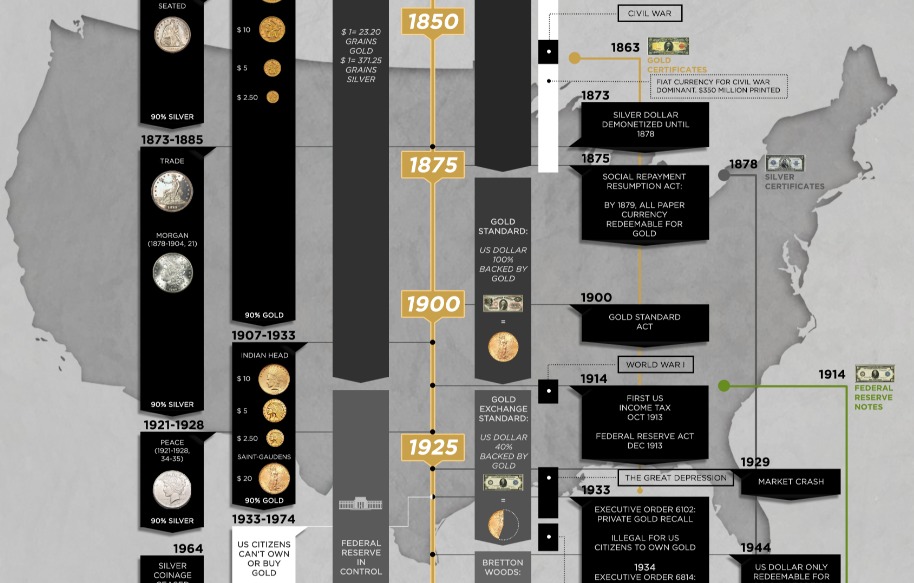

GoldSilver Infographic: History of Money and Currency in the USA

Ever wondered how the monetary system of the United States got into the fiat predicament it now finds itself? Did you know that American history has more often used some sort of gold or silver backing than not? Inspired partly by GoldSilver.com reader Greg V, we created a scrollable infographic of the history of money in the U.S.. What you’ll see is that with each monetary change in the US, our currency has gradually been destroyed. We started with 100% gold-backed currency, but via the whims and machinations of politicians, we’ve ended up with 0% gold-backing. A currency that can […]

What Is Gold Liquidity and Why Is It Important?

In a free-market economy, virtually any tangible good can be sold to someone, somewhere.

Why Do Most Nations Use Fiat Money Today?

The primary reason nations use fiat money today is that it doesn’t limit how much of their currency they can put into circulation.

What is a Troy Ounce?

The metric system, or International System of Units (SI), is widely used throughout the world. However, the troy ounce, the standard unit of weights for precious metals like gold and silver, is neither part of the metric system nor the “imperial” system used in the U.S. What is a troy ounce, and how is it different than the traditional ounce used in America? The Troy Ounce vs. Traditional Ounce The troy ounce is the standard unit used to weigh precious metals like gold and silver. A troy ounce, when converted into grams, is equal to 31.103 grams, which makes it heavier […]

Gold vs. Bitcoin Investments [Debating the pros & cons]

Could any two investments seem more different than precious metals like gold and silver versus digital currencies like Bitcoin, Ethereum, Ripple, Litecoin and their numerous brethren?

One is dug from the ground, forged in flames and hurts like heck when you drop it on your foot. The other is purely digital, created by computers crunching complex equations, existing only in bits and bytes.

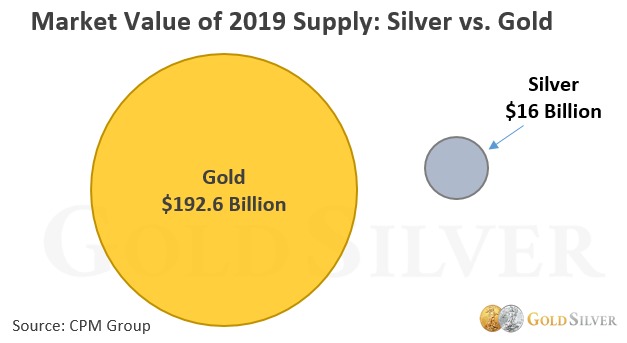

Gold vs. Silver [The 5 Differences That Matter Most to Investors]

You’d like to buy some precious metals, but do you buy silver or gold? Is there really much difference between them other than the price?

Gold & Silver Confiscation: Can the Government Seize Assets?

One concern of retail precious metals investors is the possibility of a gold confiscation. Imagine having the forethought to buy gold to shield your finances from an economic or monetary crisis—only to have it taken away from you by your government.

The Effect of a Stock Market Collapse on Silver & Gold

Many investors hold gold and silver to hedge against various economic crises. But does this hedge hold up during stock market crashes? Knowing what effect a market plunge and subsequent dollar collapse will have on silver and gold is vital to making investment decisions now and then deciding what course to take should a major recession or depression occur.

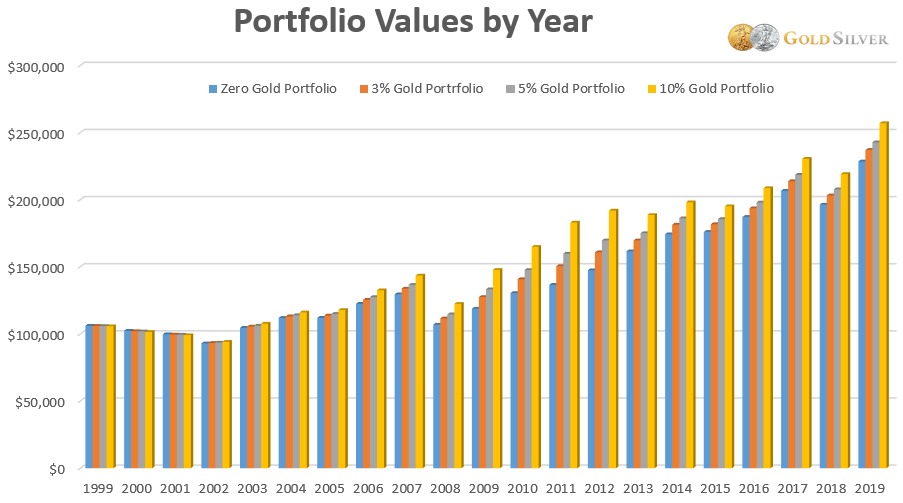

How Effective Is Gold As a Hedge? History Has an Empirical Answer

Gold has been a safe haven for literally thousands of years. But how effective is it as a “hedge”? A hedge is an asset that tends to rise when others fall. For example, an investor holding common stocks might find it advantageous to hold some gold too, since it has historically been strong during the worst stock market crashes. But in the big picture, does it really pay to always have some gold in one’s portfolio? History provides some clear answers. We analyzed several historical scenarios to see how a theoretical portfolio performed with various amounts of gold (including zero). The […]

What Is the Gold Spot Price and How Is It Set?

The spot price of gold is based on the price of one troy ounce of gold on international exchanges. Gold spot prices refer to the “bid” price you see listed—which is the price most recently quoted in the market that buyers are willing to purchase at. This is usually lower than the “ask” price sellers are currently seeking. The spot price is based on trading activity in the futures markets. It is an international standard for the spot price of gold to be quoted in US dollars. In the US, the COMEX is the primary exchange where gold is traded […]