The metric system, or International System of Units (SI), is widely used throughout the world. However, the troy ounce, the standard unit of weights for precious metals like gold and silver, is neither part of the metric system nor the “imperial” system used in the U.S.

What is a troy ounce, and how is it different than the traditional ounce used in America?

The Troy Ounce vs. Traditional Ounce

The troy ounce is the standard unit used to weigh precious metals like gold and silver.

A troy ounce, when converted into grams, is equal to 31.103 grams, which makes it heavier and therefore worth more than the traditional ounce, equal to 28.349 grams.

Troy Ounce > Traditional Ounce

A troy ounce is approximately 10% heavier than a regular ounce. An avoirdupois ounce, or traditional ounce, can be converted into a troy ounce by simply dividing it by 0.91.

Troy Pound < Traditional Pound

For every troy pound, there are only 12 troy ounces, making a troy pound lighter than a regular pound, which is 16 ounces. It can be confusing when converting between ounces and pounds, but each system has its own standards.

The avoirdupois ounce is part of the avoirdupois system of measurements, which is commonly known in America via our standard use of ‘ounces’ and ‘pounds’. The troy ounce uses the troy system; one troy ounce is almost 1.0971 avoirdupois ounces. The avoirdupois ounce, simply called an ‘ounce’ in everyday conversation, is used for measuring everything from groceries to body weight in the U.S.

History and Modern Application

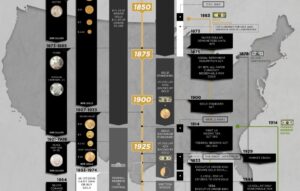

The beginning of the troy weight and measurement system is believed to have originated in the French town of Troyes, where English merchants came to trade and barter. They adopted a standardized system of measurements to make commerce easier.

Several traits of this system can also be traced back to the Roman monetary system, where Romans used bronze bars as currency. One heavy bronze bar, called “aes grave”, was equal to 1 pound. The currency was divisible into 12 one-ounce units, called “uncias”, which led to the 12-troy-ounce pound.

Ancient Roman gold coins nearly 2,000 years old.

The troy weight system was used in many parts of Europe before the metric system. The troy ounce had been used in England since the 1400s and it was adopted officially in 1527.

The troy ounce is principally the same as the British Imperial troy ounce. It is primarily used for measuring expensive metals and gemstones, as opposed to the avoirdupois ounce, which is commonly used for measuring everyday items like food. For this reason precious metals like gold and silver are measured in troy ounces.

Buying Gold and Silver in Troy Ounces

Thankfully, all gold prices and silver prices are calculated in troy ounces.

Having a universal unit of measure when dealing with precious metals is part of what makes gold and silver so liquid. Investors around the world buy and sell gold and silver using the troy ounce system, so there is no need for any other system of measure or conversion standard.

Knowing gold and silver use the troy ounce system is one of the first steps in understanding gold and silver investing. Check out our diverse selection of gold and silver bullion to start your portfolio today. You’ll see that all of our precious metals are calculated in troy ounces so that you get your money’s worth, whether you buy from us or sell to us.