Digital Yuan Fails, Hong Kong Experiments: China’s Race Against Dollar Stablecoins

China views the US GENIUS Act and the rise of dollar-backed stablecoins as a serious threat to its financial sovereignty. The new law allows regulated US banks to issue stablecoins that could attract up to $1.75 trillion in circulation over three years, creating digital dollars that can move globally beyond China’s capital controls. Beijing fears these blockchain-based tokens could undermine its financial repression system and the yuan’s role in international trade. In response, China is experimenting with its own controlled blockchain solutions, including potential renminbi-backed stablecoins in Hong Kong that would be fully traceable and programmable, reflecting Beijing’s vision of […]

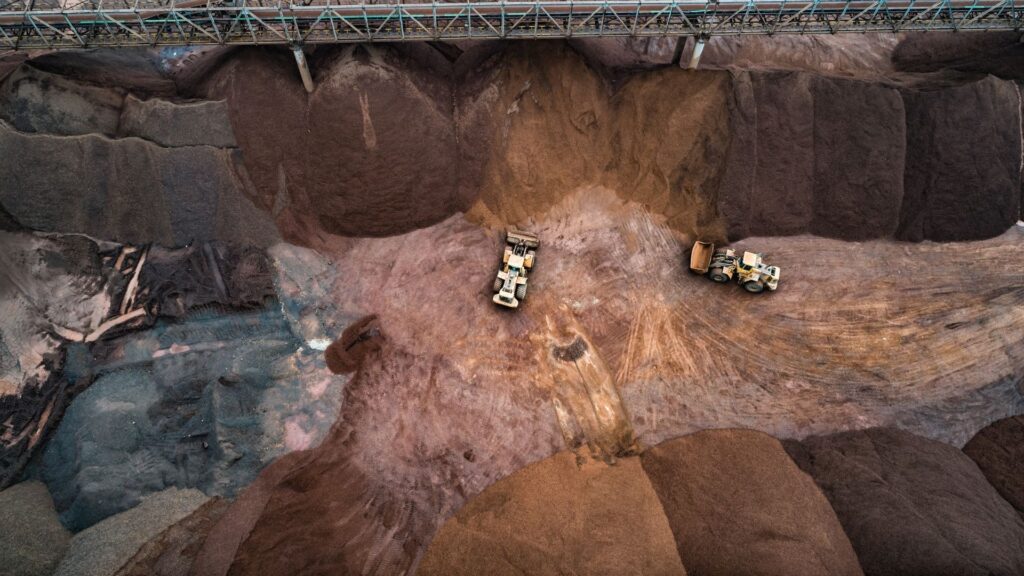

Gold Royalty Companies Post Record Profits While Traditional Miners Struggle with Rising Costs

Gold royalty and streaming companies are significantly outperforming traditional gold miners in 2025’s high-cost environment. Companies like Franco-Nevada, Wheaton Precious Metals, and Triple Flag reported record revenues and cash flows in Q2, with Franco-Nevada’s revenue jumping 42% year-over-year to $369.4 million. These firms avoid direct operating costs by financing miners in exchange for discounted future production rights, providing investors with gold price upside while protecting against downside risks. As inflation remains sticky and tariff costs shift to consumers, these companies offer an attractive “happy medium” between owning physical gold and traditional mining stocks.

From Boom to Bust: How the Cooling Job Market Is Stalling Wage Recovery

Four years after pandemic-era inflation began surging, American workers’ wages still haven’t fully caught up to price increases. According to Bankrate’s Wage To Inflation Index, the gap stands at -1.2 percentage points, with prices rising 22.7% since early 2021 while wages grew only 21.5%. Though the gap has narrowed from its peak of -4.8 percentage points in 2022, a slowing job market is hampering progress. If current trends continue, workers’ paychecks won’t fully recover their purchasing power until the third quarter of 2026.

US Economy at Crossroads: Job Growth Stalls While Inflation Refuses to Budge

The US economy faces mounting challenges as job growth slows dramatically and inflation remains stubbornly above target. July’s employment report showed just 73,000 jobs added, well below expectations, while the unemployment rate ticked up to 4.2%. Despite wage gains, inflation concerns persist with tariff-induced price pressures expected to push inflation toward 3.1% by year-end. The Federal Reserve faces a difficult balancing act between fighting inflation and supporting employment, with economists projecting GDP growth to slow to just 1% in the second half of 2025 as consumer spending weakens and businesses pull back on hiring.

From Fire Extinguishers to Auto Parts: Trump’s 50% Metal Tariffs Cast Wider Net

The Trump administration has expanded its 50% steel and aluminum tariffs to include 407 additional product categories, effective Monday. The new tariffs now cover everyday items containing steel or aluminum, including auto parts, fire extinguishers, machinery, construction materials, plastics, and specialty chemicals. Experts estimate these tariffs now affect at least $320 billion of imports, up from $190 billion, potentially adding more inflationary pressure to rising prices.

Fed Under Fire: Trump’s Rate Cut Demands Spark Fears of Political Control Over Monetary Policy

President Trump’s demands for the Federal Reserve to cut interest rates by three percentage points have raised investor concerns about “fiscal dominance”—a scenario where keeping government borrowing costs low takes priority over fighting inflation. With a recent budget bill adding trillions to US debt and Trump arguing rate cuts could save $1 trillion annually in interest costs, markets fear a return to an era of politically influenced monetary policy. The dollar has already fallen 10% this year while Treasury yields remain elevated, signaling investor worries about inflation risks. Historical precedents from Germany’s 1920s hyperinflation and Argentina’s economic crises serve as […]

Gold Trades Sideways as Markets Eye Ukraine Peace Talks and Fed Policy Signals

Gold prices are holding steady around $3,320-$3,350 per ounce as investors await two key developments: US-led diplomatic efforts to end the Ukraine war and the Federal Reserve’s Jackson Hole symposium starting Friday. Fed Chair Jerome Powell’s keynote speech is expected to provide hints about potential interest rate cuts in September, with markets pricing in an 83% probability of a 25-basis-point reduction. Lower rates typically benefit gold as a non-yielding asset.

Precious Metal Markets Hold Steady Ahead of Jackson Hole Central Bank Summit

Gold prices increased by 0.4% to $3,329.89 per ounce on Wednesday, though they continue to hover near their lowest levels in three weeks. The precious metal is trading sideways as investors await two key events: the release of the Federal Reserve’s July meeting minutes and Fed Chair Jerome Powell’s speech at the Jackson Hole central banking conference on Friday. Market analysts suggest gold needs the Fed to resume rate cuts to move higher, while the strong U.S. dollar is creating additional headwinds. Gold traditionally performs well during periods of low interest rates and economic uncertainty. Other precious metals showed mixed […]