If you’re exploring whether to buy precious metals in 2026, you’re not alone. A growing number of analysts, wealth managers, and institutional investors are rethinking how gold and silver fit into a modern portfolio — and many are arriving at the same conclusion: precious metals deserve a larger allocation than they have in decades.

This trend gained fresh momentum in September 2025, when Morgan Stanley’s Chief Investment Officer publicly endorsed a 60/20/20 portfolio strategy — 60% stocks, 20% bonds, 20% gold — positioning gold as a core inflation hedge rather than a fringe diversifier.

For an industry long anchored to the traditional 60/40 stock-bond mix, this is a seismic shift.

Why Institutions Are Increasing Precious Metals Allocation

Institutional interest in gold has been rising for years, but the past 18–24 months have accelerated that trend. Several global research desks and major banks have highlighted the same set of drivers:

- Stubborn inflation and uncertainty around long-term price stability

- Declining real yields, which historically support higher gold prices

- Growing geopolitical risk, making non-correlated assets more valuable

- Concerns about debt levels and money-supply expansion

While each institution frames its argument differently, the takeaway is consistent: precious metals offer a unique combination of liquidity, independence, and diversification benefits that traditional financial assets can’t replicate.

For investors evaluating whether to buy precious metals in 2026, this institutional backing adds credibility — and signals a broader shift in how portfolios may be constructed in the coming decade.

What Happens If Gold Becomes a Standard 20% Allocation?

Let’s run a simple thought experiment.

Scenario 1: U.S. retirees allocate 20% of their portfolios to gold

It might sound ambitious, but it’s not implausible — and the implications would be transformative.

U.S. retirement accounts hold roughly $45.8 trillion across IRAs, 401(k)s, and pension funds. If these accounts shifted to a standard 20% allocation in gold, that would represent roughly $9.16 trillion directed into precious metals.

To put that into perspective, acquiring $9.16 trillion worth of gold would require about 142,454 metric tonnes — more than 44 times the annual global mine supply.

Scenario 2: Global investors adopt similar allocations

But the U.S. is just one market. What if this becomes a global phenomenon?

If global pension funds in the top 22 markets followed suit and adopted a 20% allocation to gold, the pressure would compound dramatically:

- $11.7 trillion in potential demand

- Equivalent to roughly 181,956 metric tonnes of gold

- Nearly 57 times the annual new mine supply

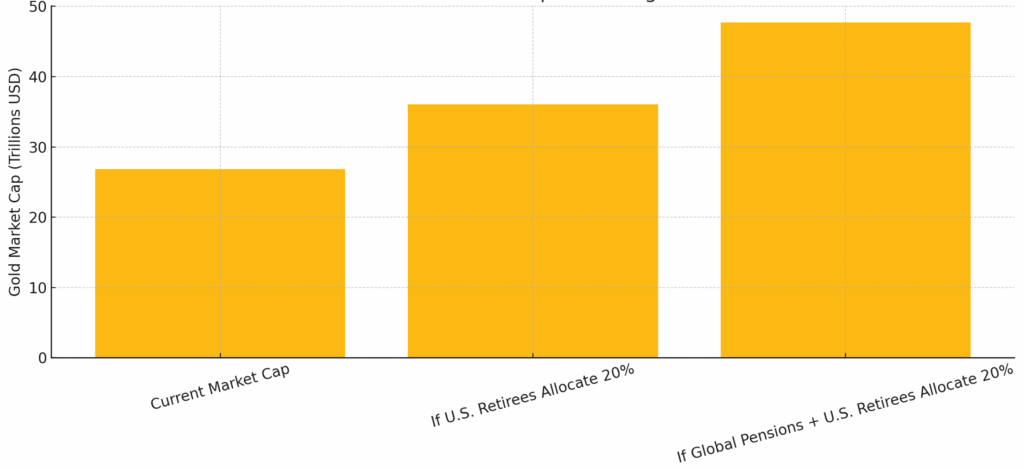

Actual vs. Theoretical Gold Market Cap Under Higher Allocation Chart

- Current market cap (at $4,000 gold): $26.86T

- If U.S. retirees allocate 20%: +$9.16T → $36.02T

- If global pension funds also allocate 20%: +$11.7T → $47.72T

Demand like this would quickly eclipse available new supply and could fundamentally reshape the structure, pricing, and liquidity dynamics of the gold market.

This is why even discussing higher allocations matters. The market doesn’t need universal adoption — it only needs a fraction of investors moving in this direction for demand to rise structurally.

Even a modest 5% shift into gold across retirement accounts would dramatically exceed today’s annual production. A 20% allocation becoming “normal” would place massive upward demand pressure on gold, far beyond what the current physical market is built to absorb.

The Academic Case for Higher Precious Metals Allocation

Long before wealth managers began revisiting gold’s role, academic researchers had already documented its impact on portfolio performance.

The findings are remarkably consistent across studies: portfolios with a 5–15% allocation to gold and silver tend to deliver better risk-adjusted returns over time. They experience smaller drawdowns during market stress and maintain more stable performance through economic uncertainty.

Why? Gold tends to perform well when equities struggle, inflation rises, or volatility spikes. Silver adds industrial leverage and further diversification within the metals allocation.

This data is measurable across decades of market cycles — and it’s why more investors are treating precious metals as a strategic position rather than a tactical trade.

Why 2026 May Be a Strategic Entry Point

A few macro forces are converging:

- Central banks continue accumulating gold at multi-decade highs.

- Real yields are fluctuating but trending lower over the long term.

- Inflation remains above pre-2020 norms in many regions.

- Market cycles appear late-stage, while geopolitical risks remain elevated.

- Structural demand from technology, solar, and energy infrastructure is rising — especially for silver.

None of these alone dictate the price direction of gold or silver. But together, they paint a picture of long-term resilience for precious metals — and a strong case for strategic accumulation.

The Bottom Line

Whether you’re a retiree protecting savings, a long-term investor seeking balance, or simply exploring how to buy precious metals in 2026, it’s clear the landscape is shifting.

Institutions are nudging allocations higher. Academic research continues to show that gold and silver can strengthen portfolios. And global uncertainties are reinforcing why metals remain one of the most reliable stores of value throughout history.

This isn’t a fear trade — it’s a strategic shift. And if you’re evaluating your next move, it pays to understand these trends before the broader market catches on.

GoldSilver has spent years helping investors navigate exactly these kinds of transitions. If you want deeper education, data, and guidance, our resources are here to help you make informed, confident decisions on your own terms.

People Also Ask

Is 2026 a good time to buy precious metals like gold and silver?

2026 may be a strategic year for buying precious metals because inflation, real yields, and global debt levels continue to support long-term demand. Analysts and institutions are also revisiting higher gold allocations as a hedge. You can explore market trends and education-driven insights at GoldSilver to make an informed decision.

Why are more investors increasing their allocation to gold?

Investors are boosting gold allocations due to persistent inflation, geopolitical uncertainty, and the weak performance of bonds in real terms. Gold has historically performed well during periods of elevated risk and declining real yields. GoldSilver provides research and tools to help investors understand these drivers.

How big is the current gold market cap at $4,000 per ounce?

At $4,000 gold, the global above-ground supply is valued at around $26–27 trillion. This provides a baseline to compare how major institutional allocations could expand the market. GoldSilver’s charts and analysis make these dynamics easy to visualize.

What percentage of a portfolio do experts recommend for gold?

Academic and quantitative studies often suggest 5–15% in gold or silver to improve diversification and reduce drawdowns. Some modern models — like the Morgan Stanley CIO’s — explore even higher allocations depending on risk profile. GoldSilver’s guides can help you evaluate the right allocation for your goals.

What would happen if U.S. retirees allocated 20% of their portfolios to gold?

A 20% allocation among U.S. retirement accounts would create roughly $9.16 trillion in new gold demand — more than 44 times the annual global mine supply. This kind of shift would dramatically reshape the gold market. The article breaks down the math and charts the potential impact.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.