Brandon Sauerwein, Editor

While Markets Tumble, Gold Shines

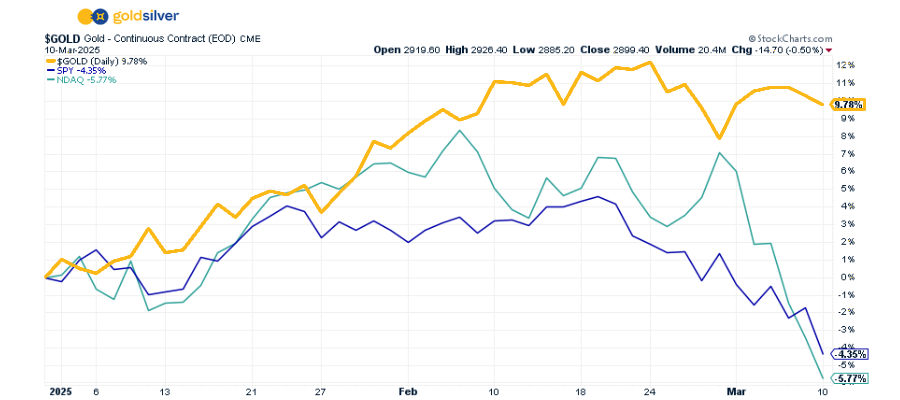

The economic landscape has shifted dramatically in recent weeks. The tech-heavy Nasdaq 100 has plunged 12% from its February peak, reaching its most oversold level since 2022. The S&P 500 has shed 8.6% from its record high — erasing over $4 trillion in market value — and is now teetering on the edge of correction territory (defined as a 10% decline).

As recession fears intensify, investors are fleeing U.S. stocks for safer global assets. Meanwhile, gold is performing exactly as promised — a haven during economic uncertainty.

Gold isn’t merely preserving investor’s portfolios during this economic turmoil; it’s actively growing it — up 10% year-to-date and poised to climb further as market volatility continues.

Despite — or rather, because of — the current economic uncertainty, there’s never been a better time to be a gold investor…

“Stocks HAMMERED… Is This Trump’s Plan?”

What About Gold?

The stock market is in freefall with no bottom in sight. All three major indices are breaking records to the downside as the post-election euphoria completely evaporates.

Today, Alan reveals how this market crash might actually be part of Trump’s economic strategy. In this urgent update, you’ll discover:

- How the S&P 500 just snapped its historic 336-day support streak

- Why the Mag 7 lost over $800 billion in market cap in a single day

- Critical charts showing why stocks might deliver ZERO returns for the next decade

- How gold is silently outperforming nearly EVERYTHING in this chaos

What Else is in the News?

🔍 “NO LONGER UNTHINKABLE”: US RECESSION CONCERNS GROW

Credit risk indicators reached their highest levels of 2025 on Monday as market sentiment deteriorates across all indexes. Several companies have postponed bond issuance amid mounting economic uncertainty tied to tariffs and federal workforce reductions. Barclays strategists have notably shifted their outlook, now considering a U.S. recession a genuine possibility rather than a remote risk.

📉 BITCOIN FALLS BELOW $80K AND INSTITUTIONAL MONEY FLEES

Bitcoin tumbled below $80,000 on Monday, briefly touching $77,459 — a 14% decline over the past week. This sell-off coincides with broader market weakness and follows four consecutive weeks of institutional investors reducing crypto exposure. Market sentiment has turned decidedly bearish, with the Crypto Fear & Greed Index collapsing to 17, while President Trump’s tariff policies and comments about a coming “period of transition” for the economy have amplified uncertainty.

📈 ROYAL MINT: GOLD BULLION SALES UP 153%

The Royal Mint has recorded a staggering 153% increase in bullion sales as UK investors seek safe-haven assets amid market turbulence. Gold coins have experienced the most dramatic demand, with sales skyrocketing 206% year-over-year. The rush has created significant supply constraints, with some refineries now reporting backlogs stretching up to 12 weeks.

🥇 GLOBAL GOLD ETF ASSETS HIT ALL-TIME HIGH

Global gold ETFs attracted a massive $9.4 billion in February — their strongest month since March 2022. North American funds led the charge with $6.8 billion in new investments, marking their best February on record and largest monthly inflow since July 2020. This unprecedented demand has pushed total ETF assets to an all-time high of $306 billion as gold prices established nine new records in February alone.

✨ GOLD UP 57% OVER PAST 24 MONTHS

In March 2023, gold traded around $1,850/oz. Those prices now seem like a distant memory as the precious metal continues its historic climb, nearing $3,000/oz.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Customer Service is very helpful!

“Travis was amazing! I was having difficulty with a wire transfer of my life’s savings, and I was very worried that I might not be able to receive it all. My husband just passed away and I’ve been worried about these funds along with grieving for 8 months. As soon as I got connected with Travis, my concerns were immediately addressed and he put me at ease. The issue was resolved within days. He even called me back with updates to keep me in the loop about what was going on with the funds. I am so grateful for a customer representative like Travis. He really cares for his clients.” — A. Howard

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?