Brandon Sauerwein, Editor

“There is an Explosion in Gold Coming”

For 20 years, we’ve been analyzing market data, identifying patterns, and helping investors protect their purchasing power.

Today, we’re sharing something extraordinary. Since our founding in 2005, we’ve watched gold quietly outperform the S&P 500, delivering a remarkable 99.4% return. But what Alan and Mike’s latest research reveals is even more striking. As Mike puts it, “There’s an explosion in gold coming” – and the data suggests he’s right.

“There’s An Explosion in Gold Coming” — Mike Maloney

In this special anniversary analysis, Alan and Mike have uncovered a disturbing trend: money supply (M2) is growing at 6.2% annually – more than double the official inflation rate. The pressure building in the system isn’t just unprecedented; it’s unsustainable.

As legendary silver expert Dave Morgan observed, “80% of the move comes in the last 20% of the time.” This pattern, combined with our latest research, suggests the biggest gains in this gold and silver bull market are still ahead.

Shop GoldSilver’s 20th Anniversary Sale: Ends Tomorrow!

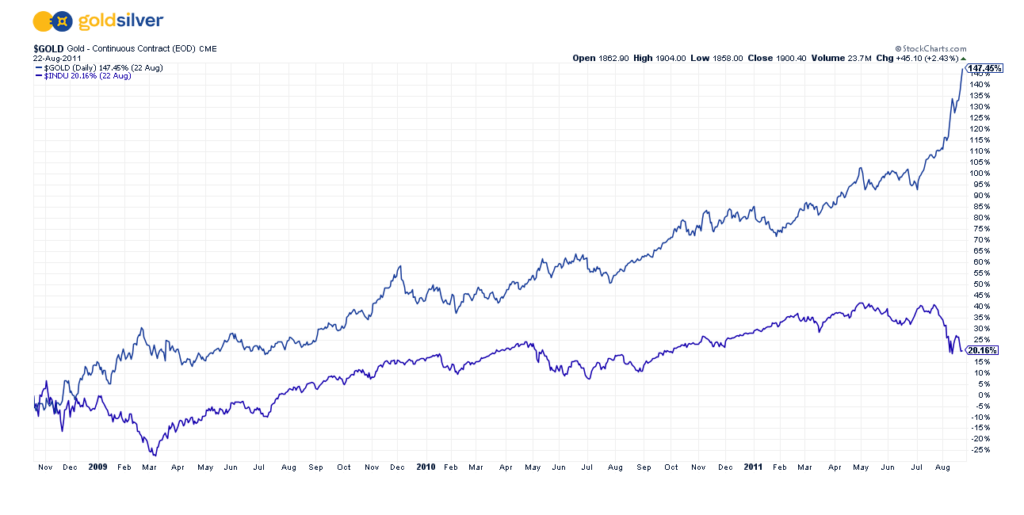

Revisiting History: The 2008-2011 Gold Bull Market

Gold’s journey from 2008 to 2011 tells a powerful story. Breaking $1,000 per ounce in March 2008, gold soared to a historic peak of $1,917.90 by August 2011.

During the 2008 financial crisis, retail buyers faced severe bullion shortages, paying premiums up to 25% above spot price.

This intense physical demand, combined with economic turmoil and Fed intervention, drove gold up as high as 167% from its 2008 low, while the Dow Jones gained just 20.5% during that same span.

What Else is in the News?

🔔 GOLD BREAKS $2,900 AS SAFE HAVEN DEMAND SURGES

Trade war fears pushed gold to a historic $2,903.21 this week, marking a 2.2% gain. Prices are already up nearly 11% year to date, after a staggering 27% gain in 2024.

🚚 MASSIVE PHYSICAL GOLD DEMAND HITS COMEX

The CME Comex is witnessing an extraordinary phenomenon as January gold deliveries reach $5.2 billion – a volume typically seen only in major delivery months. This unexpected surge suggests investors are increasingly choosing physical metal over paper contracts.

⚠️ TRADE WAR ESCALATES WITH NEW METAL TARIFFS

Trump has ordered sweeping 25% tariffs on steel and aluminum imports, targeting even close U.S. allies like Canada and Mexico. The EU has promised firm retaliation, warning of an expanding trade conflict that could drive up costs across industries.

🌎 CHINA OPENS GOLD FLOODGATES

In a historic policy shift, China is allowing major insurers to invest up to 1% of their assets in gold – potentially unleashing $27.4 billion into the market. This groundbreaking move comes as gold prices surge past $2,900, driven by Fed rate expectations and global uncertainty.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Great Educator

“I have learned more from Mike Maloney than I believe I have from anyone else. He is an excellent teacher, but what makes him stand above the rest is how much he cares. Thank you for taking the time to educate people like me.” — M. Troutman

What sets GoldSilver apart?

Free educational resources plus real human expertise – that’s the GoldSilver difference.

Our extensive video library, market analysis, and personalized guidance help you make informed precious metals investment decisions. When you need support, you’ll always get clear, reliable answers from our expert team.

Ready to build a more secure financial future?