Daily News Nuggets | Today’s top stories for gold and silver investors

January 15th, 2026

Metals Rally Hits New Records Amid Global Turmoil

Uncertainty is everywhere right now, and metals are thriving. Gold blasted past $4,600 per ounce this week while silver hit a fresh all-time high above $90.

The surge came as geopolitical tensions boiled over. The U.S. captured Venezuelan leader Nicolas Maduro. Widespread protests in Iran turned deadly. Trump’s threats of military action sent investors scrambling for safety.

The chaos extends to Washington. The Justice Department launched a criminal investigation into Fed Chair Jerome Powell. The probe targets cost overruns on a headquarters renovation. Powell called it a “pretext” for political pressure on interest rates.

This matters: Fed independence is now openly questioned. Institutional stability looks fragile. Investors are voting with their capital.

Gold is up 7% year-to-date. Silver has surged 26%. Both metals are capitalizing on supply constraints, geopolitical chaos, and eroding trust in institutions.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

New Silver Trading Rules Could Push Prices Higher

The CME just made it costlier to trade silver futures. Margin requirements shifted from fixed amounts to percentages this week. Traders now need to post 9% of contract value as collateral.

The change hits leveraged players hardest. As prices rise, collateral requirements automatically increase. That squeezes short sellers. It could force liquidations among overleveraged traders.

Physical buyers aren’t affected. This only applies to paper contracts.

The fundamentals still support higher prices. China’s export licensing is constraining supply. Industrial demand stays elevated. The market is running a structural deficit.

Silver crossed $90 this week and sits 26% higher in 2026. With supply tight and geopolitical risks rising, $100 per ounce looks increasingly realistic.

Trump Says “No Plans” to Remove Powell (For Now)

President Trump told Reuters Wednesday he has no plans to fire Jerome Powell. But he added it’s “too early” to say what he’ll ultimately do. The two are in a “holding pattern.”

Powell’s term as Fed chair expires in May. His seat on the Board of Governors runs through 2028. Trump floated names like Kevin Warsh or Kevin Hassett as potential replacements.

The statement comes amid the ongoing DOJ investigation into Powell. It also follows months of public criticism from Trump over interest rates. The president wants faster and deeper cuts than the Fed has delivered.

However, you may want to ttake this with a grain of salt. Trump has reversed course on Powell before. The market is pricing just a 5% chance of a rate cut at the Fed’s January meeting.

Inflation Looks Tame, But There’s a Catch

The headline looked reassuring: CPI inflation came in at 2.7% in December. Core CPI — which excludes food and energy — eased to 2.6%, slightly below expectations.

But consumers aren’t feeling relief. Food prices jumped 0.7% in December. That’s the largest monthly increase in over two years. Grocery inflation now runs at 3.1% annually. You can’t opt out of eating.

Here’s the disconnect most headlines miss. The Fed doesn’t set policy based on CPI. It watches PCE (Personal Consumption Expenditures) instead.

CPI uses a fixed basket of goods. It places heavy weight on housing costs. PCE adjusts as consumers change their spending habits. It captures a broader range of expenses. That includes healthcare paid on consumers’ behalf. This flexibility makes PCE look cooler than CPI over time.

The Fed emphasizes core PCE. That strips out volatile food and energy prices entirely. It may make inflation easier to manage on paper. But it’s cold comfort for households paying more for groceries, fuel, and insurance.

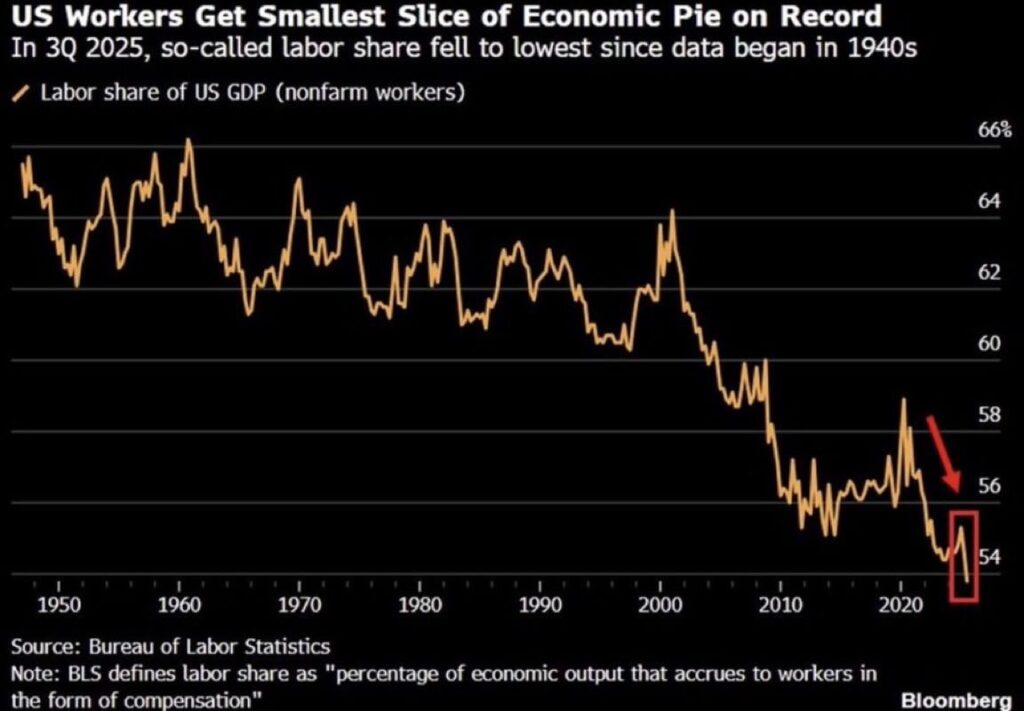

Workers Getting Record-Low Share of GDP

Here’s a stark number: workers captured just 54% of GDP in Q3 2025. That’s the smallest slice since the government started tracking this data in the 1940s.

Labor share measures how much economic output goes to workers versus capital and profits. Right now, less than ever is flowing to paychecks.

The decline has been brutal since 2000. The financial crisis accelerated it, and the trend has continued downward.

Why it matters: this isn’t just about fairness. When workers earn less of what they produce, consumer spending weakens. Inequality grows. Economic fragility increases.

For decades, labor claimed around 63% of GDP. Now it’s down to 54%. That’s a massive wealth transfer from workers to capital.

This creates long-term risks. Consumer spending drives 70% of the U.S. economy. If workers keep losing ground, growth becomes unsustainable.