Written by: The MacroButler

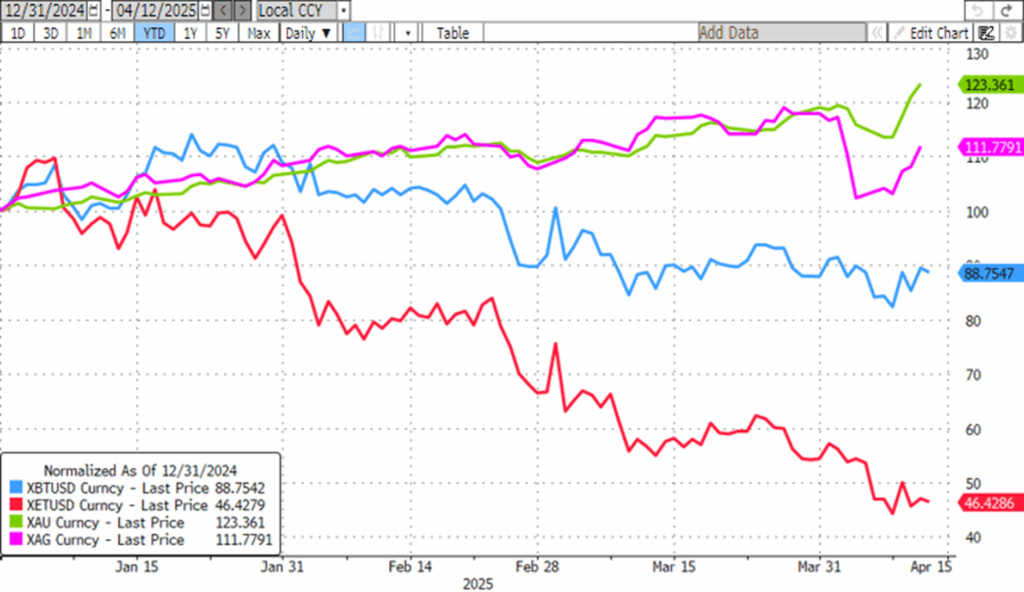

As the “Forward Confusion” campaign hits full stride under the mandate of the ‘Disruptor In Chief’, one thing’s already crystal clear: Bitcoin is doing a stellar job, at not being a store of value. Despite the breathless hype from some in the new administration touting it as the new gold, or even a future U.S. reserve asset, it promptly peaked the day after inauguration and has been gracefully tumbling ever since. And let’s not forget Ether, lovingly marketed as “digital silver” for the YOLO crowd, it’s down nearly 50% since the start of the Jubilee Year. Meanwhile, actual silver (you know, the shiny grey rock) and that unfashionable “barbaric relic” gold? Quietly posting single- to double-digit gains. So much for the antifragile dreams of digital salvation.

Performance of Bitcoin (blue line); Ether (red line); Gold (green line); Silver (purple line) in USD since December 31st 2024.

When the 47th U.S. president declared ‘Bitcoin is the new oil’ during his campaign, outside the political purpose of this statement, those familiar with the 1970s saw echoes of history. Back then, oil prices were deliberately inflated to prop up the dollar and ease America’s post-Vietnam debt burden, creating a bubble that benefited the U.S. at the expense of the rest of the energy-dependent world.

Bitcoin may well be playing the same role oil did in the 1970s, deliberately inflated to relieve unsustainable U.S. debt. Back then, oil was weaponized to prop up the petrodollar. Today, Bitcoin looks like the new bubble, ripe for speculation, designed to absorb debt pressure, and enriching a well-positioned few. But what if Bitcoin was never the anti-establishment, decentralized savior it claimed to be? What if it was rolled out as a clever Trojan horse—sold as a rebellion against central banks, only to become their tool? Imagine BTC as the gateway drug, luring capital into UST-backed stablecoins like Tether, effectively CBDCs under a different label, designed to offload U.S. debt to retail and institutional speculators.

The dots connect disturbingly well. Inflate BTC, create speculative demand, tie it to UST-backed tokens, and let the public, not the FED, monetize the government’s fiscal sins. In this light, Bitcoin investors aren’t de-centralized heroes. They’re part of the machine, knowingly or not.The ultimate irony is that this ‘decentralized revolution’ could be the most politically centralized trade in modern history, and it’s rocketing higher. Even Larry Fink, once a BTC skeptic, is now cheering it on while the biggest swindler in wall street history (i.e. Micheal Saylor) is now advising the US president to sell the US gold stored at Fort Knox to buy the biggest meme scam that has ever been created in financial history.

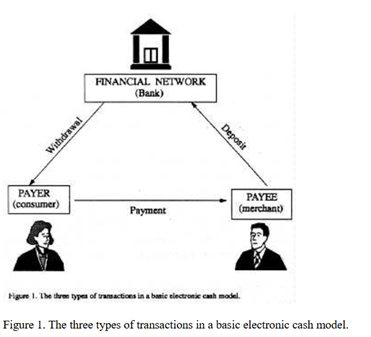

Rather than listening to the mesmerizing propaganda around Bitcoin and other crypocurrencies, savvy investors know that, despite the hype, Bitcoin has spent most of its short life moving in lockstep with risky assets. Case in point: its strong positive correlation, often above 0.5, with TQQQ, the ETF designed to triple the daily performance of the Nasdaq 100. It’s been a high-stakes dance between two speculative darlings, rising and falling together in perfect speculative harmony.

Price of Bitcoin in USD (blue line); Price of ProShares UltraPro QQQ Index (TQQQ US) (red line) & correlation.

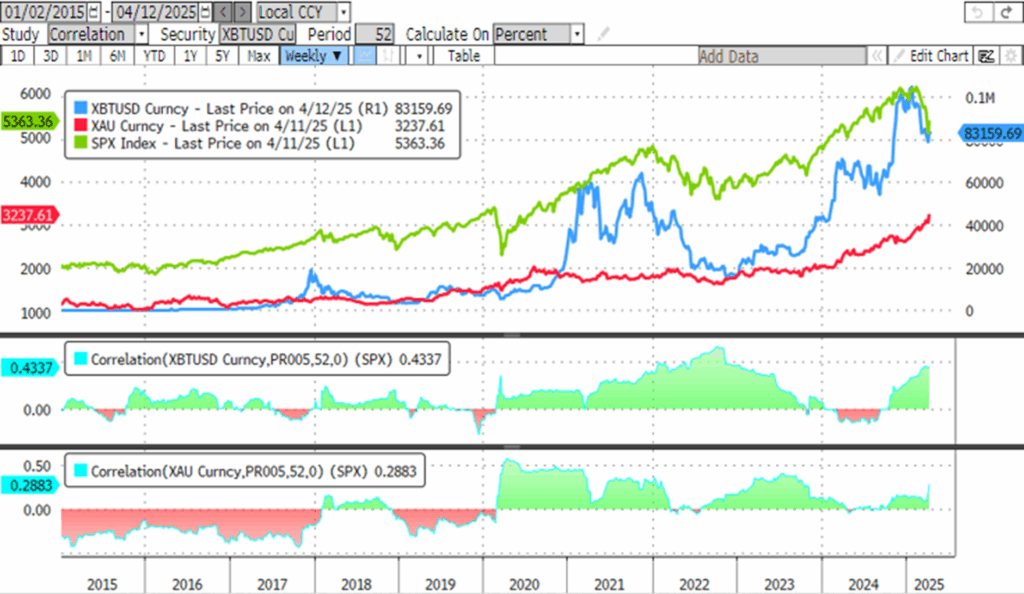

Since their respective all-time highs, the S&P 500 has corrected by almost 13%, and Bitcoin by almost 21%, yet gold continues to make new all-time highs, which could point to what really matters. The US stock market’s record-breaking run since the financial crisis may be comparable to decades of surging US trade deficits that attracted export-dependent economies. Rising beta has lifted all boats, but the lesson from Q1 is that the tide might be starting to ebb. If the S&P 500 drops another 10%, it could approach the Q1 2022 peak of around 4,800. As for Bitcoin? That similar level for the crypto is just under $48,000, an additional 40% downside from its current level . What’s interesting here is that Bitcoin’s 52-week correlation to beta (S&P 500 Index) is increasing, while gold’s correlation to beta has been decreasing since late 2024.

Bitcoin Price (blue line); Gold Price (red line); S&P 500 Index (green line) & Correlation.

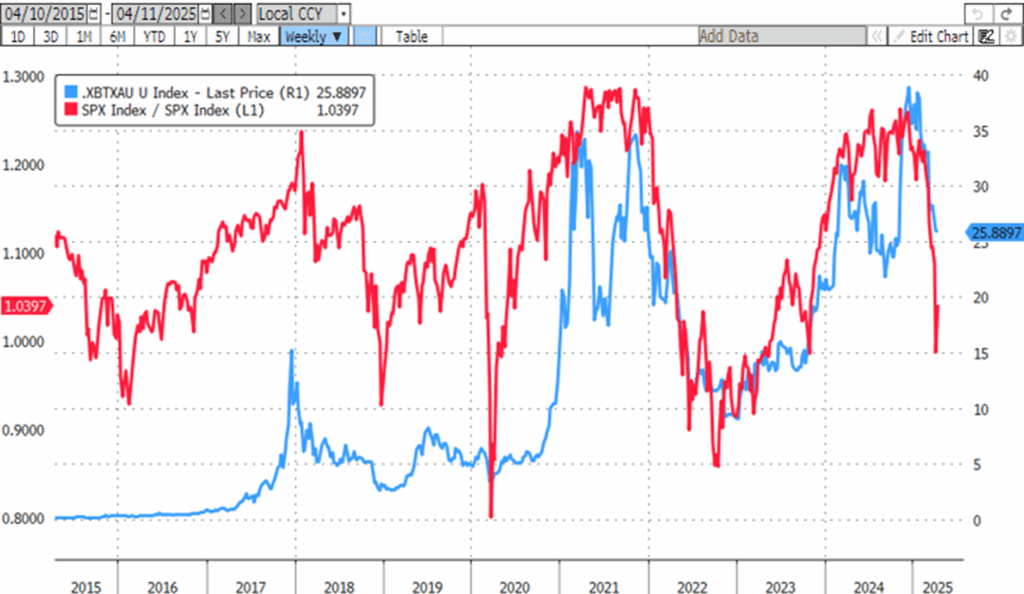

The Bitcoin-to-gold ratio, which bottomed below 3x in 2019, is still sitting at nearly 26x today. What’s preventing it from reverting lower? The answer may lie in the broader market dynamics. The S&P 500 is pulling back from a rare 25% premium to its 100-week moving average. It took the pandemic-induced crash of 2020 and the biggest money pump in history to reach this stretched level in 2021, the first time since 1999. This could signal potential for risk assets to revert, with cryptos being among the riskiest. If beta is destined to return to its mean, the same could apply to the Bitcoin/gold ratio. Historically, the 10x level has acted as a pivot since 2017. US deficit spending has fuelled speculation and inflated equity markets and risk assets, but with unprecedented austerity and tariffs ahead, the stage could be set for a reversion.

Bitcoin to Gold Ratio (blue line); Ratio of the S&P 500 Index to S&P 500 Index 100 day Moving Average (red line).

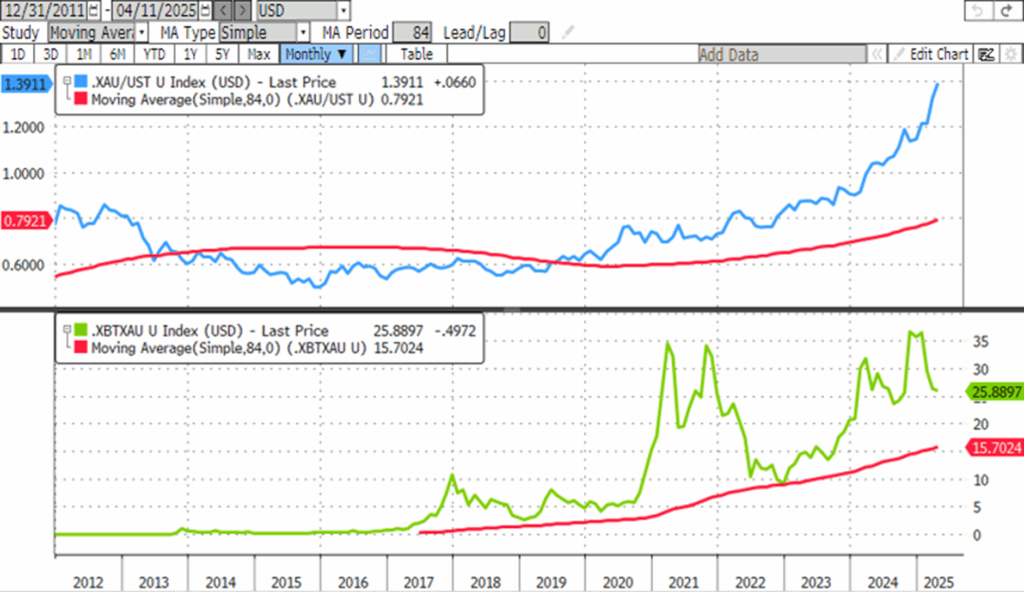

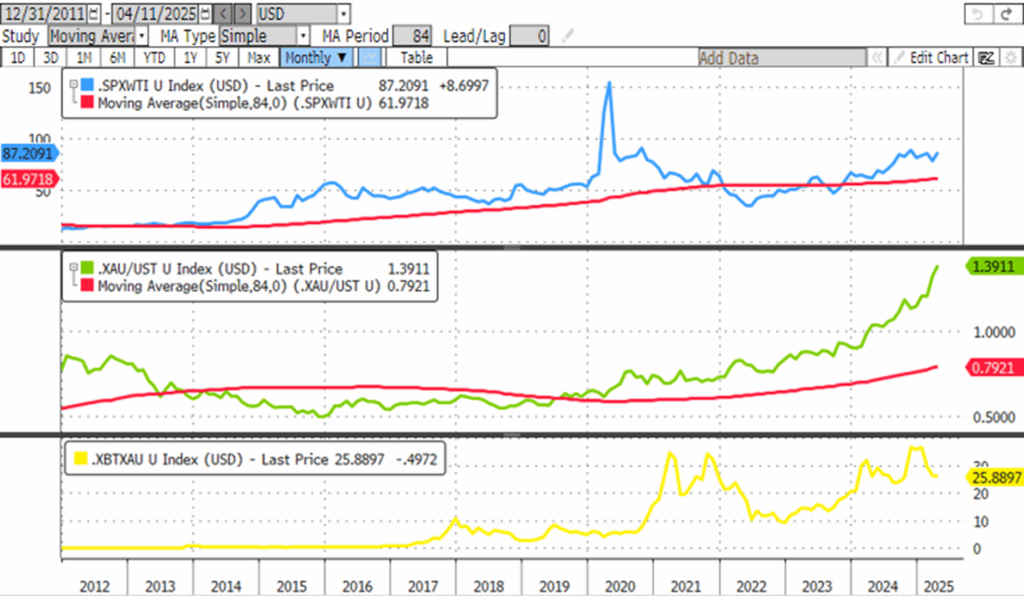

Ultimately, savvy investors know that the real DOGE is neither a phantasmagorical cryptocurrency nor a propagandistic acronym used by the ‘Disruptor in Chief’ to spread additional forward illusions and confusion among investors. What truly matters is the state of the business cycle, which can be proxied by market-driven data such as the position of the S&P 500-to-Oil ratio and the Gold-to-Bond ratio against their respective 7-year moving averages. Looking at the evolution of the Bitcoin-to-Gold ratio against its 7-year moving average, and the S&P 500-to-Oil ratio against its 7-year moving average, nobody needs a PhD in finance or a job on Wall Street to understand that the times when the Bitcoin-to-Gold ratio peaks have coincided with peaks in the S&P 500-to-Oil ratio. These peaks have usually preceded the break of the S&P 500-to-Oil ratio below its 7-year moving average by only a few months, as was the case in early 2020 and late 2021.

Upper Panel: S&P 500 to Oil Ratio (blue line); 7-year Moving Average of the S&P 500 to oil ratio (red line); Lower Panel: Bitcoin to Gold ratio (green line); 7-year Moving Average of Bitcoin to Gold Ratio (red line).

Looking at how the Bitcoin-to-Gold ratio interacts with other market-driven ratios, like the Gold-to-Bond ratio, there has been no noticeable trend that investors can use to anticipate a shift between an inflationary and a deflationary environment over the past 10 years of market data available for the cryptocurrency.

Upper Panel: Gold to Bond ratio (blue line); 7-year Moving Average of the Gold to Bond ratio (red line); Lower Panel: Bitcoin to Gold ratio (green line); 7-year Moving Average of Bitcoin to Gold Ratio (red line).

Ultimately, savvy investors who have thoroughly studied the changes in the business cycle throughout history know that the market-driven indicator that can serve as a canary in the financial coal mine to anticipate shifts in the S&P 500-to-Oil ratio is the S&P 500-to-Gold ratio; better known as the indicator of monetary illusion. Interestingly, much like the S&P 500-to-Oil ratio, peaks and troughs in the S&P 500-to-Gold ratio and its break below the 7-year moving average correspond with peaks and troughs in the Bitcoin-to-Gold ratio, as was the case in March 2020, and more recently in October 2021 and January 2025.

Upper Panel: S&P 500 to Gold ratio (blue line); 7-year Moving Average of the S&P 500 to Gold ratio (red line); Lower Panel: Bitcoin to Gold ratio (green line); 7-year Moving Average of Bitcoin to Gold Ratio (red line).

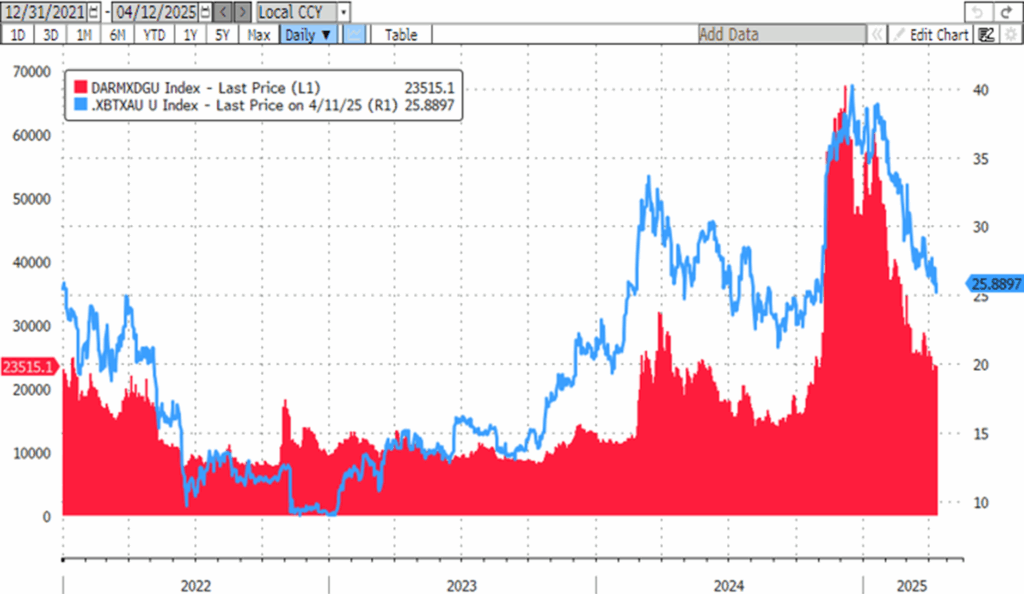

To nail the demonstration that Bitcoin is at best just a speculative tool created to satisfy the speculative greed of YOLO investors, the fact that the Bitcoin-to-Gold ratio is trading almost tick-for-tick with Dogecoin’s market cap should be the ultimate argument for savvy investors to stay away from this crypto money-laundering tool and focus exclusively on gold as the only antifragile asset with no counterparty risk.

Bitcoin to Gold Ratio (blue line); DogeCoin Market Cap (red historgram).

In a few words, many investors may have fallen into the political trap set by the ‘Disruptor In Chief’ who is also the ‘Manipulator In Chief’, who made Bitcoin partisan, presenting it as a magical asset for YOLO investors who buy into fairy tale stories. In a world on the brink of a ‘Money AIst‘, the truth is that the largest financial theft ever isn’t just tied to AI hype, but also to the belief that Bitcoin and other cryptocurrencies are antifragile assets. The reality is that Bitcoin is just another speculative tool, bound to melt down along with the AI bubble. This means most YOLO investors holding the ‘Malificent 7’ and Bitcoin, expecting a new normal, are about to face a market-driven wealth transfer.

Savvy investors understand that gold is rising not because it’s flashy, but because fiat currencies are spiraling deeper into debt, a reality even our Bitcoin fans acknowledge. Like the central banks of the East and the ascending BRICS+ nations, savvy investors recognize that gold, not Bitcoin, is the preferred trade-settlement asset in a world turning away from weaponized US dollars and US Treasuries. Even the BIS, for all its centralization, acknowledges gold as the only other Tier-1 asset alongside the “return-free-risk” of the once-revered US 10Y Treasury. The implications of gold’s Tier-1 status are profound: unlike Bitcoin, gold truly is a store of value.

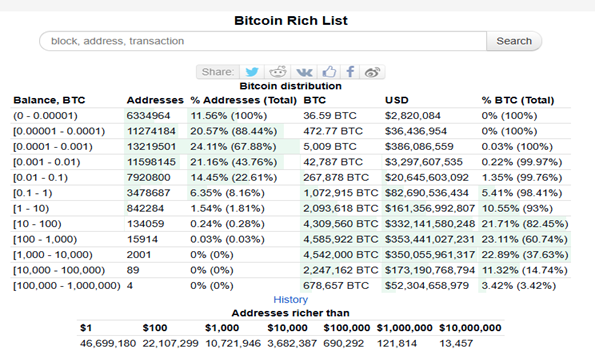

For those like Michael Saylor who still preach that Bitcoin will topple the USD as the world’s reserve currency and replace gold as the ultimate antifragile asset, it’s time to separate hype from reality. Bitcoin is a speculative trading vehicle, not a currency, nor a store of value. That may upset overnight Bitcoin millionaires or hopefuls, but truth isn’t a popularity contest. The mystery around its creator, Satoshi Nakamoto—missing since 2011 with 1 million untouched BTC (over $80 billion today)—raises serious questions. First, the name Satoshi Nakamoto, when written in Japanese, can carry multiple meanings depending on the kanji used. Satoshi (哲史) can mean “wise” or “philosopher,” while Nakamoto (中本) suggests “central origin” or “middle foundation.” This translation already add a layer of mystery to Bitcoin’s origins. Second, one wallet holds 5% of all mined Bitcoin. Will it stay untouched forever? Believing a lone genius outsmarted every government and created the perfect anti-establishment tool is naive. In truth, Bitcoin is a bureaucrat’s dream—fully traceable and programmable. It’s not financial freedom. It’s financial surveillance.

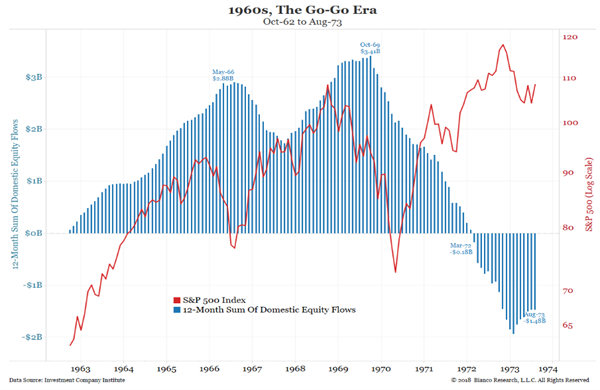

Bitcoin’s price behavior mirrors the mutual fund bubble of 1966, when funds were publicly listed and traded above their net asset value (NAV). Investors paid a premium, but during the crash, they sold at deep discounts, suffering losses of 70–90%, while the Dow fell just 26.5%. This led to mutual funds being delisted and restricted to NAV-based transactions. Unless Bitcoin changes its structure, it can never serve as a stable currency or store of value, its extreme volatility keeps it a speculative asset class, not a reliable medium of exchange.

For once and foremost, Bitcoin is a trading vehicle, no different from wheat or cattle. It is NOT a store of wealth, as it fluctuates like everything else. It rises and falls just like any other trading instrument as it does NOT maintain a constant value where one can safely park money.

Finally, when the IMF finally rolls out its vision of CBDCs and DLT-compliant stablecoins, even those will need a gold anchor to maintain credibility, lest they become just another digital fiat. So yes, despite the mania, questionable/darker motives and even undeniable price moves and direction in a now openly politicized Bitcoin, savvy investors will always stick with physical gold in a debt-mad world.

No matter the Department of Government Efficiency, mistakenly summarize as DOGE is succesful or not, a reckoning is coming. Fiat money isn’t getting better, it’s getting worse. Expect yield curve control, capital controls, and financial repression. More QE will follow, and eventually, leaders will admit what they hinted at in 2020: “We need a new Bretton Woods.” A centralized digital currency, trackable, programmable, seizable, is coming. Like it or not, that train isn’t stopping. That’s why gold at $3,000 is just the beginning. This isn’t the top—far from it. Relative to the US money supply, gold today is as cheap as it was in 1971.

Gold Price in terms of US Money Supply (M2) rebased at 100 as of December 1959.

But don’t buy gold to get rich. Buy it to avoid getting poor. Yes, if you bought early, you might afford a house or car. But gold isn’t about speculation—it’s about protection. If you want to gamble, buy tech stocks. If you want to survive monetary destruction, own gold.

For 50 years, governments, especially the U.S., have poisoned money. As Kissinger said, “To be an enemy of the U.S. is dangerous; to be a friend is fatal.” Europe followed America’s monetary lead and now faces the consequences. Trump doesn’t care, and the dollar isn’t what it used to be. Don’t wait for your local government or banker to solve it. Rely on your own judgment. You do need to understand it. Not as a gold bug, but through the lens of history and math. Whether Bitcoin hits a million or zero, one thing’s certain: Gold will never go to zero.

In this context, savvy investors understand that to preserve and grow their wealth, they must adapt to the business cycle rather than trying to change it. Indeed, investors must focus on safeguarding their wealth by owning real assets like physical gold and silver, the only antifragile assets with no counterparty risk. Investors should also focus on Return OF Capital rather than Return On Capital, holding other commodities to weather the storm unleashed by the ‘Commodity Leviathan.’ Additionally, they will actively manage their cash allocation using a portfolio of short-dated, investment-grade (IG) USD bonds with maturities under 12 months and Treasury bills (T-bills) with maturities not exceeding 3 months. These income-generating assets will provide stability. Among equities, investors should continue favoring low-leverage companies with strong EPS and FCF growth, prioritizing energy and commodity producers over consumers. By doing so, investors will ensure both peace of mind and wealth preservation.

KEY TAKEWAYS.

As the Songkran festival approaches, the key takeaways are:

- Despite deepening trade tensions, China’s rising core CPI and rebounding CPI-PPI

- As “Forward Confusion” unfolds under the 47th president, Bitcoin’s crash and Ether’s dive prove that digital assets are no match for the steady gains of gold and silver.

- Despite the hype, Bitcoin dances in sync with risky assets, showing what really matters as the tide begins to turn.

- The Bitcoin-to-Gold ratio, like the Gold-Silver ratio, mirrors the S&P 500-to-Gold and S&P 500-to-Oil ratios, making it a perfect gauge for tracking the business cycle and informing investment decisions.

- Bitcoin isn’t a store of value, it’s just a speculative asset, trading on volatility, not stability.

- As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

- Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

- Gold and silver are eternal hedge against “collective stupidity” and government hegemony, both of which are abundant worldwide.

- With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

- Long dated US Treasuries and Bonds are an ‘un-investable return-less’ asset class which have also lost their rationale for being part of a diversified portfolio.

- Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

- In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

As of April 11th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for almost 3 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

Investors who understand the business cycle know that only one asset class has preserved wealth during inflationary times: PHYSICAL GOLD. While Wall Street and politicians have sold Bitcoin as an antifragile asset, the truth is that Bitcoin, like other cryptocurrencies, is the biggest scam ever created by authoritarian governments. Historically, money has had practical, utilitarian value, like gold. Bitcoin, on the other hand, is a leveraged, energy-consuming investment tool that will underperform gold, just as energy-consuming sectors underperform energy producers when the economy shifts from inflationary boom to bust, as seen between 2022 and 2023.

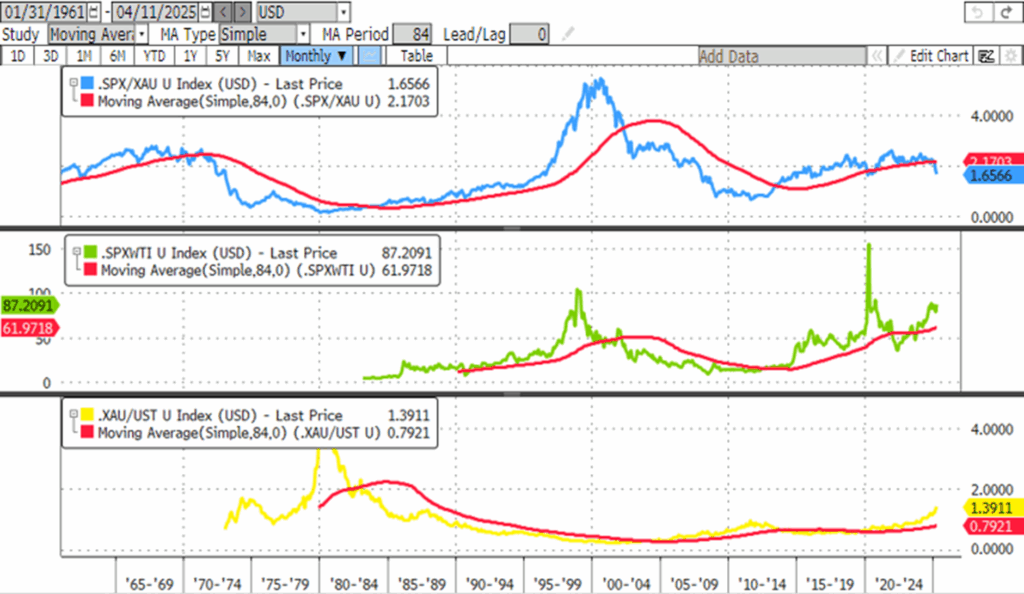

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving

Average of the S&P Gold/Bond ratio (red line); Lower Panel: Bitcoin to Gold Ratio (yellow line).

Similar to the Gold-Silver ratio, often referred to as the ‘Silver Bird,’ the Bitcoin-Gold ratio against specific moving averages can help investors allocate between stocks and cash, or adjust their equity exposure between energy consumers (like the Nasdaq) and energy producers (such as the S&P 500 Energy Index). Backtesting these strategies shows consistent outperformance since the start of the current decade, particularly during volatile periods like those seen since the start of the Jubilee Year.

By owning physical gold outside the tightening grip of centralized digital systems, the “old-fashioned” gold holders preserve something the “future-focused” Bitcoin camp may lose: true autonomy, not just from the USD, but from all fiat currencies racing toward centralization.

Gold in private vaults comes with no compliance protocols, no digital IDs, no counterparty risk, and no reliance on Ripple/XRP rails or other politically exposed, centralized infrastructures. Unlike digital assets born in 2008, gold protects not just from currency collapse, but also from volatility and centralization. It’s been doing so since 480 BC. That matters. Gold matters—yesterday, today, and especially tomorrow.