The gold-to-silver ratio has guided precious metals investors for centuries — but applying it as a strategy can be surprisingly simple. The 80/60 gold-silver rule helps investors decide when to favor one metal over the other using data, not emotion.

Understanding the Gold-to-Silver Ratio

Before diving into the 80/60 rule, it’s important to understand what the gold-to-silver ratio actually measures. The ratio represents how many ounces of silver it takes to purchase one ounce of gold.

For example, if gold trades at $4,000 per ounce and silver trades at $50 per ounce, the ratio would be 80:1. This number fluctuates constantly with market conditions, economic data, and investor sentiment — making it a useful signal for those tracking relative value in precious metals.

The 80/60 Rule Explained

The 80/60 gold-silver rule is a tactical strategy designed to help investors make more objective decisions:

- When the ratio hits 80:1 or higher → silver is relatively cheap → consider buying silver or trading some gold for silver.

- When the ratio falls to 60:1 or lower → gold is relatively cheap → consider shifting toward gold or trading silver for gold.

These thresholds are based on decades of historical data showing that the ratio tends to revert toward its long-term average of roughly 65-70:1. By using that mean-reversion tendency, investors can buy the undervalued metal and gradually rebalance as conditions change.

Why These Numbers Matter

The 80 and 60 levels aren’t arbitrary. They mark statistical extremes where the market has historically over- or under-valued one metal relative to the other.

During the 2020 pandemic, for example, the ratio spiked above 120:1 as silver lagged, then quickly fell back toward 70:1 as silver prices surged 47.9% while gold gained 25.1%. That swing showed how quickly opportunities can emerge when the ratio moves too far in one direction.

The Ratio at Work

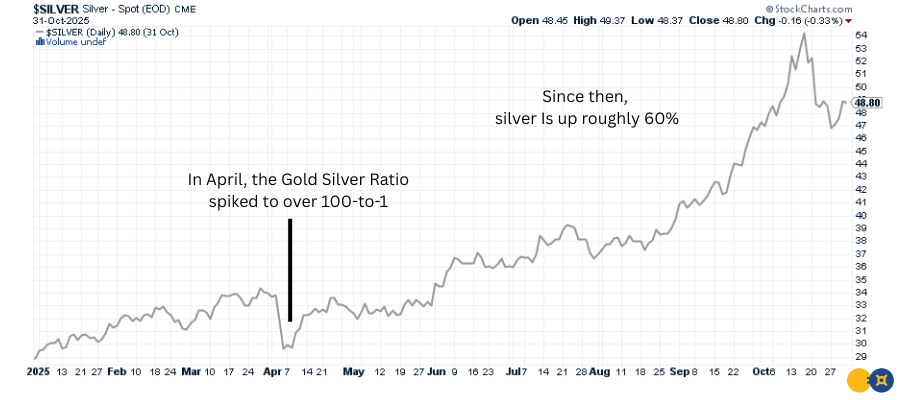

Back in April, GoldSilver highlighted that the gold-to-silver ratio had reached extreme levels above 100:1 — a signal that silver was deeply undervalued relative to gold.

At that time, silver was trading around $30 per ounce. Investors who recognized the opportunity and increased their silver exposure have since been rewarded: silver recently reached about $48 per ounce, a gain of roughly 60% in just a few months.

That powerful move shows the principle behind the 80/60 gold-silver rule: when the ratio stretches to extremes, it often signals opportunity.

As the ratio began to move back toward its long-term average, silver prices surged, rewarding those who acted when sentiment was most lopsided.

In other words, investors who followed the data rather than emotion — buying silver when the gold-silver ratio topped 100 — saw significant outperformance as the market corrected that imbalance.

How to Apply the Strategy

1. Monitor the Ratio

Check the gold-to-silver ratio regularly using reliable financial sources such as MarketWatch or major bullion dealers. Many investors track it monthly as part of their portfolio review.

2. Identify Entry Points

- Above 80: Silver may be undervalued. Consider increasing silver positions or adding silver bars and coins.

- Below 60: Gold may be undervalued. Focus on acquiring gold coins or bars.

3. Move Gradually

Avoid large, sudden shifts. Use dollar-cost averaging to adjust your holdings over time, reducing timing risk and smoothing out volatility.

Historical Validation

The gold-to-silver ratio has fluctuated dramatically throughout history — sometimes topping 100:1, other times falling below 40:1. According to Investopedia, the ratio has served as a reliable gauge of relative value between the metals for centuries.

- In 2018-2019 the ratio climbed above 85:1 — a strong silver-buying opportunity.

- Silver went on to significantly outperform gold in 2020 as the ratio normalized around 70:1.

These examples highlight why the 80/60 framework remains a valuable, repeatable guide for investors today.

Benefits of the 80/60 Gold-Silver Rule

1. Objective Decisions: By following clear ratio thresholds, investors rely on data instead of emotions or market headlines.

2. Improved Performance Potential: Buying the undervalued metal and rebalancing toward the mean can enhance long-term returns within a diversified metals portfolio.

3. Built-In Risk Management: The strategy naturally promotes diversification, balancing exposure between gold and silver based on relative value rather than arbitrary percentages.

Limitations to Keep in Mind

- It’s Not a Crystal Ball. The ratio reveals relative value, not exact price timing. Extremes can persist for months or years.

- Requires Monitoring. The 80/60 approach is more hands-on than a simple buy-and-hold strategy.

- Costs Matter. Each trade may involve dealer spreads, shipping, and storage fees — factors that can affect net performance.

The Bottom Line: A Tool, Not a Rule

The 80/60 gold-silver rule is a practical, time-tested way to guide precious-metals allocation using objective market data. While not perfect, it helps investors make smarter, more disciplined decisions within a broader, diversified investment plan.

Whether you’re new to metals or a seasoned investor, understanding how the gold-to-silver ratio works — and how to use it strategically — can help you capture opportunities and build long-term wealth.

People Also Ask

What is the 80/60 gold-silver rule?

The 80/60 gold-silver rule is a simple strategy that helps investors decide when to favor gold or silver based on their price ratio. When the ratio is above 80:1, silver is considered undervalued; when it falls to 60:1 or below, gold may offer better relative value. Learn more about how the ratio works at GoldSilver.com.

How does the gold-to-silver ratio affect investment decisions?

The gold-to-silver ratio shows how many ounces of silver equal the value of one ounce of gold. Tracking it helps investors identify when one metal is historically cheap or expensive relative to the other — creating potential opportunities to buy low and sell high.

Why did the gold-silver ratio matter when it was over 100 to 1?

A ratio above 100:1 suggests silver is extremely undervalued compared to gold. When GoldSilver noted this in April, silver was around $30 per ounce — since then it’s climbed to about $48, proving how powerful ratio-based timing can be.

Is the 80/60 gold-silver rule still relevant today?

Yes. While the ratio changes over time, the principle of mean reversion still applies. Using the 80/60 thresholds gives investors a disciplined, data-driven way to balance their precious metals holdings in changing markets.

How often should I check the gold-to-silver ratio?

Most investors monitor the ratio monthly or quarterly, similar to reviewing portfolio performance. It’s a simple yet effective indicator to include in your regular investing routine — sites like GoldSilver.com track it in real time.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.