Daily News Nuggets | Today’s top stories for gold and silver investors

January 23rd, 2026

Precious Metals Close in on Historic Milestones

Precious metals are closing in on two massive psychological milestones. The gold price is approaching $5,000 per ounce. Silver is pushing toward $100.

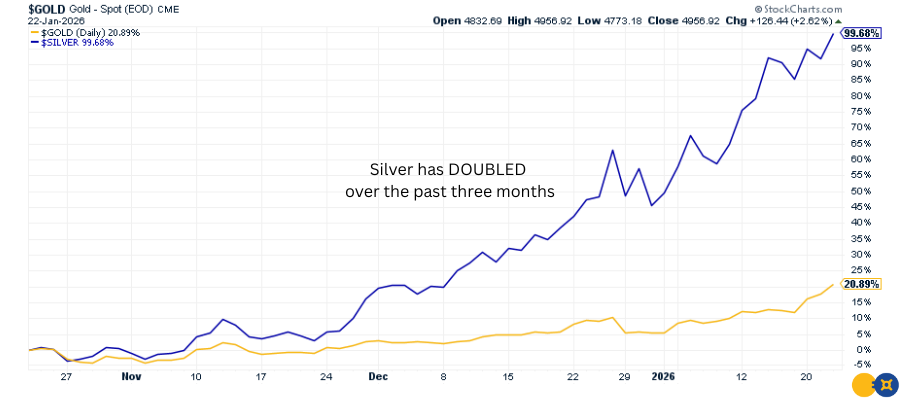

The rally has been explosive. Over the past three months, gold has surged over 20% while silver has nearly doubled in value. Both metals are trading at or near all-time highs.

Gold and Silver Returns, 3 Months

But here’s what often happens when assets cross big round numbers: they capture mainstream attention. Headlines multiply. Conversations spread.

And history shows that retail investors tend to pile in after the major institutional moves have already been made.

Analysts expect billions in retail capital to flow into precious metals. These psychological milestones act as magnets for new money.

The momentum remains strong. Both metals are within striking distance of their targets.

But not all “store of value” assets are participating in the rally.

Bitcoin’s “Digital Gold” Narrative Tested as Precious Metals Surge

The gold price nears $5,000 and silver approaches $100. Meanwhile, Bitcoin remains stuck around $89,000.

That’s down roughly 26% from its all-time highs. The contrast calls into question Bitcoin’s reputation as “digital gold.”

The numbers tell the story. Gold has rallied 14% in January. Silver is up roughly 38%. Bitcoin has traded flat.

On Polymarket, traders assign a 97% probability that gold hits $5,000 before Ethereum reaches that level. Goldman Sachs just raised its year-end gold forecast to $5,400 per ounce.

Geopolitical tensions are driving capital toward safe havens. Central banks are diversifying away from the dollar. Inflation concerns remain elevated.

Bitcoin was supposed to thrive in these conditions. It hasn’t. When uncertainty rises, investors choose what’s proven. Not what’s promised.

That shift is playing out across global markets.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Investors “Quiet Quit” US Assets as Capital Flows to Emerging Markets

Global investors are shifting billions away from US assets in what one strategist calls a “quiet-quitting” of American bonds and stocks.

Emerging market equities have surged 7% this year. The S&P 500 is up just 1%.

The biggest emerging market ETF just recorded its largest monthly inflow since 2012. Over $6.5 billion poured in during January alone. Meanwhile, currencies across Latin America and Asia have rallied.

What’s driving the exodus? Geopolitical tensions around Greenland have rattled confidence. Tariff policies have revived concerns about US fiscal sustainability. Dollar dominance no longer feels guaranteed.

Emerging markets are offering an alternative. Strong growth prospects backed by fiscal discipline. Exposure to the global AI infrastructure boom.

When confidence in any single market wavers, capital finds new homes. Now we’re seeing it as central banks load up on gold.

Poland’s central bank just approved plans to buy another 150 tons. TCW Group CEO Katie Koch told Bloomberg that investors are diversifying away from Treasuries without fanfare. They’re simply looking for better opportunities elsewhere.

Precious metals aren’t the only commodities feeling supply pressure.

Copper Shortage Looms as AI and Electrification Collide

The world is running low on copper. And the timing couldn’t be worse.

Global copper demand is expected to surge 50% by 2040, hitting 42 million metric tons annually. But supply isn’t keeping pace. The International Copper Study Group now projects a 150,000-ton deficit in 2026, reversing earlier surplus forecasts.

What’s driving demand? AI data centers, electric vehicles, renewable energy buildouts, and surging defense spending.

Meanwhile, supply faces structural constraints. Mine production growth has slowed to just 1.4%. Major operations have been hit by accidents. Ore grades are declining, and new mines take 17 years on average to bring online.

S&P Global calls the looming shortfall a “systemic risk” to global growth. Copper prices have already hit record highs above $13,000 per metric ton.

That inflationary pressure rarely stays confined to one metal. Central banks are taking notice.

Bank of England May Diverge From Fed as Rate Cuts Risk Fueling UK Inflation

A Bank of England policymaker is challenging conventional wisdom that central banks should follow the Federal Reserve’s lead on interest rates.

Megan Greene, one of nine members on the Bank’s Monetary Policy Committee, warned that if the Fed cuts rates aggressively this year, it could actually force the Bank of England to hold firm or slow its own easing.

The reason: looser US monetary policy would likely lower UK bond yields, boost equity markets, and stimulate demand for British exports — all of which would loosen financial conditions and push UK inflation higher.

UK inflation climbed to 3.4% in December, significantly above the 2% target. Greene said she’s particularly concerned about forward indicators like wage growth and inflation expectations, which remain elevated. The Bank cut rates to 3.75% in December, but markets have already priced out expectations for a February cut.

This signals monetary policy divergence is back on the table. And when major central banks move in opposite directions, volatility tends to follow.