Over the past few years, a quiet but powerful shift has been unfolding in the global gold market. Central bank gold buying has surged to historic levels — quietly reshaping how the world values monetary assets.

Central banks, not hedge funds or retail investors, are now the biggest marginal buyers of gold. This trend isn’t a speculative blip; it’s a structural realignment that may be setting a new long-term price floor for the yellow metal.

Why Central Banks Are Buying Gold—Again

Since 2018, global central bank gold demand has climbed to its highest level in five decades. The motivation isn’t simply portfolio diversification — it’s self-preservation.

When the U.S. and its allies froze Russia’s currency reserves in 2022, policymakers across the developing world took note. If your reserves can be frozen with a keystroke, they’re not really yours.

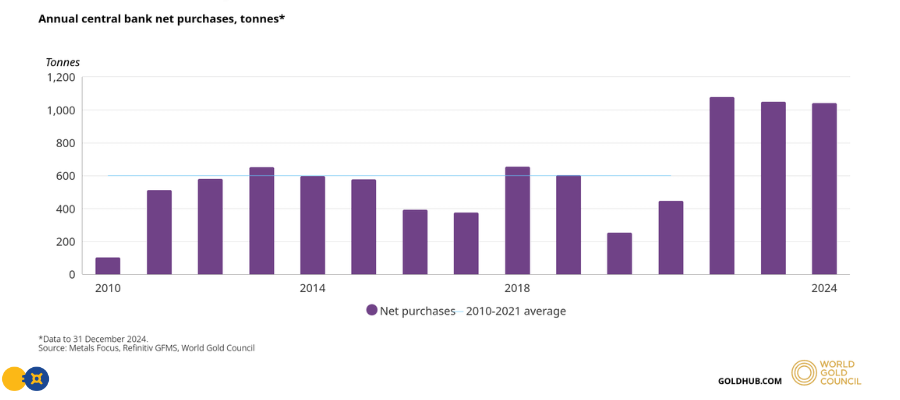

Gold, however, is different. It has no counterparty risk. It can’t be printed, devalued, or sanctioned. This realization has driven countries like China, India, Turkey, Poland, and Singapore to ramp up their gold holdings. In 2023 and 2024 alone, central banks added over 1,000 tonnes — a modern record according to the World Gold Council.

Central Banks Have Been Net Buyers For 15 Consecutive Years

As the chart shows, global central bank accumulation has not only surged well above the 2010–2021 average — it has sustained at historically high levels. This steady, institutional demand is reshaping gold’s long-term supply dynamics.

The East Is Leading a Monetary Shift

This surge in central bank gold buying also reflects a broader global transition — from West to East. While Western economies still rely heavily on the dollar-based system, the BRICS nations (Brazil, Russia, India, China, South Africa — soon joined by others) are exploring alternatives.

Gold is central to that effort.

China’s central bank has now reported more than 18 consecutive months of gold accumulation, while nations like Turkey and Kazakhstan are reshaping their reserves to rely less on the dollar.

In many ways, the current moment mirrors the post–World War II era — except this time, it’s emerging markets, not the West, leading the gold accumulation trend.

A Structural Price Floor for Gold

What makes this movement so consequential is that central banks buy differently than private investors. They don’t speculate; they accumulate.

Their purchases are deliberate, strategic, and largely insensitive to price — meaning that even when gold dips, central banks keep buying. That steady bid creates a structural price floor, offering a form of monetary “gravity” that supports gold during periods of volatility.

As Western investment demand ebbs and flows, central banks have effectively become the “strong hands” of the gold market — quietly stabilizing it from underneath.

The Takeaway: Follow the Real Money

For investors asking “who’s buying gold?” the answer is clear — and instructive. When central banks, the stewards of global monetary stability, are exchanging paper assets for tangible metal, it signals a deeper realignment in the global financial order.

Gold isn’t just an inflation hedge anymore. It’s becoming a core reserve asset once again — the foundation of trust in a world where currencies are increasingly political tools.

And as central banks continue to buy, investors might do well to follow their lead.

To build your own personal gold reserve, visit GoldSilver.com to buy gold and silver bullion and learn how to safeguard your wealth with real money.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

People Also Ask

Why are central banks buying so much gold right now?

Central banks are increasing their gold reserves to reduce exposure to the U.S. dollar and safeguard against financial sanctions or inflation. Gold offers security without counterparty risk — it can’t be printed, frozen, or defaulted on.

Which countries are leading in central bank gold buying?

China, Turkey, India, and Poland are among the most active buyers, with China reporting more than 18 consecutive months of gold accumulation. These nations view gold as a core reserve asset and a hedge against currency volatility.

How does central bank gold buying affect the gold price?

Consistent central bank demand creates a structural price floor for gold. Because central banks buy steadily and hold long-term, their purchases reduce volatility and help support gold’s long-term upward trajectory.

What does central bank gold buying mean for the U.S. dollar?

As more countries diversify away from the dollar and into gold, global demand for U.S. debt and currency could gradually weaken. This “de-dollarization” trend may strengthen gold’s role as a neutral global asset.

Is now a good time for investors to buy gold like central banks?

With central banks increasing reserves and inflation staying elevated, many investors are following suit. Buying physical gold and silver can help diversify and protect your wealth from systemic risk.

GoldSilver: Investing in Physical Metals Made Easy

GoldSilver lets you invest in real physical precious metals with flexible options to buy, sell, store, and take delivery. You’re in complete control.

Open an Account

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)