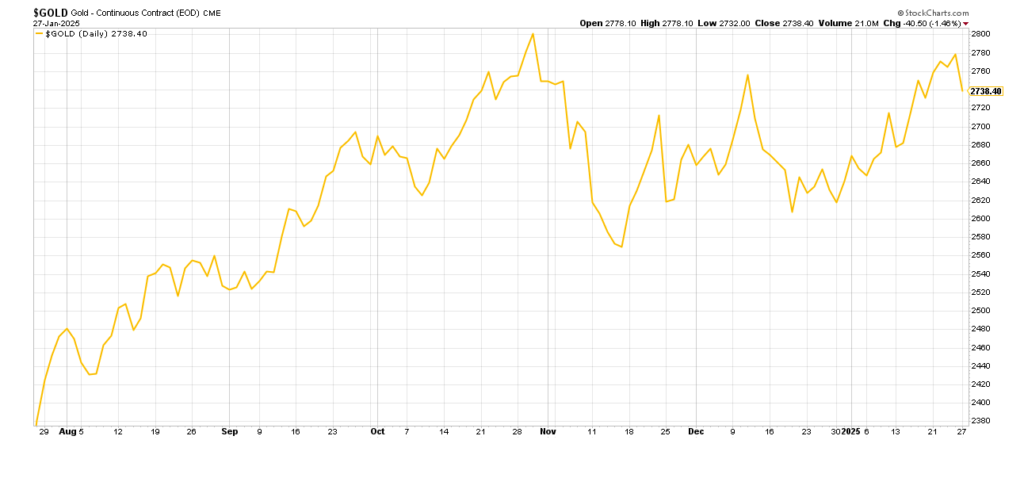

Gold’s current chart pattern suggests a significant repricing event driven by geopolitical tensions, particularly between the US and China.

Rather than a typical market trend, the pattern mirrors historical booms that could either continue climbing if global tensions persist or stabilize if diplomatic relations improve.

This makes gold not just a trading opportunity but a crucial indicator for broader investment decisions.

Gold’s current price action presents a familiar pattern that typically emerges during major market repricing events, but with a unique geopolitical twist.

The chart suggests that gold’s upward trajectory is primarily driven by US-China relations, making it more than just another market trend.

Unlike normal market movements that tend to equilibrate around risk-free rates, this pattern indicates deeper structural changes in the global economic landscape. As tensions between major powers persist, gold’s rise could accelerate as global speculators join the trend. However, the metal’s role has evolved beyond being just an investment vehicle – it’s becoming a crucial leading indicator for global stability and economic health.

For investors, understanding this dual nature of gold as both a trade and a geopolitical barometer is essential for making informed decisions across their entire portfolio, as escalating global tensions could significantly impact various sectors and businesses differently.