Daily News Nuggets | Today’s top stories for gold and silver investors

January 16th, 2026

Metals Pause After the Sprint

Gold and silver prices are pulling back today after weeks of strong gains. Gold is down about 1.5% at the time of writing, while silver is off roughly 5%.

That kind of move might sound dramatic. In context, it’s not. Precious metals have surged over the past several weeks, and short-term profit-taking is normal after sharp gains. Markets rarely move in straight lines.

Silver’s move stands out, but perspective matters. Even after today’s drop, silver remains up about 24% year to date. That’s a powerful performance for an industrial metal that’s also treated as a monetary hedge.

Pullbacks like this often reset momentum rather than end trends. They can cool overheated positioning and attract new buyers who missed the initial rally. For investors, the key question isn’t today’s dip — but whether the forces that drove metals higher have actually changed.

So far, they haven’t. One of those forces remains as strong as ever.

Central Banks Buy Gold Despite Record Prices

Central banks are rewriting the rules of reserve management. And gold is at the center.

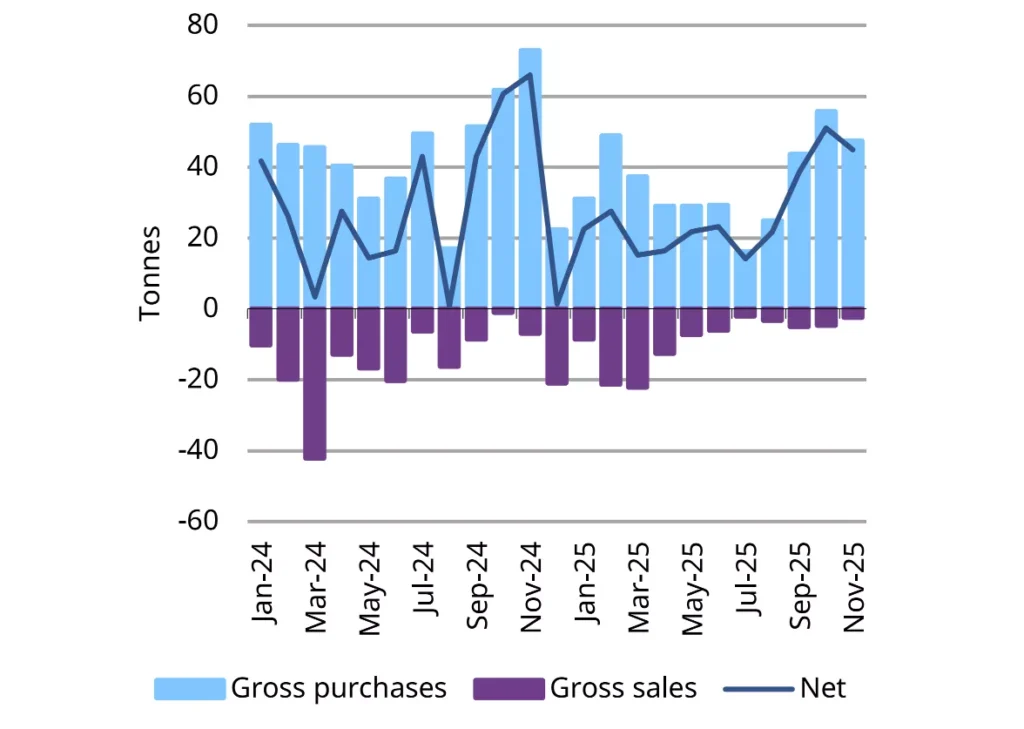

Institutional buying hit 45 tonnes in November, pushing year-to-date purchases to 297 tonnes. The chart tells the story clearly. Gross purchases are trending higher. Gross sales remain minimal.

Central bank buying has accelerated in recent months

Monthly reported central bank activity, tonnes*

*Data to 30 November 2025, where available.

Source: IMF, respective central banks, World Gold Council

Poland, Brazil, and China continue to dominate. Surveys show 95% of central banks expect to increase gold reserves in 2026, with projected purchases around 755 tonnes.

That’s well above the pre-2022 average of 400-500 tonnes. It’s also a clear signal. Central banks are diversifying away from dollar-denominated assets, regardless of gold’s price. They’re buying above $4,000 per ounce because the goal isn’t short-term gains. It’s long-term stability.

For the gold market, this creates structural support. When the world’s largest institutions are consistent buyers, it sets a floor. And that matters more than any single day’s price action.

That stability is part of gold’s appeal — and it shows up in unexpected ways.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Trump’s First Oil Sale Goes to Campaign Donor

One of Trump’s biggest donors just secured a stake in the first U.S. sale of Venezuelan oil.

John Addison, a senior trader at Vitol, gave roughly $6 million to Trump-aligned PACs during the 2024 campaign. Last week, he attended a White House meeting where Trump outlined his plans for Venezuela. Days later, Vitol — along with Trafigura — bought $500 million worth of Venezuelan crude.

U.S. forces detained Venezuela’s president, Nicolás Maduro, earlier this month. Trump says the U.S. will control the country’s oil industry and sell up to 50 million barrels. Critics are questioning the optics of major donors profiting from the deal.

World Gold Council CEO Shares Thoughts on Gold Rally

Geopolitical uncertainty — from Venezuela to elsewhere — is driving gold’s current rally.

In a wide-ranging conversation, former World Gold Council CEO David Tait breaks down why gold’s bull market looks far from finished. Tait points to a rare alignment of forces: central bank buying, rising geopolitical risk, and growing distrust in fiscal and monetary policy.

Unlike past cycles driven mainly by Western investors, today’s demand is global and structural. Gold isn’t reacting to a single headline — it’s responding to a fundamental shift in how governments, institutions, and investors think about money and risk.