Daily News Nuggets | Today’s top stories for gold and silver investors

September 25th, 2025

Jobless Claims Drop Sharply, Complicating Fed’s Next Move

New jobless claims fell to 218,000 last week — well below the 235,000 forecast — suggesting the labor market remains stronger than expected. Continuing claims also dipped to 1.7 million. Despite slowing economic momentum, employers are clearly reluctant to cut staff. Treasury yields rose and recession bets pulled back following the report.

This resilient job market complicates the Fed’s rate-cutting calculus…

Consumer Spending Powers Ahead Despite Labor Worries

While job market indicators flash warning signs, Americans keep spending. Q2 GDP rose at a revised 3.8% annualized rate, driven by surprisingly strong consumption. Many households feel financially squeezed yet continue shopping — likely tapping savings or credit to maintain their lifestyle.

What to watch: This disconnect can’t last forever. When job losses mount, consumer strength could evaporate quickly, potentially triggering a flight to safety.

Hedge Fund Warns: Rally Could Accelerate Before Crash

With U.S. stocks up 13% this year, Universa Investments sees an uncomfortable parallel to 1929. The “black swan” fund warns markets could surge another 20% before a devastating correction — classic blow-off top behavior where euphoria precedes collapse.

History shows sharp late-stage rallies often end badly. Smart investors know this is precisely when portfolio insurance matters most. The time to protect your portfolio isn’t when everything is crashing. You have to be proactive before there’s panic in the streets.

U.S. Considers $20B Lifeline for Argentina

After years of runaway inflation and repeated debt crises, Argentina may soon receive a $20 billion aid package from Washington. Talks are reportedly underway as the country struggles with triple-digit price increases, a battered peso, and dwindling reserves. For the U.S., the move would be as much geopolitical as financial, aimed at stabilizing a key regional economy.

Argentina’s ongoing crisis is a textbook case of fiat currency failure under inflationary pressure — a reminder of why investors worldwide continue turning to hard assets like gold.

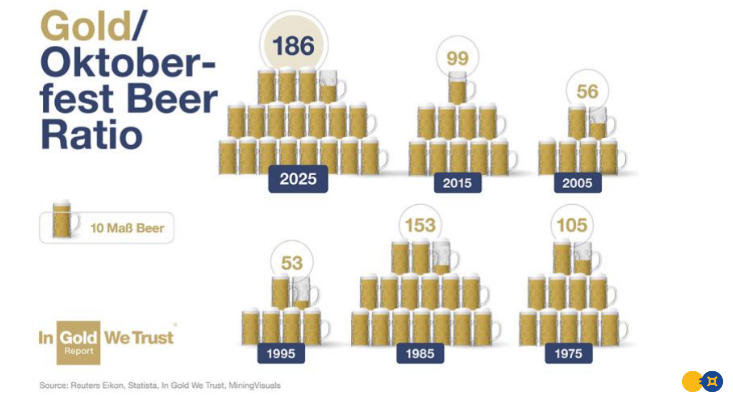

Cheers! Gold Buys More Beer Than Ever at Oktoberfest

Munich’s Oktoberfest is pricier again this year, with a Maß of beer now EUR 15.80. But measured in gold, the story flips. Incrementum’s 2025 Gold/Oktoberfest Beer Ratio shows one ounce of gold now covers 186 Maß, up 26% from last year and over 50% since 2023.

While cash holders feel the pinch of inflation at every purchase, gold maintains its purchasing power. At Oktoberfest 2025, it buys more beer than ever — proof that real money beats paper promises.