Why Gold Is the Antidote to a Corrupted System

When money loses integrity, freedom fades. Mike Maloney and Alan Hibbard explore why gold as honest money is essential to preserving trust, independence, and financial freedom in a collapsing fiat system.

Silver vs. Real Estate: How Many Houses Could Your Ounces Buy?

When you price real estate in silver instead of dollars, the results are shocking. Mike Maloney and Alan Hibbard reveal why silver’s purchasing power is soaring — and how this cycle could deliver one of the biggest wealth transfers in history.

Is Silver Poised for a Massive Reversion?

Silver may be on the verge of a powerful reversion. In the latest GoldSilver Show, Mike Maloney and Alan Hibbard reveal why soaring global demand, central bank accumulation, and an extreme gold-to-silver ratio could signal silver’s next major move. Despite recent gains, silver remains far below its inflation-adjusted highs — setting up what Mike calls a “coiled spring” opportunity as the world edges toward a monetary reset.

Gold vs. Stocks & Bonds: The Winning Gold Portfolio Allocation Strategy

New Morningstar data shows gold outpacing many assets over 1–20 years. See why a 5–15% allocation can strengthen portfolios—and how to own gold the right way.

“This Could Be the Market Top — Here’s What Comes Next”

When empires overreach, currencies crumble — and history’s warning lights begin to flash. In his latest episode of The GoldSilver Show, Mike Maloney and Alan Hibbard unpack why the markets may have already peaked, how global power is shifting toward gold, and why holding real assets has never been more essential. “This Could Be the Top” — The October Warning “I believe there’s a high potential that the top of the markets is in now,” Mike begins. The reason? A dangerous game of economic brinkmanship between Presidents Trump and Xi — a “game of chicken,” as Mike calls it — that […]

Saving vs Investing Explained: The One Shift That Builds Wealth

Most people think saving is safe and investing is risky—but it’s the opposite when you understand value. In Saving vs Investing Explained: The One Shift That Builds Wealth, Alan Hibbard shows why holding cash quietly destroys purchasing power and how separating real savings from risk assets builds lasting financial strength.

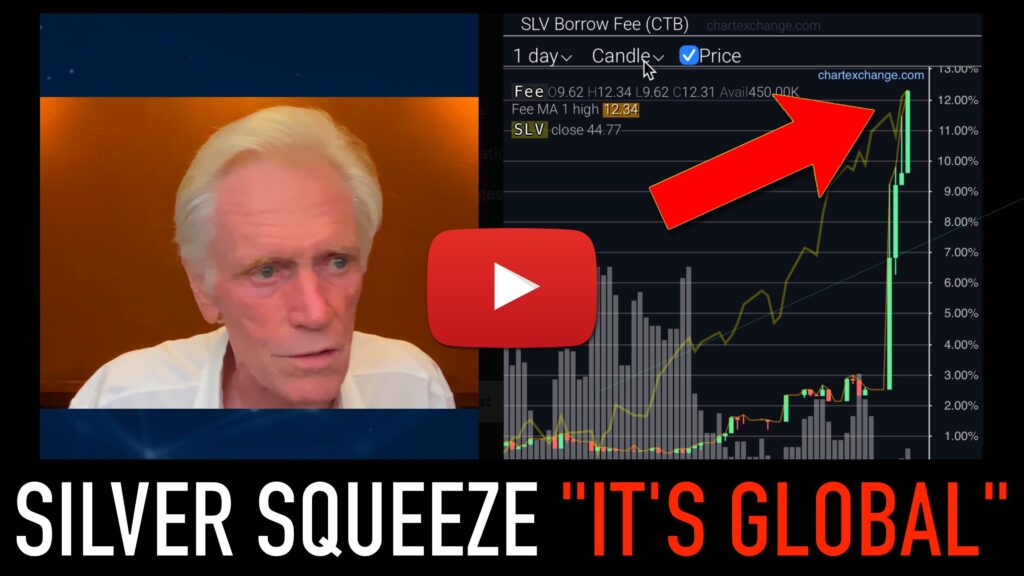

Global Silver Shortage: Why the Physical Price Is Breaking Away From Paper

Few times in history has the silver market looked like this. In the latest episode of The GoldSilver Show, Mike Maloney and Alan Hibbard unpack an extraordinary squeeze that’s pushing the physical and paper markets in completely different directions — and it’s happening fast. Lease Rates Explode: A Market Under Stress Silver lease rates — the cost of borrowing silver for short trades — have rocketed to over 33%, a level almost never seen. Under normal conditions, those rates hover near zero. A 33% spike signals something deeper: a market starved of liquidity. For short sellers, this is a nightmare. […]

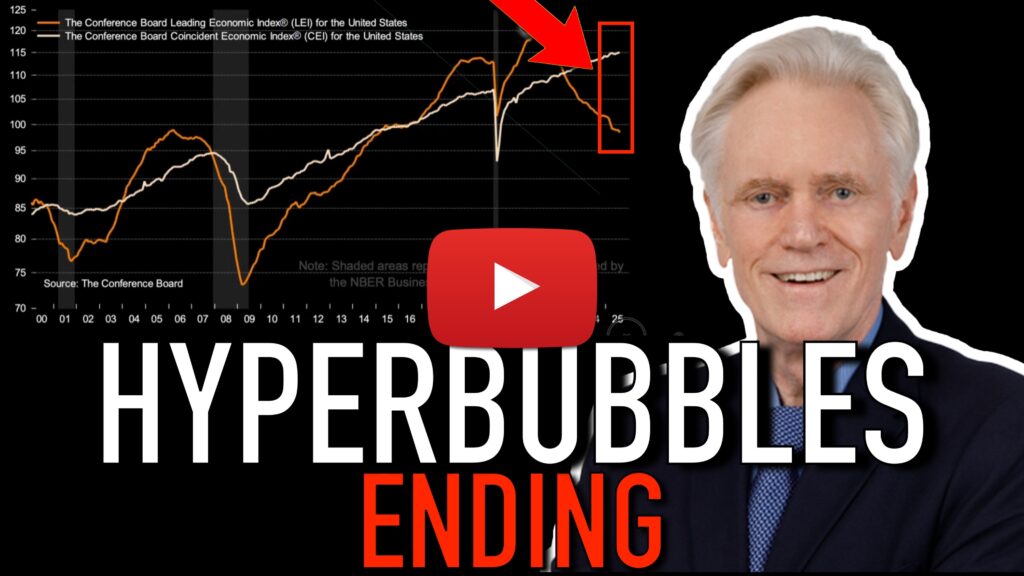

The Hyperbubble: Is the Next Crash Already Unfolding?

Silver’s sharp rise this week may be more than a market move — it could be a signal. In his latest video, Mike Maloney, best known for predicting the 2008 financial crash, says today’s economy is flashing red across every major sector. And this time, the warning signs go far beyond real estate. “Not a Bubble — a Hyperbubble” According to Mike, the U.S. housing and credit markets have gone far past typical “bubble” territory. “Do we have a housing bubble? No,” he says. “We’ve got a hyperbubble.” Insider data shows homebuilders are selling off their own stock — a […]

Silver Squeeze 2025: The 45-Year Chart Pointing to Triple-Digit Prices

Mike Maloney believes we’re witnessing the most significant turning point in the silver market’s history — and his latest video, Understand the Silver Squeeze, reveals why. From London to Tokyo, silver lease rates are skyrocketing — now higher than platinum’s — as bullion banks struggle to find metal to lend. “Nobody’s got silver,” one market insider told Mike. “Lease rates are 20 to 30 percent if you’re lucky enough to find a lender.” That’s not normal. It’s a sign of deep, systemic stress. For the first time in decades, even the largest players are admitting that there’s “no free-floating silver […]

$50 Silver, $4,000 Gold: Here’s What Happens Next

Those who think they’ve “missed out” on gold are missing the point. As Mike Maloney puts it: “If a ship goes down, those who paid more for their lifeboats aren’t any less happy than those who paid less.” In his latest video, Mike describes what he calls the “lifeboat moment” for gold — a phase when physical demand surges, small bars vanish from the market, and ordinary investors rush to secure real metal before prices accelerate. This isn’t a headline-driven pop. It’s a turning point. The Small Gold Bar Shortage Has Begun In Tokyo, Japan’s largest bullion dealer, Tanaka Kikinzoku, […]