Brandon Sauerwein, Editor

Last week, gold made history. This week, it’s catching its breath.

After an explosive surge to an all-time high of $3,500 per ounce — one of the fastest bull runs in gold’s history — prices have pulled back to around $3,300. Some may wonder if the rally has peaked. But for seasoned investors, this looks less like a top… and more like a textbook buying opportunity.

Because the forces behind gold’s rise haven’t faded — they’re accelerating. Consider this:

- Gold is still up more than 28% year-to-date

- Central banks continue to add to reserves — particularly in the East

- Global de-dollarization is accelerating amid geopolitical realignment

Mike Maloney believes we’re in the early stages of a massive monetary reset — and that gold is nowhere near its final destination…

What If the Future of Money Isn’t Digital — but Gold?

In his newest must-watch video, Mike Maloney presents his boldest argument yet for a new gold-backed global monetary system — and a potential gold price of $10,000.

With Treasury Secretary Scott Bessent, global central banks, and major hedge funds like Bridgewater now openly calling for monetary reform, the signs are everywhere:

- Mike believes a new Bretton Woods-style agreement may be brewing

- China is stockpiling gold, while the U.S. quietly replenishes its own reserves

- A $10,000 gold price may not just be possible — it may be essential after the monetary reset on the horizon

“We’re not at the end of this system. We’re on the edge of the next one. And gold will be at the center of it.” – Mike Maloney

If you watch one video this week, make it this one.

Why This Pullback Could Be the Best Entry Point All Year

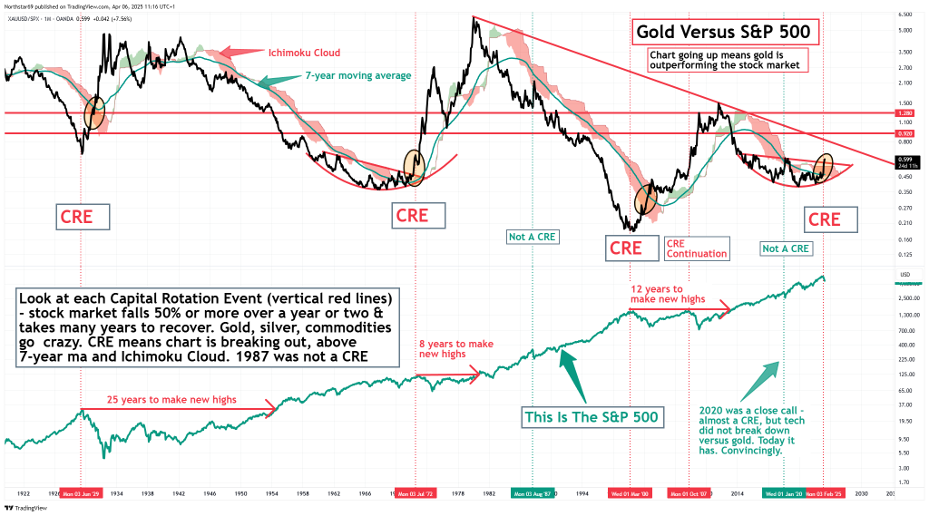

In a powerful recent panel, Alan Hibbard, Kevin Wadsworth, and Patrick Karim revealed why we may be in the early stages of a rare and historic Capital Rotation Event — a shift of wealth from overvalued paper assets into tangible stores of value like gold and silver.

These rotations are rare. But when they happen, they reshape financial markets. Consider:

- 1929: After the crash, it took 25 years for the S&P 500 to recover

- 1972: Post-Nifty Fifty bubble, stocks needed 8 years to reclaim their highs

- 2000: After the tech bust, it took 12 years for the S&P to bounce back

Source: Northstar Bad Charts

In each case, capital fled stocks and flowed into gold and silver. Those who moved early captured outsized gains.

Secure Bulk Pricing on Every Single Gold & Silver Purchase

What Else is in the News?

📉 Three-Year Growth Streak Ends as US Economy Shrinks in Early 2025

The US economy shrank by 0.3% in the first quarter of 2025, marking the first economic contraction in three years. This decline was slightly worse than economists’ expectations of a 0.2% drop and represents a significant slowdown from the 2.4% growth recorded in late 2024. The Bureau of Economic Analysis says the contraction in part to a surge in imports — which subtract from GDP — as companies rushed to secure goods ahead of new tariffs.

Markets are reacting sharply to the news. At the time of writing, the Dow is down as much as 700 points, as investors digest the economic slowdown.

🚢 U.S. Supply Chains Brace for Impact as China Tariffs Begin to Bite

President Trump’s 145% tariffs on Chinese goods have already caused cargo shipments to plunge 60% since early April. The ripple effects are imminent: major retailers like Walmart and Target are warning of empty shelves and rising prices by mid-May as inventories thin. Even if trade talks resume soon, restarting imports could overwhelm logistics networks — echoing the shipping delays and cost spikes seen during the pandemic.

💵 Trump Tariffs Slam the Dollar — Worst Drop Since 2002

The U.S. dollar is on track for its largest two-month decline in over 20 years, down 7.7% in March and April. The fall was triggered by Germany’s stimulus plans (boosting the euro) and Trump’s tariff war (driving investors into safe-haven currencies). While reports of possible tariff relief gave the dollar a modest bounce on Tuesday, foreign investors remain wary of U.S. assets amid the chaotic trade negotiations.

💳 Credit Crisis: Fed Warns of Highest Consumer Distress in 12 Years

Financial strain is building. The Federal Reserve Bank of Philadelphia reports 11.1% of Americans are now making only minimum payments on their credit cards — the highest rate since 2012. Delinquencies are also surging, driven by years of inflation and rising reliance on debt for essentials. With average credit card interest rates now above 21%, households are feeling the squeeze.

📉 Gold Pulls Back After $3,500 Peak

After a record-breaking run — 28 new highs and a 28% YTD gain — gold has cooled to around $3,300. For long-term investors, this could be a healthy reset — and potentially a strong entry point.

📊 Goldman Sachs Reaffirms $4,500 Gold Tail Risk

Goldman Sachs thinks this pullback could be temporary. They’ve just raised their 2025 target to $3,700 — and say gold could spike to $4,500 if markets face a Fed pivot or broader systemic stress. In their view, the upside remains very much alive.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Customer Service is very helpful!

“Travis was amazing! I was having difficulty with a wire transfer of my life’s savings, and I was very worried that I might not be able to receive it all. My husband just passed away and I’ve been worried about these funds along with grieving for 8 months. As soon as I got connected with Travis, my concerns were immediately addressed and he put me at ease. The issue was resolved within days. He even called me back with updates to keep me in the loop about what was going on with the funds. I am so grateful for a customer representative like Travis. He really cares for his clients.” — A. Howard

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?