India’s gold market showed mixed signals in June and early July, with prices gaining 0.7% domestically to INR 95,676 per 10g despite seasonal jewelry demand weakness. Investment demand surged dramatically, with gold ETFs recording their highest monthly inflows since January at INR 20.8 billion. The Reserve Bank of India resumed modest gold purchases after a three-month pause, adding 0.4 tonnes to reach record reserves of 880 tonnes. However, gold imports plummeted 26% year-over-year to $1.8 billion as high prices deterred consumers.

News

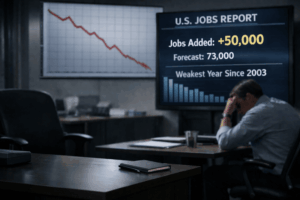

Gold Rises as Jobs Slow and Global Growth Falters

U.S. job growth is fading, housing starts have slumped to pandemic-era lows, and China’s economy remains under pressure. As growth doubts spread globally, gold is holding firm — supported by shifting Fed expectations and steady central bank demand.