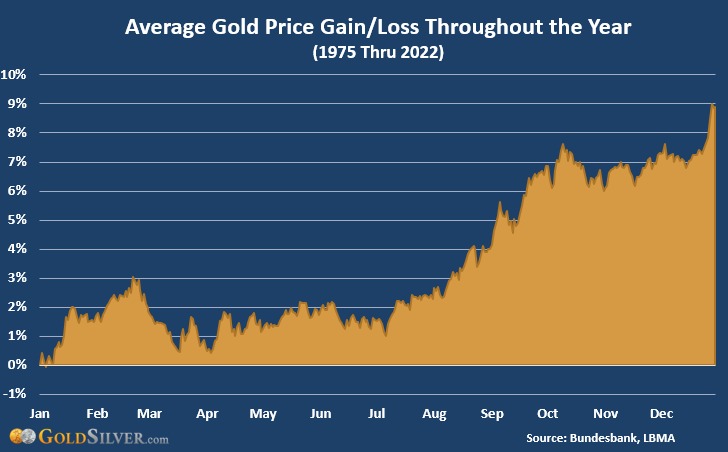

The Best Time to Buy Gold & Silver in 2024

Can’t decide if you should buy gold now or wait? We looked at the historical data to see if we could identify the best time of the year to buy. Is there a best time of year to buy gold? To fully answer that, let’s start at the beginning. Why Buy Gold? We don’t just buy gold in isolation. We buy gold as part of a portfolio – part of a broader strategy, and we choose our allocation to gold relative to our allocation to other assets. One of the best frameworks for choosing these allocations is through the lens […]

How Much is My Gold or Silver Worth?

Whether you are looking to sell your gold or silver for the best price, or just value it for insurance purposes, you can easily get an accurate estimate of how much you should reasonably be able to expect for it. Gold and silver are constantly priced on the open market according to the forces of supply and demand, setting what it costs to buy or what you can expect to receive for selling a pure troy ounce (or gram, depending on your market) of metal, and thus anything derived from it… much the same way changes in the global market […]

A Guide to Trading Gold and Silver Futures Contracts

There are two primary ways to invest in precious metals: buying physical metals and via futures contracts. Futures markets are electronic trading markets where buyers and sellers trade contracts based on the ability to take delivery of a certain amount of gold at a certain price on a certain future date Though they technically involve the eventual delivery of large amounts of physical gold, the vast majority of trading in futures markets is done as short-term speculation and very few traders ever receive (or want to receive) physical gold, as they’re bought and sold well ahead of the dates such […]

How Much Gold and Silver is Needed for Financial Crises

Here’s How Much Gold and Silver You Need for the Crises Most of you reading this are already convinced of the need to own gold and silver. But as you continue to accumulate, a question naturally arises: how much do you need? Imagine the sick feeling in your gut if we get to the next financial crisis and you suddenly realize you didn’t buy enough bullion to get through it. For this reason alone, it’s worth thinking about how many ounces you might need. More and more investors are recognizing this, and we receive questions about it. The wording varies, […]

What Is the London Fix Price?

The “London Fix” is issued by the London Bullion Market Association (LBMA). It is the way that global daily prices are set for precious metals including silver, platinum and palladium. But most importantly, gold. The “London Fix Price” is an agreed-upon fair-value price for a precious metal based on current buying/selling interest at various prices and as agreed to by LBMA member banks; for gold it is set twice per day These days, the London Fix Price is not nearly as important as it used to be, as all metals’ constantly changing spot prices (i.e. fair-value current prices) are easily […]

The Risks of Gold and Silver ETF’s vs. Physical Metals

On the surface, buying a bullion-backed exchanged-traded fund seems harmless. An ETF (or ETN, Exchange-Traded Note) is a security that tracks an index, sector, commodity, or other asset, but can be bought or sold just like a stock. Gold ETFs are no different. They track the price of the metal, don’t require you to store any bullion, and even list the serial numbers of the bars they hold on their website. Sounds good, right? But similar to the old joke about “waterfront” land in Florida that turns out to be swampland, these products are not as straightforward as they sound […]

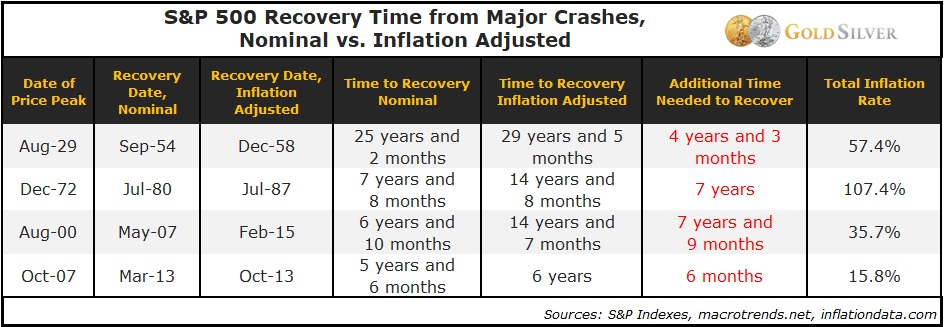

Here’s How Long It REALLY Takes to Recover From Stock Market Crashes

With everything going on in the world right now, do you worry about the potential for a stock market crash? Whether one materializes or not, this is a good time to consider how long it might take to recover from it, in real terms. That’s an important consideration, since the argument “the market always goes up over time” overlooks the corroding effects of inflation and the reality of declining purchasing power, especially when the recovery is long and inflation is high. Let’s dive into how long it really takes to recover from a big stock market crash, along with how gold […]

Your Ultimate Guide to the Gold Market

Interested in the gold market, but not sure how to get started or what any of it means? Here’s a quick overview of the gold market to enable you to begin investing in gold. If you have a specific question, these quick links will help you get to your topic faster. Introduction to the Gold Market? History of the Gold Market Gold and Currency Global Gold Market Types of Gold Bullion Gold Price Buying Gold What Affects the Gold Market? Investing in Gold Benefits of Owning Gold Selling Gold – When To Sell What Is the Gold Market? The gold […]

Gold Price Predictions 2026: After a 60+% Surge in 2025, What Comes Next?

2025: The Year Gold Broke Every Forecast Gold’s performance in 2025 wasn’t just strong — it was historic. Gold delivered a stunning 64% gain in 2025, surging past $4,400 per ounce and crushing Wall Street expectations. While most banks forecasted prices between $2,500 and $3,500, gold exceeded even the bulls by hundreds of dollars. What Happened? In 2025, we saw a perfect storm of: The result: gold soared to new heights that many analysts failed to see coming. After being humbled in 2025, many institutions have revised their expectations upward — some dramatically. Below are the latest forecasts: Gold Price […]