Ask Alan: Why Most Cryptocurrencies Aren’t Actually Decentralized

Most cryptocurrencies claim decentralization, but few truly achieve it. Alan Hibbard breaks down why most networks remain centrally controlled—and why only systems governed by math or physics, like Bitcoin and gold, avoid the risks investors overlook.

The Physics of Money: Why Entropy Is the Silent Enemy of Wealth

In The Physics of Money, Alan Hibbard reveals how entropy—the universal force of disorder—quietly erodes wealth. By viewing money through the lens of physics, he explains why real money like gold, silver, and Bitcoin excels at resisting this decay, while fiat currencies accelerate it. This episode reframes value, work, and wealth preservation in a way every investor needs to understand.

“This Is Going to Be Horrific” — The Crisis on the Horizon

Mike Maloney warns that the 2025 economic crisis may be far worse than past downturns, with both the stock and real estate markets in historic bubbles and key indicators already flashing red before the real crash begins.

Are We Entering a “Super Capital Rotation”?

Analysts warn we may be entering a Super Capital Rotation — a massive shift of money from stocks into silver and gold. In a new discussion with Northstar Bad Charts, Alan Hibbard breaks down why silver could be the key trigger, the $55–$56 breakout zone to watch, and how this setup echoes the late 1960s before metals went parabolic.

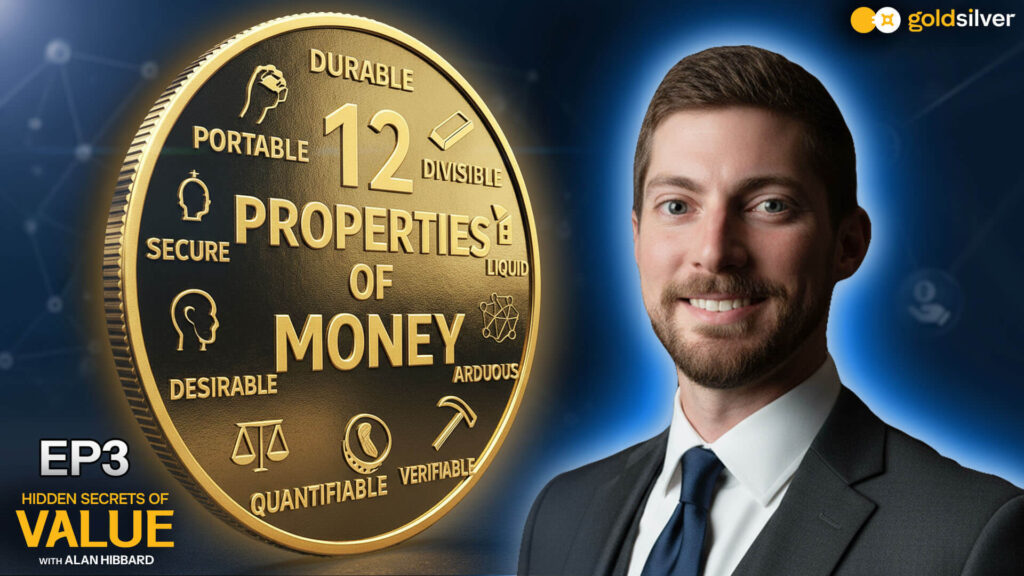

The 12 Properties of Money: What Really Makes Something Valuable

In a world where everything — from your paycheck to your crypto wallet — claims to be “money,” Alan Hibbard asks a question few ever stop to consider: What actually makes something a true store of value? In Episode 3 of Hidden Secrets of Value, Alan breaks down the 12 properties that define real money, exposing why most currencies fail—and why gold continues to stand the test of time. A $100 Gift Card and a Painful Lesson In his twenties, Alan received a $100 Pier 1 gift card — a little stash of value he decided to save for later. But when […]

They’ve Put a Floor Under Gold and Silver Prices

At the New Orleans Investment Conference, Mike Maloney and Alan Hibbard reveal why central banks’ steady gold and silver buying has created a lasting price floor — signaling that smart money is positioning early, not late.

Why Gold Is the Antidote to a Corrupted System

When money loses integrity, freedom fades. Mike Maloney and Alan Hibbard explore why gold as honest money is essential to preserving trust, independence, and financial freedom in a collapsing fiat system.

The 80% Red Alert: The Bubble No One’s Talking About

U.S. households now hold a record 80% of their wealth in stocks — an all-time high that signals a dangerous concentration. As Alan Hibbard warns, when both stocks and bonds move together, traditional diversification fails. History shows these moments often precede major market resets — and gold may once again prove the ultimate hedge.

Silver vs. Real Estate: How Many Houses Could Your Ounces Buy?

When you price real estate in silver instead of dollars, the results are shocking. Mike Maloney and Alan Hibbard reveal why silver’s purchasing power is soaring — and how this cycle could deliver one of the biggest wealth transfers in history.

Is Silver Poised for a Massive Reversion?

Silver may be on the verge of a powerful reversion. In the latest GoldSilver Show, Mike Maloney and Alan Hibbard reveal why soaring global demand, central bank accumulation, and an extreme gold-to-silver ratio could signal silver’s next major move. Despite recent gains, silver remains far below its inflation-adjusted highs — setting up what Mike calls a “coiled spring” opportunity as the world edges toward a monetary reset.