The world of precious metal investing offers two tempting options that often leave newcomers scratching their heads — should you go with straightforward bullion or venture into collectible numismatics? The bullion vs numismatic coins decision requires understanding some key differences.

Let’s break down everything you need to know to make the right choice.

What Are Bullion Coins?

Bullion coins offer a simple way to own pure gold or silver, with their value based solely on metal content. Popular examples include the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand.

Government mints produce these coins in large quantities, which keeps premiums low and ensures high liquidity in the market.

Why investors love bullion coins:

- Transparent pricing tied closely to spot metal rates

- Wide availability in sizes from 1 oz to fractional

- Easy liquidity anywhere in the world

“Bullion coins offer a straightforward entry to precious metals,” says the World Gold Council.

Learn more about our selection of high-purity bullion coins → Bullion Coins Collection

What About Numismatic Coins?

You may have heard about numismatic coins—those collectible pieces valued for rarity, history, or unique design. Although fascinating, numismatic coins don’t suit investors looking to hedge against inflation or market instability. Here’s why we focus on bullion, not numismatics:

- Volatile premiums: Prices of numismatic coins can fluctuate dramatically as collector interest shifts, driven by market trends, auction results, or renewed historical focus. These swings in premiums make it difficult to forecast returns and can erode gains if collector demand softens unexpectedly.

- Lower liquidity: Unlike bullion—which trades continuously in global markets—rare coins often require locating specialized buyers or timing sales around auctions. This can delay transactions and result in less competitive pricing compared to bullion’s ready market.

- Expertise required: Accurately assessing a numismatic coin’s value demands deep knowledge of grading standards, provenance verification, and condition nuances. Investors may incur additional costs for professional grading services and face risks of misjudging authenticity or grade, leading to potential mispricing.

If you’re comparing bullion vs numismatics, keep in mind that GoldSilver focuses on bullion to give you simplicity, transparency, and reliability.

Why We Recommend Bullion vs Numismatic Coins

At GoldSilver, our mission is to help you protect and grow your wealth. Bullion coins deliver on these goals with:

- Pure value: Bullion coins track the real-time spot price of gold and silver, tying your investment directly to market value. Unlike numismatic coins with added collector premiums, bullion lets you buy and sell based on metal content—no hidden markups.

- Low premiums: Bullion coins typically carry markups of just 1–5% over the spot price — far lower than the 20–100%+ premiums common among numismatic coins. Keeping premiums low means more of your capital is allocated directly to acquiring precious metal, improving your cost basis and long-term returns.

- Global liquidity: Popular bullion coins like the American Gold Eagle and Canadian Maple Leaf enjoy deep, active markets around the world. Moreover, whether you’re selling at home or abroad, you can quickly convert bullion into cash at transparent prices. This flexibility becomes essential during market volatility or unexpected financial needs—so you’re never left waiting for the right buyer.

“Bullion is the simplest and most transparent way to own physical gold.” — World Gold Council

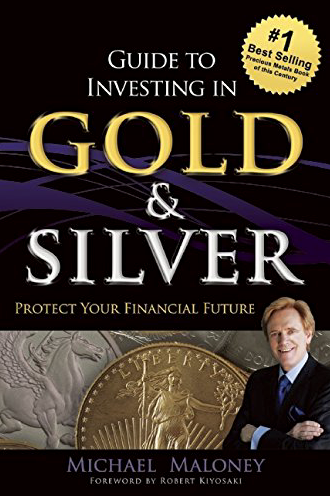

Wait! Don't Forget Your Free Book

Mike Maloney's #1 all-time bestselling investment guide.

Discover our selection of high-purity bullion coins and bars

Building Your Bullion Strategy

Ultimately, whether you’re new to precious metals or expanding your existing stash, bullion coins should form the core of your strategy. Here’s our recommended approach:

- Start with pure ounces: Aim for well-known 1 oz coins (American Eagles, Maple Leafs) to maximize liquidity.

- Add fractional pieces: Including 1/2, 1/4, or 1/10 oz coins gives you flexibility as prices move.

- Watch the market: Bullion coins track spot prices—monitor gold trends to buy on dips.

By prioritizing bullion over numismatics, you embrace a time-tested hedge that aligns with your long-term financial goals.

The Bullion vs Numismatics Verdict

When you compare bullion vs numismatic coins, bullion wins every time for investors seeking security and simplicity. That’s why GoldSilver only sells bullion coins — no confusing premiums, no tricky grading, just pure, tangible wealth you control.

Ready to add bullion to your portfolio? Explore our selection and get started today.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

- ⏰ Timely alerts on major price moves and important events

- 📢 Market updates from Mike Maloney & Alan Hibbard

- 💡 Strategies to profit from this rare opportunity

This article is provided for informational purposes only and should not be considered investment advice. Always conduct thorough research or consult with qualified financial professionals before making investment decisions.