When the road ahead is uncertain, there’s no wiser choice than to listen to those with experience.

To those who have seen enough market cycles to judge what’s most likely to happen next.

Today we had the good fortune to interview financial advisor Ted Oakley, managing partner & founder of Oxbow Advisors, who has over 40 years experience helping clients, mostly high net worth families, protect and build wealth through good times and bad.

Here at the start of 2023, we ask him:

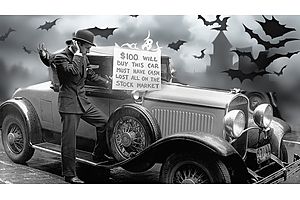

Is the bear market is over?

Or has it been simply sharpening its claws, waiting to strike again?

Ted walks us through a parade of charts in his answers to these questions.

And he explains why he predicts that numerous vulnerable stocks are headed to $0 this year.

To hear his rationale why, watch today’s video with Ted Oakley.

If you like these videos – subscribe to Wealthion, it’s one of the fastest-growing financial channels on YouTube.