a source of instability.