Trump Eyes Temporary Fed Pick, Chair Decision Still Pending

President Trump announced he will likely appoint a temporary Federal Reserve governor within days to fill the soon-to-be-vacant seat left by Adriana Kugler, whose term ends in January. This move would buy time for the administration to continue evaluating long-term candidates—especially for the crucial Fed Chair position, currently held by Jerome Powell. Trump’s team is weighing several Wall Street insiders for the temporary role and continues to consider “the two Kevins”—Kevin Warsh and Kevin Hassett—as potential successors to Powell, whose term expires in May 2026.

White House Eyes Fed Vacancy as Trump Pushes for Rate Cuts

With a vacancy opening on the Federal Reserve’s board, the Trump administration is weighing its options to influence the central bank’s direction. Fed Governor Adriana Kugler is stepping down early, and the White House is reportedly considering a temporary appointment to fill the five remaining months of her term. President Trump, who has long criticized the Fed for keeping rates steady, is pushing for interest rate cuts to stimulate the slowing U.S. economy. The decision on Kugler’s replacement — and potentially Fed Chair Jerome Powell’s successor in 2026 — could shape the Fed’s policy path in a time of economic […]

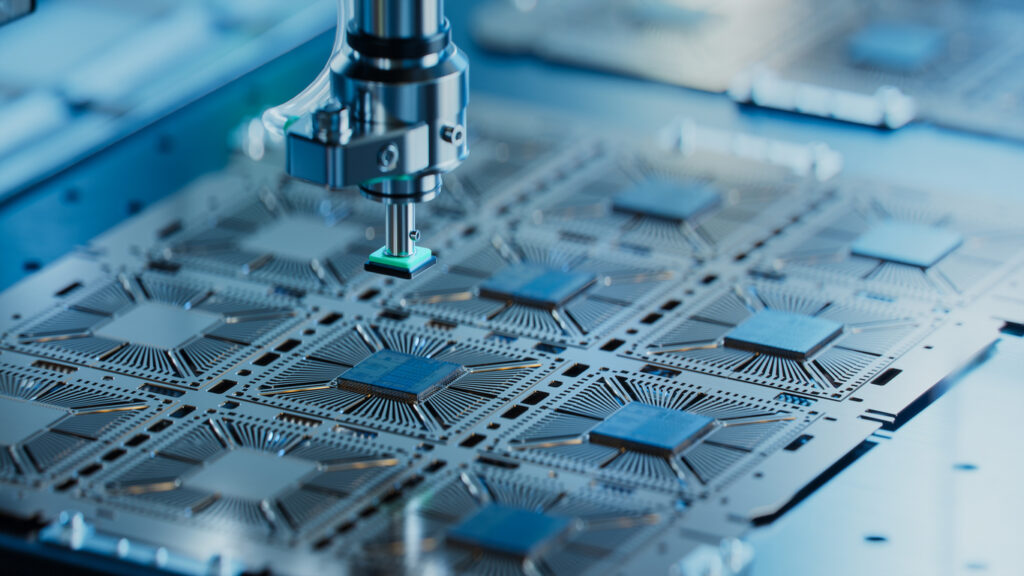

Trump Threatens 100% Chip Tariff to Push U.S. Manufacturing

President Trump announced a sweeping 100% tariff on imported computer chips, aiming to pressure tech companies to shift manufacturing to the U.S. The tariff won’t apply to chips made domestically, which has helped boost confidence in firms like Apple and Nvidia that have already committed major investments in U.S. production. While the policy could support American manufacturing, it also risks raising prices on electronics, vehicles, and household goods—potentially fueling inflation and creating new supply chain challenges.

China Keeps Buying: PBOC Adds Gold for 9th Straight Month

China’s central bank increased its gold reserves for the ninth month in a row in July, bringing holdings to nearly 74 million ounces—valued at almost $244 billion. This consistent buying trend by one of the world’s largest central banks underscores a long-term strategic shift toward gold. The move reinforces gold’s role as a safe-haven asset amid ongoing global economic uncertainty. Analysts continue to raise their gold price forecasts, with one Reuters poll predicting an average of $3,220 per ounce this year.

Investors Turn to Gold Amid Trade Friction and Weak Jobs Data

Gold climbed to its highest level in over two weeks as trade tensions and expectations of interest rate cuts boosted safe-haven demand. President Trump’s new tariffs took effect, sparking global trade friction, while U.S. jobless claims rose to a one-month high—fueling speculation that the Federal Reserve will cut rates soon. Analysts say that if economic data continues to weaken, gold could see even stronger support. With uncertainty rising and rate cuts likely, gold’s role as a safe-haven asset is once again in focus.

Gold Remains Resilient as Fed Faces Tough Choices

Gold prices remain near recent highs despite a slight dip, as investors grow concerned about the U.S. economy slipping into stagflation—a troubling mix of stagnant growth and rising inflation. A disappointing jobs report and weakening service-sector data have increased expectations that the Federal Reserve may soon cut interest rates. With real yields falling and economic uncertainty rising, gold’s appeal as a safe-haven and inflation hedge continues to grow. For now, the outlook for gold remains bullish, especially if the Fed shifts to a more dovish stance.

Why Silver’s Supply Shock Is Inevitable

Here’s something wild: most silver mines aren’t really silver mines. Roughly 70% of all silver comes as a byproduct of mining for other metals like copper, zinc, and lead. That means silver production isn’t responding to silver demand — or even silver prices. And that’s a problem. In the latest episode of The Gold Silver Show, Mike Maloney and Alan Hibbard break down why this strange dynamic is setting silver up for an explosive move — and why the supply side may be powerless to stop it. Silver Supply Is Tied to Other Markets Unlike gold, silver isn’t typically mined […]

Traders Trim Gold Bets as Kremlin Hints at De-escalation in Ukraine

Gold prices saw an early jump but later trimmed gains after the Kremlin confirmed upcoming talks between Vladimir Putin and Donald Trump. The announcement follows a meeting between Putin and Trump’s envoy, suggesting a potential shift toward peace in Ukraine. Any easing in geopolitical risk tends to soften demand for gold, which thrives in uncertainty. Despite this pullback, gold remains up nearly 30% year-to-date, driven largely by turmoil in the first half of the year. Investors are also watching U.S. trade moves and a possible Fed appointee who could favor lower interest rates — a supportive backdrop for gold.