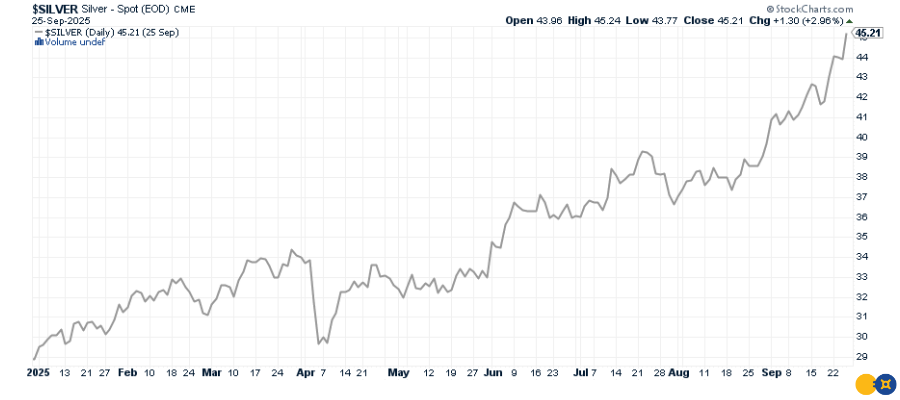

Silver prices have surged to $46.71 an ounce, up a remarkable 61% year-to-date (see chart below). That’s the sharpest rally in decades, pushing silver within striking distance of its all-time high of $49.45 set in January 1980.

This run-up isn’t happening in isolation. Silver has a history of explosive price moves during periods of economic stress, inflation, and financial uncertainty. To better understand what could come next, let’s look back at the last time silver neared $50 and compare it with today’s environment.

Silver’s Last Peak: Lessons from 1980

In January 1980, silver prices spiked to nearly $50 amid:

- Double-digit U.S. inflation (over 13%).

- Oil price shocks following the Iranian revolution.

- A weakening U.S. dollar that pushed investors toward hard assets.

- Speculative buying pressure, most famously from the Hunt brothers.

While that episode ended abruptly, the parallels with today — stubborn inflation, rising geopolitical risks, and growing distrust in fiat currencies — can’t be ignored.

Today’s Macro Backdrop: Why Silver is Surging

1. Inflation Hedge: Despite rate hikes, inflation remains sticky. Silver, like gold, provides protection when purchasing power erodes.

2. Industrial Demand: Silver is indispensable in solar panels, electric vehicles, and electronics, causing demand to explode worldwide. This dual role — as both monetary and industrial metal — strengthens its long-term case more than in 1980.

3. Currency & Geopolitical Risks: From trade wars to central bank disputes, today’s headlines are eroding confidence in fiat money. Precious metals are direct beneficiaries.

4. Gold Leading the Way: Gold’s rally above $3,700 has set the stage. Historically, silver follows gold’s trajectory — but with greater volatility and upside.

Will Silver Break $50?

Crossing the silver all-time high would be more than symbolic. It would confirm that investors are piling into tangible assets as a hedge against inflation, debt, and financial instability.

History shows that when silver moves, it moves fast. During the famous 1979–1980 spike, silver prices didn’t just grind higher — they went parabolic:

- In late 1979, silver rocketed from around $30 to $40 in just three weeks.

- Then, in January 1980, the climb accelerated — silver surged from $40 to $49.45 in a matter of days, an unprecedented 24% gain in less than two weeks.

To put that into perspective: investors saw nearly a decade’s worth of typical silver price appreciation compressed into a few trading sessions. That’s the nature of silver bull markets — they tend to be shorter, sharper, and more dramatic than gold’s, rewarding those who position early.

We saw echoes of this pattern again in 2011, when silver ran from $30 to $48 in just three months before briefly touching the high-$40s.

This historical explosiveness suggests that if silver breaks above $50, the move could be swift — and potentially overshoot far higher before settling.

The Next Move in Silver

The silver price rally to over $46.50 reflects more than speculative momentum. It’s a convergence of industrial demand, inflation pressures, and geopolitical uncertainty.

Whether silver breaks its all-time high near $50 in the coming months or consolidates first, the opportunity is clear: silver remains one of the most asymmetric plays in today’s market — with downside protection from its monetary role and explosive upside from its industrial demand.

Silver is within a few dollars of its historic peak. Learn more about owning gold and silver with expert guidance at GoldSilver.com.

People Also Ask

What is the current silver price and how close is it to the all-time high?

As of September 26th, the silver price is around $46.71 per ounce, just shy of its all-time high of $49.45 set in 1980. With silver up over 60% year-to-date, many investors are watching for a breakout past $50. You can track live prices on GoldSilver Price Charts.

When did silver hit $50 before?

Silver has only approached $50 an ounce twice — in January 1980 and again in April 2011, when it reached $48. Both rallies were driven by inflation fears and financial uncertainty. Today’s environment has many of the same ingredients.

How fast did silver rise during the 1980 silver spike?

In late 1979, silver jumped from $30 to $40 in just three weeks, and by January 1980 it surged from $40 to $49.45 in under two weeks. That explosive move shows how quickly silver can overshoot once momentum builds.

What is the gold-to-silver ratio and why does it matter?

The gold-to-silver ratio measures how many ounces of silver equal the price of one ounce of gold. Historically, when the ratio is high, silver is considered undervalued relative to gold — often signaling strong potential upside.

How can I invest in silver safely?

Investors can buy physical silver bars and coins, or use modern platforms that provide secure, insured vault storage. GoldSilver offers both options, with liquidity and expert guidance for serious investors.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.