Daily News Nuggets | Today’s top stories for gold and silver investors

September 16th, 2025

All Eyes on the Fed: Near Certain Rate Cuts

The wait is nearly over. The Fed begins its two-day meeting today, with traders betting on the first rate cut since 2020. A quarter-point trim looks all but certain — but there’s still a 1-in-5 chance of a bolder half-point move, according to CME’s FedWatch tool.

The real suspense? Whether Powell hints at a single “insurance cut” or the start of a broader easing cycle. The Fed’s shift from fighting inflation to fearing recession has already changed the playbook. That pivot usually unleashes a potent mix for gold and silver: lower rates, a weaker dollar, and stronger safe-haven flows.

And investors aren’t waiting for the press conference — the dollar is already sliding.

Macro Winds Favor Metals: Dollar Weakens Ahead of Fed

The U.S. dollar index slipped to 97.08 this morning, down nearly 4% from a year ago. At the same time, 10-year Treasury yields retreated to 4.04%, about 30 basis points lower over the past month.

Falling yields and a softer dollar have historically provided a tailwind for precious metals, as they make non-yielding assets like gold and silver more attractive. With the Fed expected to cut rates tomorrow, this “perfect storm” of dollar weakness and easier financial conditions is already feeding into higher metals prices.

And right now, both gold and silver are testing major psychological levels…

Gold Nears $3,700, Silver Breaks Higher

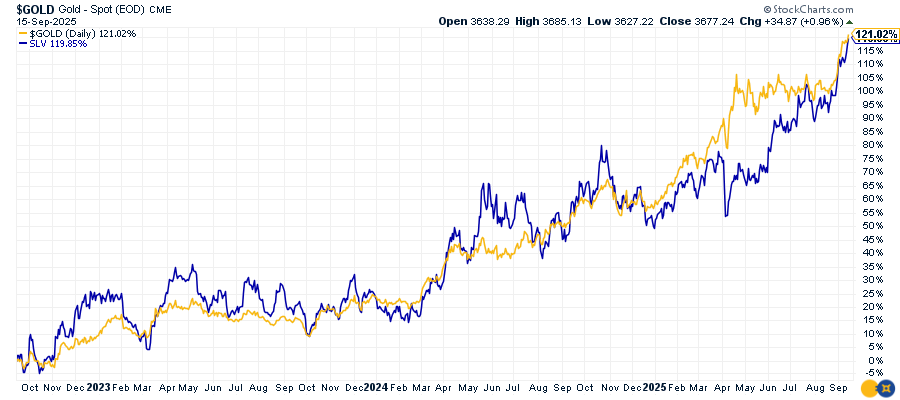

Gold is pressing toward uncharted territory, climbing to $3,690 and testing the $3,700 level for the first time ever. Silver is also gaining ground, approaching $43 an ounce, its highest level in over a decade. The three-year chart below shows just how powerful this move has been:

Gold up 121%, silver up 119%. Both metals have left stocks and bonds in the dust, reinforcing their role as portfolio insurance when uncertainty runs high. With the Fed decision looming today and tomorrow, momentum remains firmly with the bulls.

Silver’s 2025 Rally Is the Strongest in Years

Silver’s 46% year-to-date surge makes 2025 one of its sharpest rallies since the disco era. The catalyst? A perfect confluence of industrial demand from semiconductors and clean energy, dollar weakness, and geopolitical jitters.

While impressive, this year’s gains pale compared to history’s legendary silver rallies – 2011’s 83% moonshot and 1979’s epic 267% explosion. But don’t count silver out yet.

Mike Maloney believes the real fireworks begin when silver breaks through $50 – both a psychological barrier and its all-time high. Once that ceiling shatters, he expects silver to rocket into triple-digit territory. The gold-to-silver ratio supports this bullish case, suggesting the white metal still remains undervalued compared to gold historically.

40% Gold: Central Banks Go All-In

Central banks have crossed a stunning threshold: 40% of their reserves now sit in gold vaults, according to Citi’s latest analysis. Most financial advisors would call that concentration reckless – imagine parking 40% of your portfolio in a single asset.

But these aren’t rookie investors. These are the world’s monetary guardians, and they’re hoarding gold at unprecedented levels. Why? Years of weaponized sanctions, currency wars, and exploding sovereign debt have shattered faith in paper promises.

This relentless accumulation isn’t just another data point – it’s the bedrock supporting gold’s long-term bull market. When the institutions responsible for national financial security are betting this heavily on gold, individual investors might want to ask themselves: what do central bankers know that we don’t?

Investing in Physical Metals Made Easy

Open an Account