Singapore Silver & Gold Vault - GST Free

GoldSilver.com

Seeking diversifcation from potential bank bail-ins and currency devaluations, high net worth buyers of physical gold and silver bullion are having their precious metals delivered and stored at fully segregated, non-bank vaults in Asia.

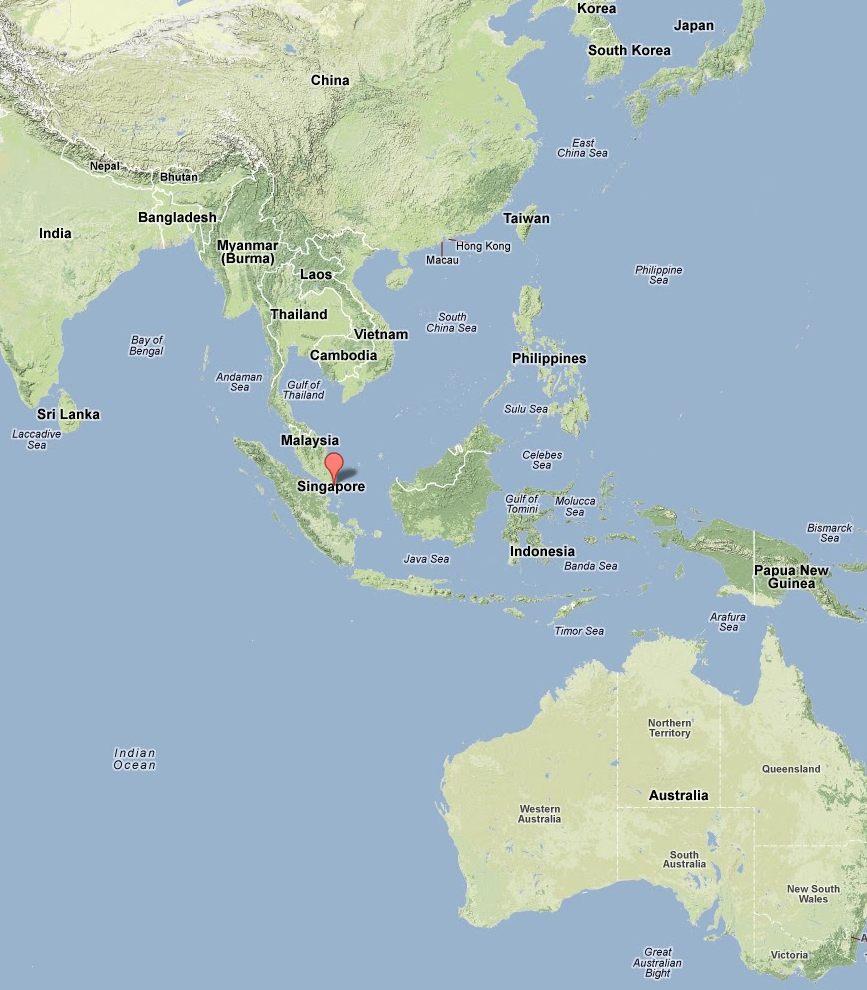

The trend of private gold and silver moving to the East has allowed investment safe-havens such as Singapore, to overshadow Switzerland's traditional role of being the go to gold vault option of the wealthy.

Although Switzerland may have been a sanctuary for high net worth capital last century, today's affluent are flocking to Singapore and Hong Kong, which now offer some of the most private gold and silver vault options in the world.

Mike Maloney and the GoldSilver.com Team are pleased to announce a new fully insured, longterm segregated vault storage service, securely held within the acclaimed Singapore FreePort.

Through GoldSilver.com customers can now choose to privately buy and hold physical gold and silver bullion in one of the world's most state of the art vaulting facilities.

Full body scanners, multiple 7-ton vault doors, anti-tunneling vibration sensors, remote vault access controls, triple power redundancies, and 24/7 armed guards now provide GoldSilver.com customers a new gold and silver vault storage facility conveniently located next to Singapore's Changi International Airport.

Take An Online Tour of The Singapore Freeport

Designed by Swiss architects, Swiss engineers and Swiss security experts, the 270,000-square-foot facility is part bunker, part gallery. Unlike the free-port facilities in Switzerland, which are staid yet secure warehouses, the Singapore FreePort sought to combine security and style.

The lobby, showrooms and furniture were designed by contemporary designers Ron Arad and Johanna Grawunder. A gigantic arcing sculpture by Mr. Arad, titled "Cage sans Frontières," (Cage Without Borders) spans the entire lobby. Paintings that line the exposed concrete walls lend the facility the air of a gallery.

Private rooms and vaults, barricaded by seven-ton doors, line the corridors. Near the lobby, private galleries give collectors a chance to view or show potential buyers their art under museum-quality spotlights. A planned second phase will double the size of the facility to 538,000 square feet.

Singapore, the Silver & Gold Sanctaury

Singapore is perhaps the world's most sought after safe haven for wealth, allowing it to rival both Switzerland and Hong Kong for high net worth wealth management.

Nearly 1 in 6 households in Singapore ( approx. 17% ) are millionaire households. And while Singapore only currently controls some 2% of global gold demand, this wealthy city-state aims to grow that share to some 10 to 15% over the next five to 10 years.

How will they do that you ask?

As of October 1, 2012 - Singapore's government has repealed a 7% tax on specific gold and silver bullion products, giving investors the option to hold physical bullion without costly value added taxes.

For Asian investors holding paper gold or passbook silver accounts, now is an ideal time to redeem your capital and acquire your physical silver or gold bullion outright.

Singapore GST Free Bullion Products Include

| GOLD | SILVER |

| American Gold Buffalo Coins | American Silver Eagle Coins |

| Canadian Gold Maple Leaf Coins | Canadian Silver Maple Leaf Coins |

| Austrian Gold Philharmonic Coins | Austrian Silver Philharmonic Coins |

| Johnson Matthey Gold Bars | Johnson Matthey Silver Bars |

| Credit Suisse Bars | Royal Canadian Mint Bars |

Fully Insured - Segregated - 3rd Party Custodian

All vaulted metals are segregated, fully insured, and managed by a trusted third party vaulting partner who has been in the business of safeguarding valuables for over 150 years ( since 1859 ).

Account holders are issued signed third party vault storage certificates which fully document exact holdings and inventory levels.

Extremely Competitive Vault Storage Rates - Cheaper & Safer Than ETFs

Our new Singapore gold vault and silver storage options offer some of the most competitive gold and silver storage rates.

For example, you can choose to store $ 150,000 worth of gold for a mere $ 25 a month ( 20 basis points ). You can have $ 84,000 worth of silver held for a mere $ 35 a month ( 50 basis points ).

Safety & Convenience

Singapore Vault Storage Customers can schedule visitations, elect for pickup, physical withdrawal, or securely sell metals during GoldSilver trading hours.

For additional information on our

Singapore Silver & Gold Vault Services - Click Here.