Daily News Nuggets | Today’s top stories for gold and silver investors

November 7th, 2025

Gold at $4,000, Silver Near $49 — Momentum Holds

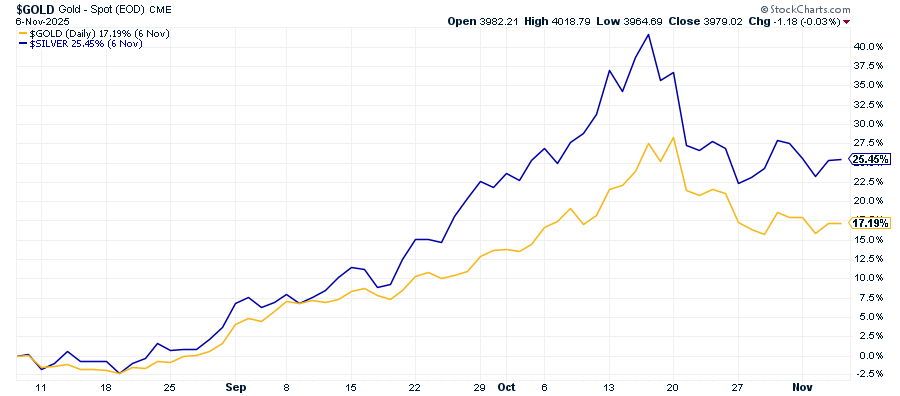

Gold climbed back over $4,000 per ounce this morning as investors weighed political gridlock, inflation concerns, and a weakening dollar. Silver rose to $48.58, rebounding from recent losses but still well below last month’s record spike near $54. Despite recent volatility, both metals are on a tear. Over the past three months, gold is up 17% and silver is up over 25%.

Think about that for just a moment. Both metals delivered what investors typically consider a strong year — in a single quarter.

Under the hood, it’s the same forces that have been driving precious metals all year: steady central bank buying, concerns over U.S. fiscal stability, and a rotation toward hard assets. For silver, industrial demand from solar, EVs, and data centers is amplifying gains in an already tight market.

This isn’t just an inflation trade anymore. With policy and fiscal uncertainty elevated, investors are reaching for assets without counterparty risk. Part of what’s driving that uncertainty? A government shutdown that’s left key economic data in the dark…

No Jobs Report, Big Speculation

The October jobs report is missing thanks to the government shutdown — but economists say it likely would’ve shown a cooling labor market. Estimates point to around 125,000 new jobs and unemployment ticking up to 4.2%, marking the weakest job growth since mid-2023.

Investors aren’t waiting around for confirmation. Fewer jobs mean less wage pressure and more room for the Fed to cut rates. That’s feeding expectations for easier policy ahead, even as the central bank maintains its wait-and-see stance publicly. Gold’s push above $4,000 reflects markets pricing in a softer path forward — and a fragile economy that may need it. When economic signals weaken, even in the absence of hard data, safe-haven assets tend to benefit. And it’s not just the jobs data that’s missing.

Fed’s Data Blind Spot Adds Risk to Inflation Outlook

Austan Goolsbee, President of the Federal Reserve Bank of Chicago, warned this week that the ongoing delay in official inflation data (caused by the federal government shutdown) is forcing policymakers to “drive in the fog.” With no fresh CPI or PCE releases, the Federal Reserve is relying increasingly on private‐sector indicators and internal surveys. Goolsbee noted that before data publication halted, inflation was showing signs of an uptick—raising the risk that the true pace of price growth is under-estimated.

Without the usual inflation barometer, the Fed may act more cautiously, slowing expected rate cuts or even delaying them altogether. For gold and silver investors, this means the “lighter monetary policy” scenario might be postponed—and safe-haven precious metals could benefit from the uncertainty surrounding inflation and policy.

The data blackout is also hitting the real economy.

Airlines Cut Flights as Shutdown Drags On

The partial government shutdown is starting to hit travelers. Airlines are preemptively trimming flights amid staffing shortages and delayed FAA safety inspections, with reductions likely across major hubs starting Friday. The timing couldn’t be worse, with holiday travel season approaching and millions of Americans planning trips.

Every prolonged shutdown carries a cost. This one could shave 0.3% off GDP growth this quarter — a notable drag on an already slowing economy. Markets are responding with the usual playbook: lower Treasury yields and higher gold prices. When Washington gridlocks and economic uncertainty rises, investors reach for stability. It’s a pattern that’s played out in every major fiscal standoff over the past decade.

While short-term disruptions dominate headlines, longer-term policy shifts are also in motion.

Silver Lands on U.S. Critical Minerals List

The Trump administration just expanded its list of “critical minerals” vital to U.S. economic and national security — adding ten new entries, including silver and copper. The designation recognizes their essential roles in electric vehicles, data centers, and renewable energy infrastructure.

It’s a policy win for the mining sector and could unlock federal support for domestic production, permitting assistance, and supply chain development. The U.S. currently relies heavily on imports for both metals, making domestic supply a strategic priority. For silver, it’s official recognition of what the market already knows: it’s not just a precious metal anymore — it’s critical infrastructure. Expect this to fuel conversation about reshoring mining operations and reducing foreign dependency.